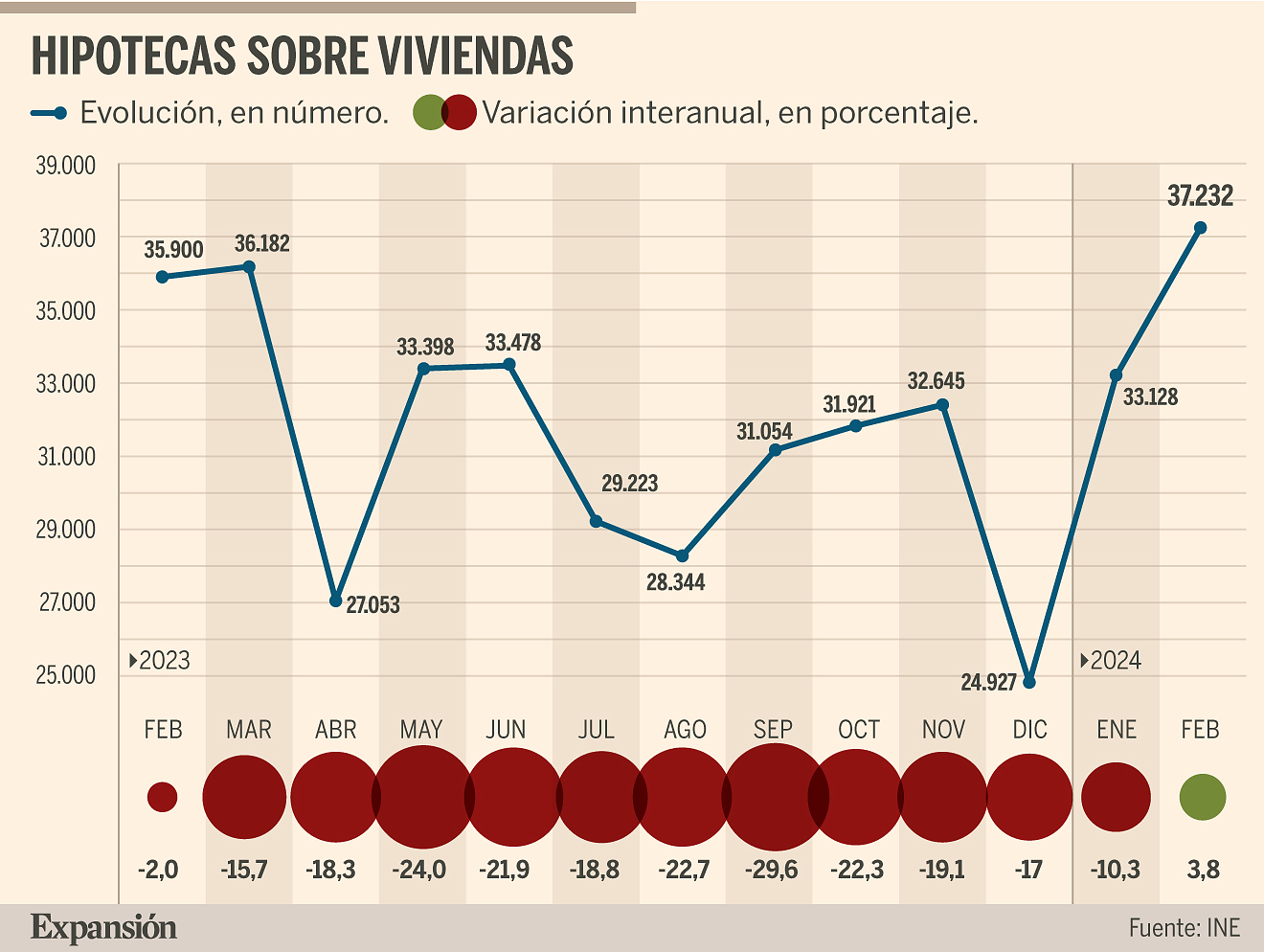

This is clear from the data released today by the National Institute of Statistics (INE), which highlights that, with the year-on-year increase in February, the signing of home mortgages returns to positive rates after 12 months of chaining declines.

María Matos, Director of Studies at Fotocasa, points out that the February data "shows a small change in trend in mortgages due to the stability that the Euribor is showing in recent months, after the ECB has not made any further increases in types recently."

"The year will probably be differentiated between two marked stages, the one before interest rates fall and the one after. If the forecasts for de-escalation in rates by the ECB are confirmed and begin in June, we will once again see how the Access to housing improves as the conditions for access to mortgage credit are lowered and the demand that was kept waiting will return to the market with force," adds Matos.

Juan Villén, general director of Idealista/mortgages agree that "the volume of mortgages registered in February already shows a slight but certain recovery, which began to occur at the beginning of this year." In his opinion, "it is very possible that this trend will continue in the coming months, but the shortage of housing supply could slow down this recovery."

"Interest rates are also beginning to reflect the drop in the Euribor, as well as greater competition between banks," says Villén. "This strong mortgage war is being fought fundamentally in fixed and mixed mortgages, which continue to dominate the market," she adds.

For his part, Ferran Font, director of Studies at Pisos.com, indicates that the INE statistics "show the change in trend in the sector that was already anticipated in sales." Font highlights that the borrowed capital follows the same dynamic and contracts only 1.6% "getting closer to the growth that, in all probability, will reach next month."

The average amount of mortgages constituted on homes fell by 5.2% year-on-year in the second month of the year, to 136,145 euros, while the capital lent decreased by 1.6%, to 5,068.9 million euros.

Following the interest rate policy carried out by the European Central Bank (ECB) to try to contain inflation and the evolution of the Euribor, the average interest rate was 3.33% in February for mortgages constituted on homes, with an average term of 23 years. In this way, it decreased slightly from 3.46% in January, when it reached its highest value since the end of 2014. With the exception of January, February has been the highest interest since December 2015, the month in which was 3.36%.

Compared to a year earlier, the average interest rate for home loans has increased almost half a point. It is the eleventh consecutive month in which the interest rate exceeds 3%.

44.7% of mortgages were established in February at a variable rate and 55.3% at a fixed rate. The average interest rate at the beginning was 3.07% for variable rate home mortgages and 3.57% for fixed rate mortgages.

War in Ukraine: one week later, where is the Russian offensive in Kharkiv?

War in Ukraine: one week later, where is the Russian offensive in Kharkiv? An American tourist steals a mug of beer from a tavern in Munich and admits it...50 years later

An American tourist steals a mug of beer from a tavern in Munich and admits it...50 years later Madagascar calls for replacement of EU ambassador

Madagascar calls for replacement of EU ambassador Chinese journalist released from prison four years after denouncing China's handling of Covid

Chinese journalist released from prison four years after denouncing China's handling of Covid Suicide attempts and self-harm on the rise among young girls

Suicide attempts and self-harm on the rise among young girls In Europe, 10,000 people die every day from cardiovascular disease

In Europe, 10,000 people die every day from cardiovascular disease Brussels raises Spanish GDP forecasts to 2.1% and foresees a deficit of 3% in 2024

Brussels raises Spanish GDP forecasts to 2.1% and foresees a deficit of 3% in 2024 Inflation rises to 3.3% in April due to gas and food

Inflation rises to 3.3% in April due to gas and food MEPs elevate agriculture to “major general interest”

MEPs elevate agriculture to “major general interest” New Caledonia: “resupply” operations in view of shortages

New Caledonia: “resupply” operations in view of shortages Paul McCartney becomes first British musician billionaire

Paul McCartney becomes first British musician billionaire SNCF: RER and commuter trains “very severely disrupted” Tuesday May 21 in Île-de-France

SNCF: RER and commuter trains “very severely disrupted” Tuesday May 21 in Île-de-France Chaillot signs a partnership with a Rwandan dance company

Chaillot signs a partnership with a Rwandan dance company In the Saint-Germain-des-Prés church, a classical music concert takes place at the Jazz festival

In the Saint-Germain-des-Prés church, a classical music concert takes place at the Jazz festival The Le Bon Air festival deprograms the DJ I Hate Models for a private jet story

The Le Bon Air festival deprograms the DJ I Hate Models for a private jet story A golden reward for Yasmina Reza

A golden reward for Yasmina Reza Omoda 7, another Chinese car that could be manufactured in Spain

Omoda 7, another Chinese car that could be manufactured in Spain BYD chooses CA Auto Bank as financial partner in Spain

BYD chooses CA Auto Bank as financial partner in Spain Tesla and Baidu sign key agreement to boost development of autonomous driving

Tesla and Baidu sign key agreement to boost development of autonomous driving Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33%

The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33% This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella New Caledonia: Zemmour accuses Le Pen of “giving in to the thugs and looters”

New Caledonia: Zemmour accuses Le Pen of “giving in to the thugs and looters” Europeans: between the RN and the “euro-gagas”, the communist Léon Deffontaines dreams of breaking through to the left

Europeans: between the RN and the “euro-gagas”, the communist Léon Deffontaines dreams of breaking through to the left Europeans: professor threatened with death Didier Lemaire shows his support for François-Xavier Bellamy

Europeans: professor threatened with death Didier Lemaire shows his support for François-Xavier Bellamy LFI: Manon Aubry places social issues at the center of her European campaign

LFI: Manon Aubry places social issues at the center of her European campaign These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Paris 2024 Olympics: a letter to Hitler from Pierre de Coubertin reproduced in a book

Paris 2024 Olympics: a letter to Hitler from Pierre de Coubertin reproduced in a book Paris 2024 Olympic Games: “We despise sport”, Estelle Denis revolted against the “people” carrying the flame

Paris 2024 Olympic Games: “We despise sport”, Estelle Denis revolted against the “people” carrying the flame Tour de France: middle finger, Alaphilippe-Lefevere duel, doping, the enticing teaser for season 2 of Netflix

Tour de France: middle finger, Alaphilippe-Lefevere duel, doping, the enticing teaser for season 2 of Netflix Bundesliga: Thomas Tuchel confirms his departure from Bayern

Bundesliga: Thomas Tuchel confirms his departure from Bayern