Be careful during this end-of-year shopping period. The fraud rate on card payments reached its lowest level in 2022 at 0.99%, but manipulation fraud techniques are developing, with an annual increase of 27%, the Bank of France warned on Thursday. “This is an important point of vigilance,” explains Alexandre Stervinou, director of studies and payment monitoring at the Banque de France, on the subject of this new type of fraud, the total amount of which is estimated at 340 million euros. euros in 2022.

Most often, the manipulation results in identity theft: “the fraudster pretends to be the bank advisor of the targeted person and asks them to provide their banking credentials,” explains Julien Lasalle, deputy to Alexandre Stervinou. The security provided by sophisticated IT mechanisms such as double authentication is thus circumvented. “This is one of our main difficulties today,” he insists.

The manipulation thus makes it possible to obtain personal data, or even the banking information necessary for a transaction without the knowledge of the victims, who belong to “all socio-professional categories”, assures Julien Lasalle. To combat this phenomenon, telephone operators could be an important lever, by making it possible to authenticate the origin of a malicious call and possibly block it.

The Naegelen law, passed in 2020, is also supposed to regulate telephone canvassing and reduce “the space of possibilities” for fraudsters, in the words of Alexandre Stervinou. But the Bank of France deplores in its report published Thursday “delays” in its application, “due to high technical complexity”.

The institution speaks of an “urgency” to put in place “a mechanism to protect sensitive numbers in the payments sector in an approach involving banks and operators”. In the meantime, the Banque de France highlights the “cautious attitude” to adopt to protect itself from fraudsters. “No one has to ask you for your account number on the phone,” insisted Alexandre Stervinou. Overall, the Banque de France counted 7.2 million fraudulent transactions in 2022, for an amount reaching 1.2 billion euros, all types of fraud combined.

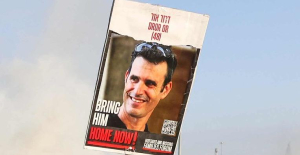

Who was Dror Or, the Israeli father who died as a hostage in the hands of Hamas?

Who was Dror Or, the Israeli father who died as a hostage in the hands of Hamas? “Pay in cash”: at his trial, Donald Trump faced with an embarrassing recording

“Pay in cash”: at his trial, Donald Trump faced with an embarrassing recording Italy: a grandmother accidentally serves a bottle filled with wine to a baby, he has an alcoholic coma

Italy: a grandmother accidentally serves a bottle filled with wine to a baby, he has an alcoholic coma The mysterious skeletons of Hermann Göring's villa

The mysterious skeletons of Hermann Göring's villa Children born thanks to PMA do not have more cancers than others

Children born thanks to PMA do not have more cancers than others Breast cancer: less than one in two French women follow screening recommendations

Breast cancer: less than one in two French women follow screening recommendations “Dazzling” symptoms, 5,000 deaths per year, non-existent vaccine... What is Lassa fever, a case of which has been identified in Île-de-France?

“Dazzling” symptoms, 5,000 deaths per year, non-existent vaccine... What is Lassa fever, a case of which has been identified in Île-de-France? Sánchez cancels his agenda and considers resigning: "I need to stop and reflect"

Sánchez cancels his agenda and considers resigning: "I need to stop and reflect" Health carpooling, this source of savings which arouses the ire of patients and taxis

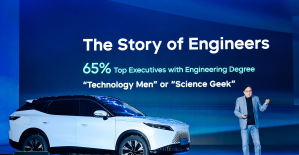

Health carpooling, this source of savings which arouses the ire of patients and taxis Tesla Model 3, MG4 and Dacia Spring.... With the end of the ecological bonus, these electric cars produced in China are seeing their sales fall

Tesla Model 3, MG4 and Dacia Spring.... With the end of the ecological bonus, these electric cars produced in China are seeing their sales fall For the 2024 Olympics, Airbnb commits to fighting prostitution in its accommodation

For the 2024 Olympics, Airbnb commits to fighting prostitution in its accommodation “Shrinkflation”: supermarkets obliged to alert their customers from July 1

“Shrinkflation”: supermarkets obliged to alert their customers from July 1 The electro of Justice and the echoes of Portishead

The electro of Justice and the echoes of Portishead 1924 Olympic Games: according to his daughter, the hero of Chariots of Fire was “not a bigot”

1924 Olympic Games: according to his daughter, the hero of Chariots of Fire was “not a bigot” The “German Brothel” in Yvelines: an uncertain future for the ruined residence

The “German Brothel” in Yvelines: an uncertain future for the ruined residence The eye of the INA: when Paul Auster visited Bernard Pivot

The eye of the INA: when Paul Auster visited Bernard Pivot Omoda 7, another Chinese car that could be manufactured in Spain

Omoda 7, another Chinese car that could be manufactured in Spain BYD chooses CA Auto Bank as financial partner in Spain

BYD chooses CA Auto Bank as financial partner in Spain Tesla and Baidu sign key agreement to boost development of autonomous driving

Tesla and Baidu sign key agreement to boost development of autonomous driving Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33%

The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33% This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Facing Jordan Bardella, the popularity match turns to Gabriel Attal’s advantage

Facing Jordan Bardella, the popularity match turns to Gabriel Attal’s advantage Europeans: a senior official on the National Rally list

Europeans: a senior official on the National Rally list Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels

Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon

Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Monaco - Clermont: Minamino cornerstone, Fofana essential, the Clermont defense overwhelmed... The tops and the flops

Monaco - Clermont: Minamino cornerstone, Fofana essential, the Clermont defense overwhelmed... The tops and the flops Gymnastics: two gold medals for the Italian Manila Esposito during the European Championships

Gymnastics: two gold medals for the Italian Manila Esposito during the European Championships Champions Cup: in pain, Leinster beats Northampton and qualifies for the final

Champions Cup: in pain, Leinster beats Northampton and qualifies for the final Liga: Real Madrid crowned champion of Spain after FC Barcelona's defeat in Girona

Liga: Real Madrid crowned champion of Spain after FC Barcelona's defeat in Girona