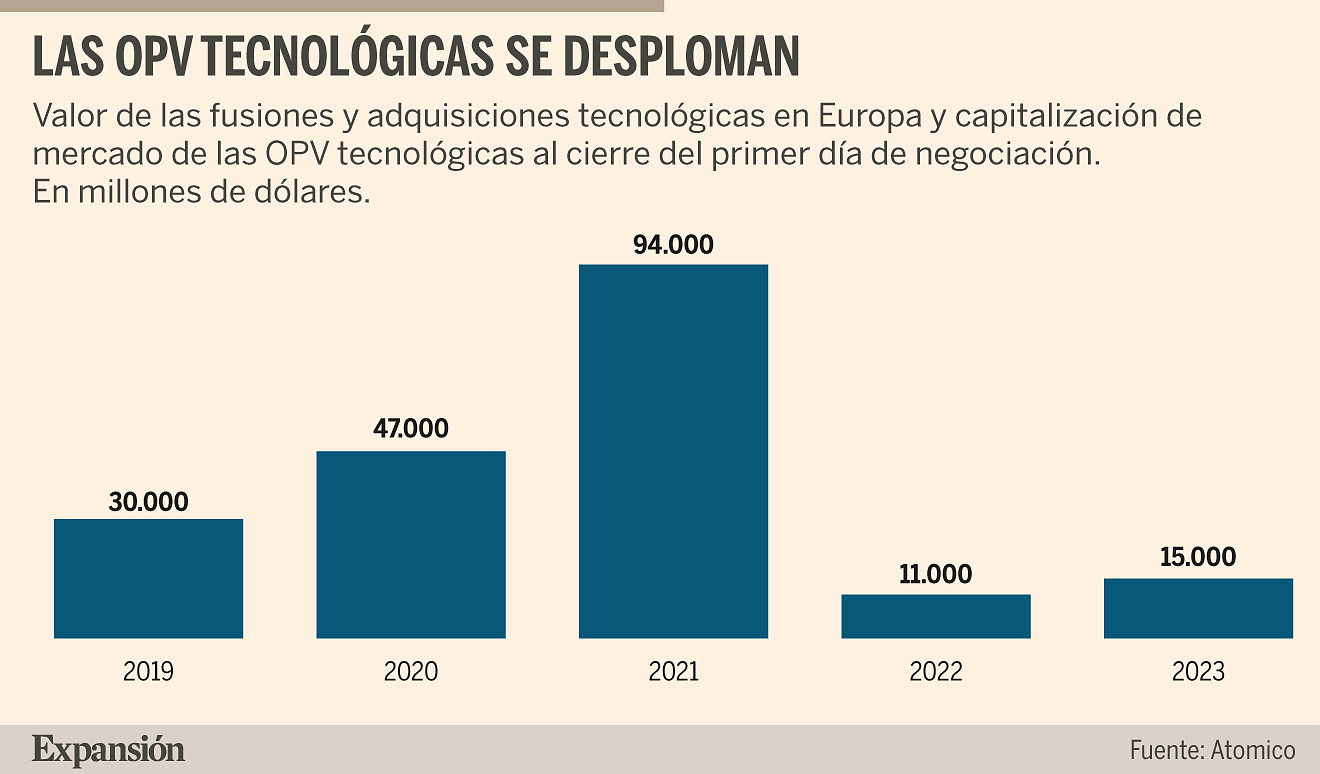

Euronext, the main capital markets operator at European level, wants to revitalize the battered technology IPO (Public Offering) market in Europe. The value of IPOs by venture capital-backed technology groups in the region has plummeted from the 2021 peak of $94 billion (€86.7 billion) to just $15 billion last year, according to data from the latest State report. of European Tech prepared by the Atomico investment fund.

To break this trend, the company, which manages the Amsterdam, Paris, Milan and Dublin stock exchanges, among others, launched Euronext Tech Leaders almost two years ago, a new stock index aimed at giving visibility to European technology companies with greater potential and attract investors. "The objective is to give more visibility and facilitate access to these European companies for North American or Asian investors. With this index they can quickly identify the leading technology companies in Europe," explains Susana de Antonio, head of Euronext in Spain.

Currently, 119 companies are part of the Euronext Tech Leaders, with a combined market value of more than 900,000 million euros, among which are some of the largest European technology groups: the payment methods company Adyen; the manufacturer of ASML chip production machines; the telecommunications multinational Nokia or the video game developer Ubisoft. Among the hundred companies there is only one Spanish, the fintech Allfund, which appeared in 2021 at Euronext in Amsterdam.

In total, 22 new companies have joined since the launch of this index. The latest is the French Pluxxe (a spin off of Sodexo), dedicated to business profits, which made the jump to the stock market on January 30. To access this new index it is necessary to be listed, have a market value of more than 300 million euros and a high growth rate, between 5% and 20% in the last three years depending on turnover.

Euronext also offers companies access to a network of investors specialized in technology, as well as networking events and advice for those companies that have not yet made the leap to the stock market but are considering doing so.

Euronext is aware that, by itself, this initiative will not push companies to list. "This is not going to make them decide to do an IPO or not to do it," De Antonio acknowledges. "However, for those technology companies that hesitate between several options, it can be an incentive," he adds.

Nor will it prevent large groups, as happened last year with the British chip designer Arm, from going public in the United States instead of in Europe. Although he defends that except for "very large companies", the reality is that it is not so beneficial to debut on the other side of the Atlantic. "The investor does not perceive you in the same way as a North American company and there is usually greater volatility in the valuation. Maybe on the first day you have a higher rise, but in the long run the price is more stable in the European markets," says De Antonio.

As far as Spain is concerned, the IPO drought makes it difficult to remember the last IPO of a high-profile technology company in our country. The head of Euronext in Spain attributes this to the lack of references. "In Spain there are very few IPOs in general. If you don't have precedents or the experience of comparable companies, fewer companies will consider it," she emphasizes. And she adds: "In countries like France or Italy we see many more technology IPOs. If there are comparable companies there are investors. If there is little activity it is difficult for someone to launch."

And there is no shortage of candidates. The list of potential unicorns – start-ups with valuations of more than $1 billion – is long. From the Idealista real estate portal to the Cabify transportation app, through the Jobandtalent employment platform or the online travel agency for companies Travelperk, among others.

Ukraine has lost 10 million inhabitants since 2001... and could lose as many by 2050

Ukraine has lost 10 million inhabitants since 2001... and could lose as many by 2050 Russia: schools will train children to use drones at the start of the school year

Russia: schools will train children to use drones at the start of the school year Austria: incestuous torturer Josef Fritzl, nicknamed the “national monster”, could soon be released

Austria: incestuous torturer Josef Fritzl, nicknamed the “national monster”, could soon be released An airline continues to treat a centenarian as a one-year-old baby

An airline continues to treat a centenarian as a one-year-old baby Sánchez cancels his agenda and considers resigning: "I need to stop and reflect"

Sánchez cancels his agenda and considers resigning: "I need to stop and reflect" The Federal Committee of the PSOE interrupts the event to take to the streets with the militants

The Federal Committee of the PSOE interrupts the event to take to the streets with the militants Repsol: "We want to lead generative AI to guarantee its benefits and avoid risks"

Repsol: "We want to lead generative AI to guarantee its benefits and avoid risks" Osteoarthritis: an innovation to improve its management

Osteoarthritis: an innovation to improve its management The French will take advantage of the May bridges to explore France

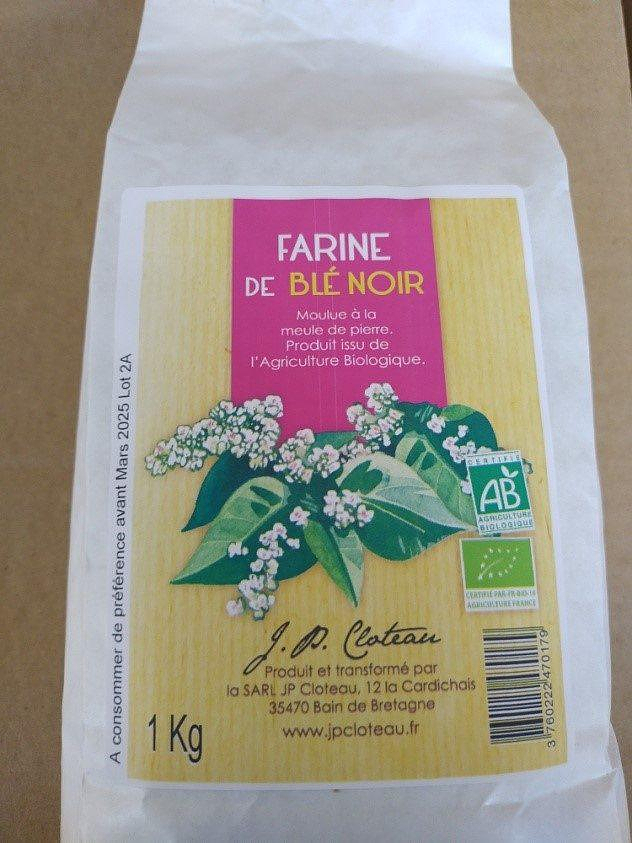

The French will take advantage of the May bridges to explore France Organic flour contaminated by a recalled toxic plant

Organic flour contaminated by a recalled toxic plant 2024 Olympics: Parisian garbage collectors have filed a strike notice

2024 Olympics: Parisian garbage collectors have filed a strike notice Controversial free trade deal between EU and New Zealand comes into force this Wednesday

Controversial free trade deal between EU and New Zealand comes into force this Wednesday Lang Lang, the most French of Chinese pianists

Lang Lang, the most French of Chinese pianists Author of the “New York Trilogy”, American novelist Paul Auster has died at the age of 77

Author of the “New York Trilogy”, American novelist Paul Auster has died at the age of 77 To the End of the World, The Stolen Painting, Border Line... Films to watch this week

To the End of the World, The Stolen Painting, Border Line... Films to watch this week Omar Sy on all cultural fronts

Omar Sy on all cultural fronts Omoda 7, another Chinese car that could be manufactured in Spain

Omoda 7, another Chinese car that could be manufactured in Spain BYD chooses CA Auto Bank as financial partner in Spain

BYD chooses CA Auto Bank as financial partner in Spain Tesla and Baidu sign key agreement to boost development of autonomous driving

Tesla and Baidu sign key agreement to boost development of autonomous driving Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33%

The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33% This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Europeans: a senior official on the National Rally list

Europeans: a senior official on the National Rally list Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels

Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon

Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon “Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne

“Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar NBA: with 46 points, Maxey saves Philadelphia single-handedly

NBA: with 46 points, Maxey saves Philadelphia single-handedly Tennis: a Nadal-Alcaraz double at the 2024 Olympics? “If all goes well, yes,” replies the cadet

Tennis: a Nadal-Alcaraz double at the 2024 Olympics? “If all goes well, yes,” replies the cadet Tennis: “Actually it was a joke, I’ll come back next year!”, Nadal bids farewell to Madrid with humor and emotion

Tennis: “Actually it was a joke, I’ll come back next year!”, Nadal bids farewell to Madrid with humor and emotion Bayern Munich-Real Madrid: “Everything is still in our hands”, welcomes Manuel Neuer

Bayern Munich-Real Madrid: “Everything is still in our hands”, welcomes Manuel Neuer