Contributory pensions will rise by 3.8% and minimum and non-contributory pensions by up to 14%. But in addition to the increases in the pensioners' payroll, the access requirements for pre-retirement and early retirement also come into force and the Treasury can continue to be asked to return the double contribution to professional mutual societies if the criteria are met.

Among the main novelties that will already be in force on January 1, 2024, the increase in the ordinary retirement age, the minimum age for early retirement, and the age to access partial retirement in the case of a replacement contract stand out. ; the increase in the maximum contribution base above the CPI, the update of the minimum and maximum contribution bases of each 15 contribution brackets for self-employed workers; the increase above the CPI of the minimum retirement and disability pensions, non-contributory pensions, the minimum vital income and the gender gap supplement, as recalled by the BBVA Pensions Institute.

Contributory pensions (retirement, permanent disability, orphanhood and widowhood) will increase from January 1, 2024, by 3.8%, a percentage increase according to the average interannual variation of the CPI between December 2022 and November 2023 (12 months prior to December of the previous year) as confirmed by the final inflation data for November 2023 on December 14. The system's average pension, of 1,200 euros, will increase by 638 euros per year, which amounts to 46 euros per month.

The minimum retirement and widowhood and non-contributory pensions will increase above that figure, as well as the minimum vital income and the gender gap supplement.

In the case of minimum retirement pensions, their amount will be increased to progressively equate it with 100% of the poverty line, with the aim of converging with it starting in 2027. To determine this poverty line for A household made up of two adults will multiply by 1.5 the poverty threshold corresponding to a single-person household.

Non-contributory pensions will increase until they converge in 2027 with 75% of the poverty threshold calculated for a single-person household, based on the Living Conditions Survey of the National Institute of Statistics (INE). Thus, in 2024, minimum retirement pensions will be increased in addition to the CPI by the percentage necessary to reduce the existing gap by 20%.

The objective is that the minimum contributory retirement pension with a spouse will be at least 16,500 euros per year (1,178.5 euros per month) in 2027, 22% more than in 2023. For 2024, specifically, they will increase by 6.9 %, increasing its total amount to almost 7,300 euros per year (almost 520 euros per month). The same occurs in the case of the Minimum Living Income (IMV), which will also increase by 6.9% in 2024, approximately between 16.5 and 100 euros per month, depending on the type of pension and personal circumstances, since The amount is referenced to that of the non-contributory amounts.

The minimum widow's pensions, for their part, will be increased to progressively equate them over 4 years, starting in 2024, with the minimum retirement pensions. The minimum pension for widows with family responsibilities will increase by 14.1%, from the current 905.9 euros per month to around 1,033.6 euros per month, 127.7 euros more per month than in 2023: its amount from 12,682 euros per year (906 euros per month in 14 payments) from 2023 to 14,457 euros per year (1,033 euros per month).

In 2024, the additional increase in the gender gap supplement will also begin to be applied. This supplement will increase by 10% in 2024 (and another 10% in 2025), in addition to its annual revaluation according to the CPI. Taking into account the increase in the average interannual CPI (December 2022-November 2023) by 3.8% plus that 10% additional increase, in 2024 the gender gap complement is located at 34.71 euros per month per child (compared to at 30.40 euros in 2023), up to a maximum of 4 times that amount.

The legal age of ordinary retirement in 2024 will rise two months compared to that of 2023, standing at 66 years and 6 months when there are less than 38 years of contributions. However, if you have 38 or more years of contributions, it will be possible to retire at 65 years of age.

The minimum age to access early retirement will also be delayed as it is linked to the previous one. It is possible to access voluntary early retirement up to 24 months (2 years) before the ordinary legal age. To access it it will be necessary to have reached the age of 64 years and 6 months, in the case of having less than 38 years of contributions. With 38 or more years of contributions it will be from 63 years of age.

It is possible to access involuntary or forced early retirement up to 48 months (4 years) before the ordinary age, adds the BBVA study service, and from 62 years and 6 months if you have less than 38 years of contributions, or from age 61 if contributions have been accumulated for 38 or more years.

The minimum age to access partial retirement with a relief contract will be delayed to 64 years with 33 years or more of contributions, or 62 years and 6 months in the case of 36 years or more. The partial retirement age without a replacement contract will be the same as the legal ordinary retirement age.

In 2024 the progressive increase in the contribution rate of the Intergenerational Equity Mechanism (MEI) begins, an additional 0.1% annually until reaching 1.2% in 2029. Therefore, in 2024 it will be at 0.7%, distributed, in the case of employed workers, 0.58% paid by the employer and 0.12% paid by the worker. The self-employed will fully assume that 0.7%.

Starting in 2024, the progressive increase above the CPI of the maximum contribution base comes into effect, which will increase each year, until 2050, by a percentage equal to the revaluation of pensions (according to the average interannual CPI), plus an additional increase annual of 1.2 percentage points.

In 2023, the maximum contribution base has been 4,495.50 euros per month (53,946 euros per year). Considering the average interannual inflation between December 2022 and November 2023, of 3.8%, the maximum contribution base will increase by 5% in 2024, standing at 4,720.28 euros per month (.56,643.30 euros per year).

In 2024, the amounts of minimum and maximum contribution bases (and therefore contribution quotas) are updated for each of the 15 net income brackets of the self-employed contribution system. These are the new minimum and maximum bases per section for 2024:

In 2023, self-employed workers with net income of less than 14,001.48 euros per year pay a minimum fee of 230 euros per month and contribute for a minimum base of 751.63 euros. In 2024 the minimum payment will be 225 euros per month and the minimum base will be 735.29 euros.

Ukraine has lost 10 million inhabitants since 2001... and could lose as many by 2050

Ukraine has lost 10 million inhabitants since 2001... and could lose as many by 2050 Russia: schools will train children to use drones at the start of the school year

Russia: schools will train children to use drones at the start of the school year Austria: incestuous torturer Josef Fritzl, nicknamed the “national monster”, could soon be released

Austria: incestuous torturer Josef Fritzl, nicknamed the “national monster”, could soon be released An airline continues to treat a centenarian as a one-year-old baby

An airline continues to treat a centenarian as a one-year-old baby Sánchez cancels his agenda and considers resigning: "I need to stop and reflect"

Sánchez cancels his agenda and considers resigning: "I need to stop and reflect" The Federal Committee of the PSOE interrupts the event to take to the streets with the militants

The Federal Committee of the PSOE interrupts the event to take to the streets with the militants Repsol: "We want to lead generative AI to guarantee its benefits and avoid risks"

Repsol: "We want to lead generative AI to guarantee its benefits and avoid risks" Osteoarthritis: an innovation to improve its management

Osteoarthritis: an innovation to improve its management The French will take advantage of the May bridges to explore France

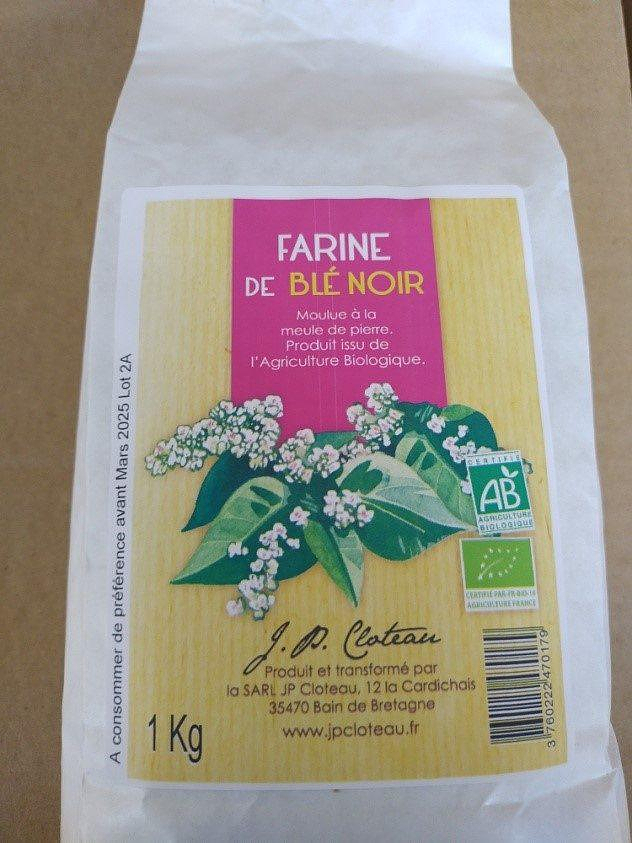

The French will take advantage of the May bridges to explore France Organic flour contaminated by a recalled toxic plant

Organic flour contaminated by a recalled toxic plant 2024 Olympics: Parisian garbage collectors have filed a strike notice

2024 Olympics: Parisian garbage collectors have filed a strike notice Controversial free trade deal between EU and New Zealand comes into force this Wednesday

Controversial free trade deal between EU and New Zealand comes into force this Wednesday Lang Lang, the most French of Chinese pianists

Lang Lang, the most French of Chinese pianists Author of the “New York Trilogy”, American novelist Paul Auster has died at the age of 77

Author of the “New York Trilogy”, American novelist Paul Auster has died at the age of 77 To the End of the World, The Stolen Painting, Border Line... Films to watch this week

To the End of the World, The Stolen Painting, Border Line... Films to watch this week Omar Sy on all cultural fronts

Omar Sy on all cultural fronts Omoda 7, another Chinese car that could be manufactured in Spain

Omoda 7, another Chinese car that could be manufactured in Spain BYD chooses CA Auto Bank as financial partner in Spain

BYD chooses CA Auto Bank as financial partner in Spain Tesla and Baidu sign key agreement to boost development of autonomous driving

Tesla and Baidu sign key agreement to boost development of autonomous driving Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33%

The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33% This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Europeans: a senior official on the National Rally list

Europeans: a senior official on the National Rally list Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels

Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon

Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon “Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne

“Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar NBA: with 46 points, Maxey saves Philadelphia single-handedly

NBA: with 46 points, Maxey saves Philadelphia single-handedly Tennis: a Nadal-Alcaraz double at the 2024 Olympics? “If all goes well, yes,” replies the cadet

Tennis: a Nadal-Alcaraz double at the 2024 Olympics? “If all goes well, yes,” replies the cadet Tennis: “Actually it was a joke, I’ll come back next year!”, Nadal bids farewell to Madrid with humor and emotion

Tennis: “Actually it was a joke, I’ll come back next year!”, Nadal bids farewell to Madrid with humor and emotion Bayern Munich-Real Madrid: “Everything is still in our hands”, welcomes Manuel Neuer

Bayern Munich-Real Madrid: “Everything is still in our hands”, welcomes Manuel Neuer