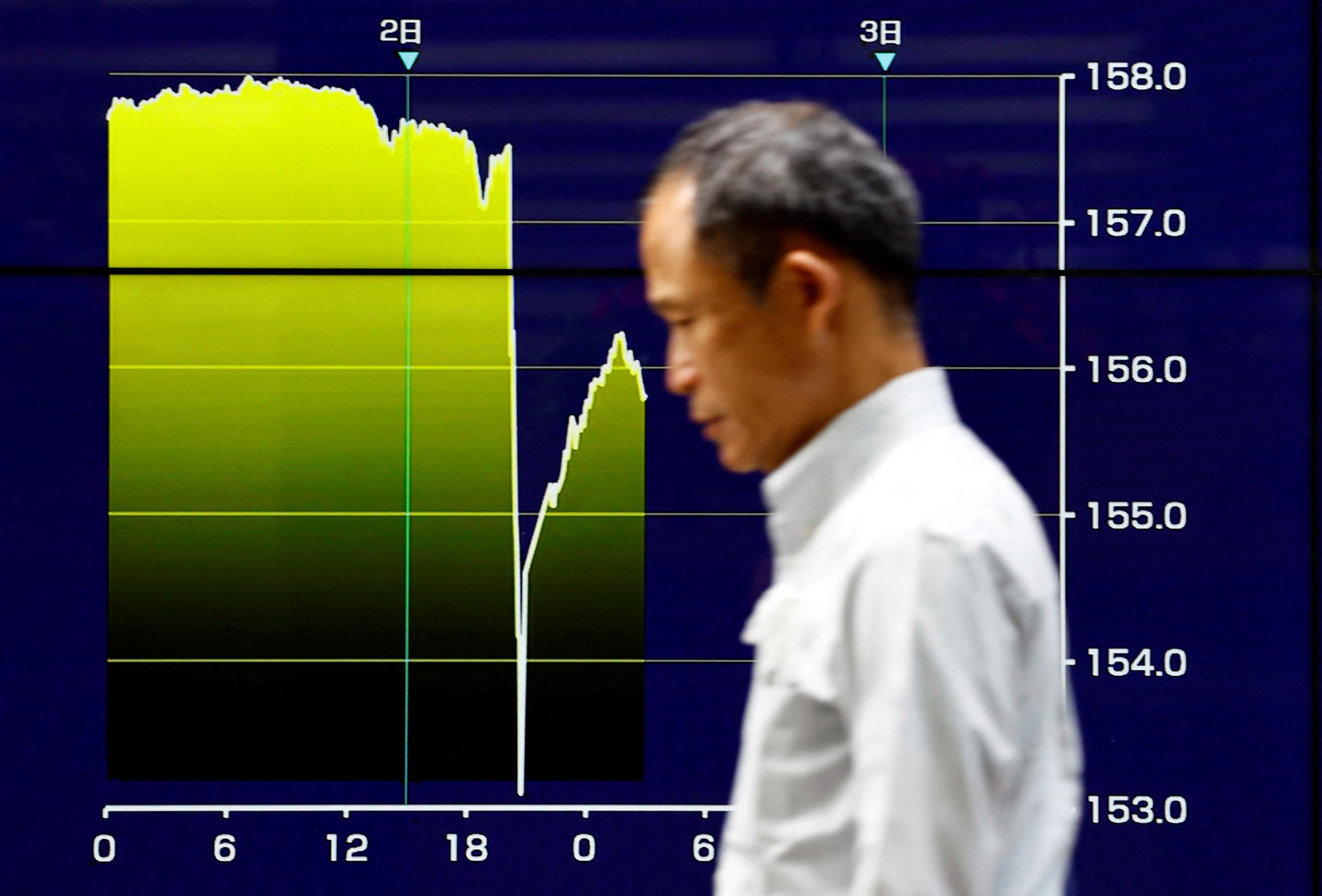

The yen soared on Wednesday shortly before 9:00 p.m. GMT, briefly gaining more than 3% against the dollar before falling again, leading to further speculation about possible intervention by Japanese authorities to support their currency. This brutal movement, which brought the Japanese currency up to 153.04 yen per dollar, occurred a few minutes before 9:00 p.m. GMT, the time at which the closing prices of the day are set. Around 00:30 GMT on Thursday, however, the Japanese currency had already fallen to 155.88 yen per dollar.

The yen had already experienced a similar rebound on Monday, which was seen as the result of an initiative by Japan to stop the slide of its currency. Weakened by a very accommodating monetary policy of the Bank of Japan (BoJ), the archipelago's currency fell on Monday to 160.17 yen per dollar, its lowest level in 34 years, before recovering.

“Many conclude that this is an intervention” by the Japanese authorities to defend their currency, Marc Chandler of Bannockburn Global Forex reacted on Wednesday after the collapse of the yen. “And she seems more aggressive than Monday.” The Japanese authorities do not traditionally communicate during an intervention, and only provide information several days or even weeks later. They had acted in 2022, successfully, once in September and twice in October, putting more than 60 billion dollars on the table to strengthen their currency.

In addition to direct intervention in the foreign exchange market, a country can raise its rates to make them more attractive to foreign investors, which helps to stimulate its currency. In the case of economies poor in natural resources and raw materials, which is the case of Japan, central bankers may be encouraged to act to prevent currency depreciation from causing import prices to soar and boosting inflation. . But during his press conference on Friday, BoJ Governor Kazuo Ueda said that the effect of the current weakness of the yen on inflation was "not significant" for the moment, thus ruling out , in fact, an increase in the key rate to revive the currency of the archipelago.

“Teachers are there to teach facts to students”: in the United Kingdom, the government wants to backtrack on gender theory in schools

“Teachers are there to teach facts to students”: in the United Kingdom, the government wants to backtrack on gender theory in schools Construmat grows by 50% and focuses on sustainability and innovation

Construmat grows by 50% and focuses on sustainability and innovation War in Ukraine: one week later, where is the Russian offensive in Kharkiv?

War in Ukraine: one week later, where is the Russian offensive in Kharkiv? An American tourist steals a mug of beer from a tavern in Munich and admits it...50 years later

An American tourist steals a mug of beer from a tavern in Munich and admits it...50 years later Suicide attempts and self-harm on the rise among young girls

Suicide attempts and self-harm on the rise among young girls In Europe, 10,000 people die every day from cardiovascular disease

In Europe, 10,000 people die every day from cardiovascular disease Brussels raises Spanish GDP forecasts to 2.1% and foresees a deficit of 3% in 2024

Brussels raises Spanish GDP forecasts to 2.1% and foresees a deficit of 3% in 2024 Inflation rises to 3.3% in April due to gas and food

Inflation rises to 3.3% in April due to gas and food Paris 2024 Olympic Games: will Le Coq sportif be on time to equip the athletes?

Paris 2024 Olympic Games: will Le Coq sportif be on time to equip the athletes? OpenAI disbands artificial intelligence risk team

OpenAI disbands artificial intelligence risk team Tax return: it's high time to look into the issue, here's how to get free help

Tax return: it's high time to look into the issue, here's how to get free help “No one supports me”: influencer Poupette Kenza defends herself after her anti-Semitic remarks

“No one supports me”: influencer Poupette Kenza defends herself after her anti-Semitic remarks The big classic family arrives in Six-Fours-les-Plages

The big classic family arrives in Six-Fours-les-Plages The eye of the INA: In Cannes, when scandals did not create the buzz

The eye of the INA: In Cannes, when scandals did not create the buzz Twelve days in the life of Céline: May 27, 1894, the sad child

Twelve days in the life of Céline: May 27, 1894, the sad child Reina Sofia Museum changes name of lecture series criticized by Israeli Embassy

Reina Sofia Museum changes name of lecture series criticized by Israeli Embassy Omoda 7, another Chinese car that could be manufactured in Spain

Omoda 7, another Chinese car that could be manufactured in Spain BYD chooses CA Auto Bank as financial partner in Spain

BYD chooses CA Auto Bank as financial partner in Spain Tesla and Baidu sign key agreement to boost development of autonomous driving

Tesla and Baidu sign key agreement to boost development of autonomous driving Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33%

The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33% This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella New Caledonia: Zemmour accuses Le Pen of “giving in to the thugs and looters”

New Caledonia: Zemmour accuses Le Pen of “giving in to the thugs and looters” Europeans: between the RN and the “euro-gagas”, the communist Léon Deffontaines dreams of breaking through to the left

Europeans: between the RN and the “euro-gagas”, the communist Léon Deffontaines dreams of breaking through to the left Europeans: professor threatened with death Didier Lemaire shows his support for François-Xavier Bellamy

Europeans: professor threatened with death Didier Lemaire shows his support for François-Xavier Bellamy LFI: Manon Aubry places social issues at the center of her European campaign

LFI: Manon Aubry places social issues at the center of her European campaign These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Boxing: Why Fury-Usyk is the most anticipated heavyweight fight in 25 years

Boxing: Why Fury-Usyk is the most anticipated heavyweight fight in 25 years MMA: “Cédric Doumbé still has his hype, we saw it this evening”, the French fighter (very) ambitious for the future

MMA: “Cédric Doumbé still has his hype, we saw it this evening”, the French fighter (very) ambitious for the future NBA: Indiana calms the New York Knicks and equalizes

NBA: Indiana calms the New York Knicks and equalizes Olympic Games 2024: Antoine Dupont as a superstar and a great atmosphere in Toulouse for the flame

Olympic Games 2024: Antoine Dupont as a superstar and a great atmosphere in Toulouse for the flame