After an annus horribilis in 2022, return to normal for EDF in 2023. Not content with returning to profit, the group posted a record net profit of 10 billion euros, for a turnover of 139.7 billion euros. 'euros. In twelve months, the group reduced its debt by ten billion euros to bring it down to 54.4 billion. The Luc Rémont method, who took over as head of the company in November 2022, is bearing fruit.

The contrast with the 2022 annual results is striking. The group then recorded a record loss of 17.9 billion euros, bringing its debt to nearly 65 billion. The causes of the underperformance are known. In 2022, the stress corrosion crisis, these microcracks discovered on certain parts of nuclear power plant piping, had caused the park's production to fall to a historic low: 279 TWh (terawatt hours). Unheard of since 1992, when France did not have as many reactors as today. Faced with the collapse in production, France had to import 57 TWh. Above all, EDF had been forced to source electrons on the market, at a time when prices had soared, while by contract, it resold them much cheaper to its customers. In 2022, the increase in electricity prices on wholesale markets penalized the electrician. In 2023, he benefited from it.

The lights gradually turn green again. The guideline was set by Luc Rémont upon his arrival: improve “metal time”, that is to say the time actually spent on the main tasks, on the machines. The group's nuclear production in France increased in 2023 to reach 320 terawatt hours. The trajectory is set, “the estimates of nuclear production in France are confirmed in the ranges 315-345 TWh for 2024, 335-365 TWh for 2025 and 2026”, mentions EDF. Certainly, still far from the unofficial ambitions for 2030, of 400 TWh, but little by little the nuclear fleet is climbing back up. “15 of the 16 reactors most sensitive to the phenomenon of stress corrosion are repaired at the end of 2023 and the last will be treated during its ten-year inspection which begins in February 2024,” specifies the group. The start-up of Flamanville 3 is also looming, while fuel loading is planned for March 2024. The completion of this project after eighteen years of work would sound like a victory as much as a real relief.

At the same time, hydropower grew by 19.4%, to 38.7 TWh. Nuclear power plants and dams are the two main sources of electricity production for the group, which also develops wind power and photovoltaics, in France and abroad.

Also read: Luc Rémont: “EDF will invest 25 billion euros per year”

However, EDF is not done with the challenges to be met. The group must make a colossal investment effort to maintain and renew its production tools. In the nuclear sector, it's a big shake-up. An operation which aims to extend the life of power plants beyond 40 years and which results in around fifty billion investments. Added to this is 96 billion in spending by 2040 in the Enedis electricity distribution network, to support the energy transition. Finally, the issue of the management of hydraulic dams could find its epilogue, which would allow the group, in the event of a favorable agreement with Brussels, to make investments in these installations to substantially improve their performance.

The group must also face the challenge of new nuclear power, at least an investment of 50 to 60 billion euros, to build at least six EPR2s. The financial terms of this vast program have not yet been defined, but the group has already started to purchase land near the sites concerned in order to quickly begin civil engineering work.

Faced with these increasing expenses, EDF must secure the revenue line, while the end of the nuclear electricity sales system (Arenh) is looming at the end of 2025, this system in which 100 TWh is sold each year to 42 euros per MWh. Last year EDF reached an agreement with the French state, setting the price of its nuclear electricity at an average of 70 euros per MWh for the next fifteen years. Beyond 78 to 80 euros, the group will return 50% of the difference to consumers, under the universal nuclear payment, and 90% above 110 euros per MWh. An incentive for the group to produce more and better. The system, which has not yet been approved by Europe, has a major drawback: there is no downward threshold. If wholesale electricity prices fall, EDF takes the risk of seeing its profitability melt away like snow in the sun.

However, this is not the only lever available to the group. From November, it put in place nuclear production allocation contracts (CAPN), with a duration of ten, fifteen, twenty years or more. The latter include risk sharing between EDF and potential customers who are the approximately 150 large electro-intensive industrial companies in the country. Although it only represents a few percent of EDF's nuclear production, the CAPNs are no less structural for the sector given their duration. The competitiveness of the manufacturers concerned and that of EDF largely depend on it. For now, negotiations are continuing behind the scenes. The CEO of TotalEnergies notably said he was interested in the principle but very reserved on the idea of risk sharing!

The revival of nuclear power includes a rise in power in the industrial sector, with significant challenges in terms of human resources. The necessary “upgrade in skills” is on everyone’s lips. The sector's needs have been estimated at 100,000 hires over ten years by Gifen, the sector's professional union.

If the mechanics seem well underway for EDF, a major shadow remains on the table: the repurchase of the Arabelle turbines, which had been sold to the American General Electric by Alstom. Ofac, the armed arm of the American Treasury, blocked the transaction. The Americans are in no hurry to see EDF regain competitiveness while international competition is raging. More and more countries are relaunching nuclear programs and the French are a serious rival for the Americans. EDF thus remains in the running, alongside the South Korean KHNP, for the construction of nuclear reactors in the Czech Republic. Prague, on the other hand, excluded the American Westinghouse. Enough to offend some sensibilities in Washington.

What is chloropicrin, the chemical agent that Washington accuses Moscow of using in Ukraine?

What is chloropicrin, the chemical agent that Washington accuses Moscow of using in Ukraine? Poland, big winner of European enlargement

Poland, big winner of European enlargement In Israel, step-by-step negotiations for a ceasefire in the Gaza Strip

In Israel, step-by-step negotiations for a ceasefire in the Gaza Strip BBVA ADRs fall almost 2% on Wall Street

BBVA ADRs fall almost 2% on Wall Street Sánchez cancels his agenda and considers resigning: "I need to stop and reflect"

Sánchez cancels his agenda and considers resigning: "I need to stop and reflect" The Federal Committee of the PSOE interrupts the event to take to the streets with the militants

The Federal Committee of the PSOE interrupts the event to take to the streets with the militants Repsol: "We want to lead generative AI to guarantee its benefits and avoid risks"

Repsol: "We want to lead generative AI to guarantee its benefits and avoid risks" Osteoarthritis: an innovation to improve its management

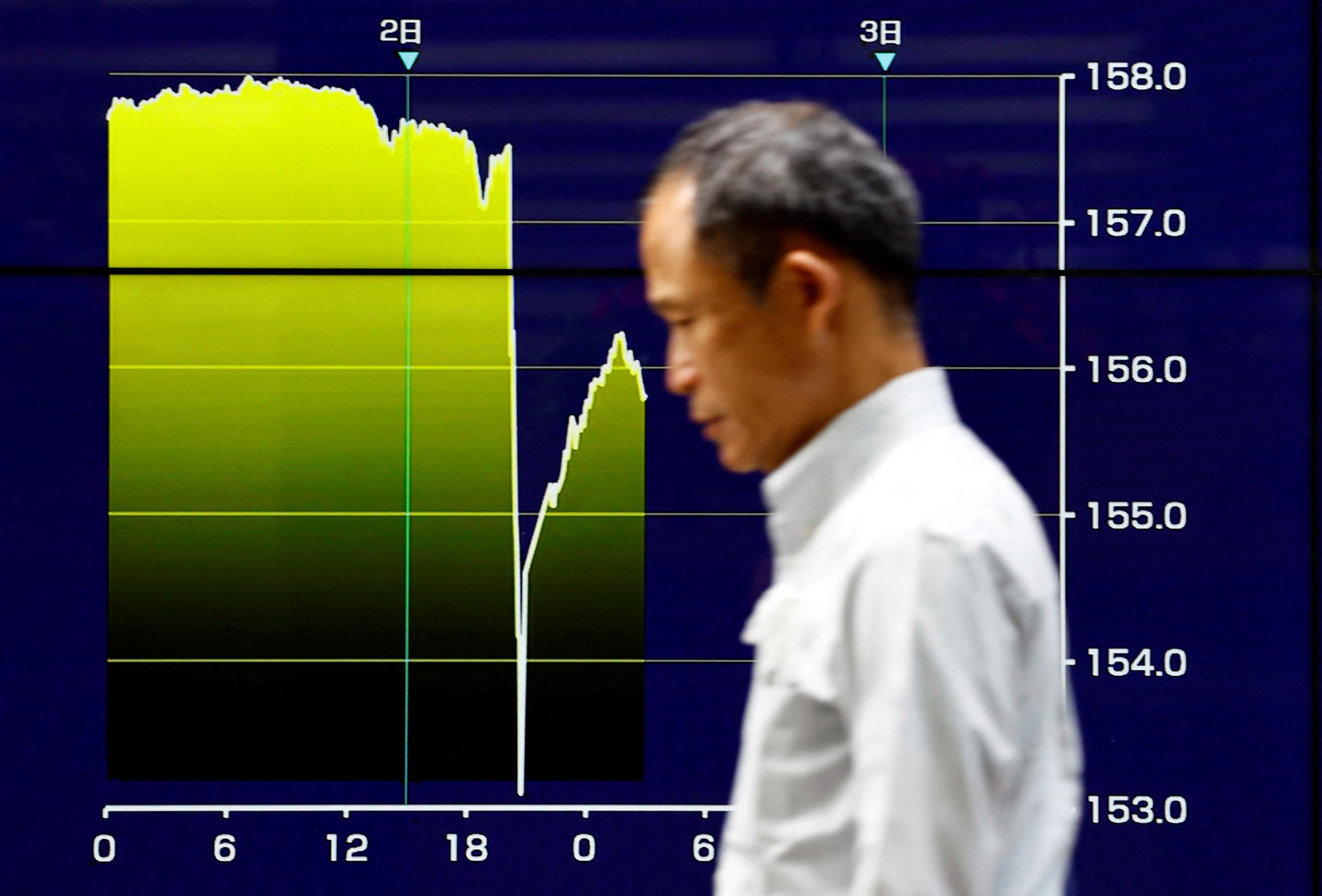

Osteoarthritis: an innovation to improve its management The yen jumps 3% then falls again, amid speculation of Japanese intervention

The yen jumps 3% then falls again, amid speculation of Japanese intervention A very busy Friday on the roads of Île-de-France before the Ascension Bridge

A very busy Friday on the roads of Île-de-France before the Ascension Bridge Fraud: the government is preparing new measures for the fall

Fraud: the government is preparing new measures for the fall Nike breaks the bank to keep the Blues jersey

Nike breaks the bank to keep the Blues jersey Madonna ends her world tour with a giant - and free - concert in Copacabana

Madonna ends her world tour with a giant - and free - concert in Copacabana Harry Potter: Daniel Radcliffe “really saddened” by his final breakup with J.K. Rowling

Harry Potter: Daniel Radcliffe “really saddened” by his final breakup with J.K. Rowling Leviathan, New York Trilogy... Five books by Paul Auster that you must have read

Leviathan, New York Trilogy... Five books by Paul Auster that you must have read Italy wins a decisive round against an American museum for the restitution of an ancient bronze

Italy wins a decisive round against an American museum for the restitution of an ancient bronze Omoda 7, another Chinese car that could be manufactured in Spain

Omoda 7, another Chinese car that could be manufactured in Spain BYD chooses CA Auto Bank as financial partner in Spain

BYD chooses CA Auto Bank as financial partner in Spain Tesla and Baidu sign key agreement to boost development of autonomous driving

Tesla and Baidu sign key agreement to boost development of autonomous driving Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33%

The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33% This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Europeans: a senior official on the National Rally list

Europeans: a senior official on the National Rally list Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels

Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon

Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon “Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne

“Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Mercato: Verratti at Barça? A track studied

Mercato: Verratti at Barça? A track studied Rugby: after the defeat during the Six Nations, the Blues will meet the English in September for a test match

Rugby: after the defeat during the Six Nations, the Blues will meet the English in September for a test match Premier League: Liverpool unveils its new jersey for next season

Premier League: Liverpool unveils its new jersey for next season Formula 1: Alpine holds its new executive technical director

Formula 1: Alpine holds its new executive technical director