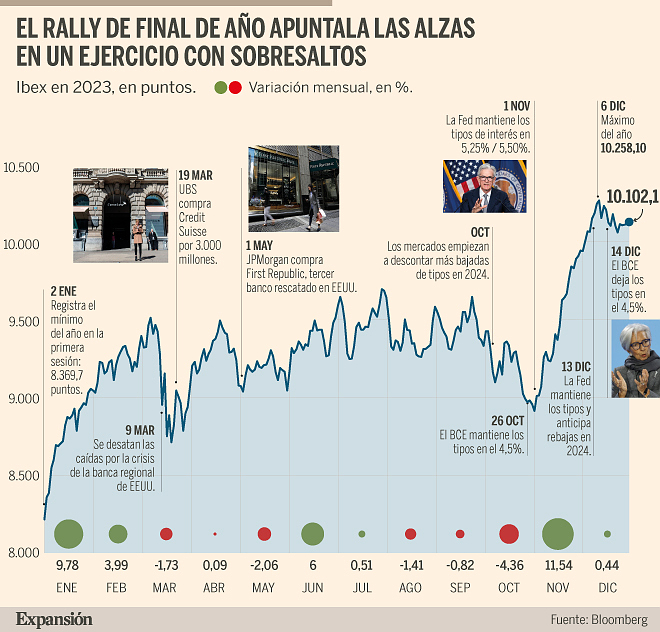

It has risen 22.76% since January, after running a rally of 11.54% in November and adding 0.44% in December, a month marked by the weakness of Spanish banking, which had been stronger the rest of the year. anus. Rumors, confirmed this week, that the tax on the sector remains in place have led investors to cash in last month.

The gains have been imposed on the main world indices, which in some cases set records.

The Ibex has been among the best in 2023. And in March the stock markets fell as a result of the crisis of regional banks in the US that led to the rescue of several entities, such as First Repulic, which ended up in the hands of JPMorgan. In Europe, distrust in the sector took down Credit Suisse, which was acquired by its rival UBS.

But the markets have been able to overcome these shocks and even the worsening of geopolitical tension. In October, the war between Israel and Hamas was added to the conflict in Ukraine, which remains unresolved, due to terrorist attacks.

Throughout the year the pace of the markets has been marked by the leadership of the central banks, inflation and growth data. The Federal Reserve stopped raising interest rates in July, when it made its last increase to 5.50%, and the ECB reached 4.5% in September and has remained there.

The expectation that has been generated since October that the cuts in the price of money will begin in 2024 put a stop to the escalation of debt profitability and has given wings to the stock markets to take off in November in Europe and more strongly in the US in December.

Twenty-eight of the 35 Ibex values achieved gains during the year. Despite a weaker last month in the Spanish stock market, marked by the declines of the banks most exposed to the national business (Sabadell, Unicaja and Bankinter lost more than 10%). Eleven companies revalued between 30% and 67%.

Rovi, Inditex and ACS rise to the profitability podium, with increases of more than 50%, followed by BBVA, Grifols, Aena, Ferrovial and Santander, which advance more than 34.86%.

The recovery of the pharmaceutical company Rovi's business led it to revise upwards its 2023 figures. Added to this are the encouraging prospects for 2024 due to the possible marketing authorization of its drug Risvan by the FDA and the repurchase of shares for its subsequent amortization, which have supported its price. It rose 66.94% after falling 51% the previous year.

Investors have bet heavily on Inditex, which skyrocketed 58.67% and has added more than 45.4 billion in market capitalization (almost what Santander was worth at the end of 2022), up to 122.89 billion. The solidity of the results and its ability to maintain margins at historical highs give wings to the price, which closed the year at 39.43, a new record (prices adjusted for dividends and other operations).

ACS scores 50% and also ends the year at historical highs (40.16 euros). Investors applaud its international strategy and point out that focusing on the construction and concessions divisions allows for solid growth.

In total, eleven companies have achieved records on the stock market this year (prices adjusted for dividends and other operations) and among them are three banks that set it in November: BBVA, CaixaBank and Bankinter. The latter has suffered since then and despite recovering in December, it ends the year on the downside.

BBVA and Santander have been among the most bullish since January in a year in which investors have valued international diversification, which makes them less vulnerable to national taxes, such as the one extended by the Government. The entity chaired by Carlos Torres registered 46% on the stock market, its biggest increase since 2009 when it added 47%.

Santander has added 34.86% since January, its highest annual revaluation since the 71% in 2009. This entity was the furthest behind in 2022, when it fell 4.69% against the trend of the sector. Despite the rise it has accumulated, it still has the potential for revaluation on the stock market.

Other stocks that have set records in different months this year have been Endesa, Ferrovial, Indra, Logista, Repsol and Iberdrola.

The electricity company chaired by Ignacio Sánchez Galán rises 8.6% and closes the year as the value that weighs the most on the Ibex (14.48%) with Inditex behind due to its lower free float (free capital in the market) stepping on its heels. heels (14.17%).

The ranking by market capitalization maintains Inditex, Iberdrola, Santander and BBVA as leaders, but Amadeus rises from seventh to sixth position after revaluating by 33.64% and overtakes Naturgy.

The recovery of the tourism sector after the pandemic has also boosted Aena on the stock market, which has close to 40% and has climbed 11 places in the capitalization ranking, up to the eighth place.

And Grifols' strong rebound in December led it to accumulate an increase of 43.5%. On Friday it confirmed the sale of 20% of Shanghai Raas.

Only seven Ibex values closed the year in negative. The worst part goes to Acciona and its renewable subsidiary Acciona Energía, which have said goodbye to more than 22% of their market capitalization. The rise in interest rates in the last year, which has made financing more expensive, has played against this type of company. They have also faced pressure from high costs and raised questions about whether their growth expectations are ambitious.

Other renewable companies have been encouraged on the Stock Market by the heat of corporate movements in the sector after this year's takeover of Opd-energy. In the case of Acciona Energía, this scenario is ruled out due to its large size and the control of its shareholders.

High interest rates have made securities considered bond proxies less attractive, such as Redeia and Enagás, which end up among the weakest. Unicaja, Bankinter, Repsol and Enagás complete the group of laggards.

What is chloropicrin, the chemical agent that Washington accuses Moscow of using in Ukraine?

What is chloropicrin, the chemical agent that Washington accuses Moscow of using in Ukraine? Poland, big winner of European enlargement

Poland, big winner of European enlargement In Israel, step-by-step negotiations for a ceasefire in the Gaza Strip

In Israel, step-by-step negotiations for a ceasefire in the Gaza Strip BBVA ADRs fall almost 2% on Wall Street

BBVA ADRs fall almost 2% on Wall Street Children born thanks to PMA do not have more cancers than others

Children born thanks to PMA do not have more cancers than others Breast cancer: less than one in two French women follow screening recommendations

Breast cancer: less than one in two French women follow screening recommendations “Dazzling” symptoms, 5,000 deaths per year, non-existent vaccine... What is Lassa fever, a case of which has been identified in Île-de-France?

“Dazzling” symptoms, 5,000 deaths per year, non-existent vaccine... What is Lassa fever, a case of which has been identified in Île-de-France? Sánchez cancels his agenda and considers resigning: "I need to stop and reflect"

Sánchez cancels his agenda and considers resigning: "I need to stop and reflect" “Amazon product tester”: the gendarmerie warns of this new kind of scam

“Amazon product tester”: the gendarmerie warns of this new kind of scam “Unjustified allegations”, “promotion of illicit products”… Half of the influencers controlled in 2023 caught by fraud repression

“Unjustified allegations”, “promotion of illicit products”… Half of the influencers controlled in 2023 caught by fraud repression Extension of the RER E: Gabriel Attal welcomes a “popular” ecology project

Extension of the RER E: Gabriel Attal welcomes a “popular” ecology project WeWork will close 8 of its 20 shared offices in France

WeWork will close 8 of its 20 shared offices in France “We were robbed of this dignity”: Paul Auster’s wife denounces the betrayal of a family friend

“We were robbed of this dignity”: Paul Auster’s wife denounces the betrayal of a family friend A masterclass for parents to fill in their gaps before Taylor Swift concerts

A masterclass for parents to fill in their gaps before Taylor Swift concerts Jean Reno publishes his first novel Emma on May 16

Jean Reno publishes his first novel Emma on May 16 Cannes Film Festival: Meryl Streep awarded an honorary Palme d’Or

Cannes Film Festival: Meryl Streep awarded an honorary Palme d’Or Omoda 7, another Chinese car that could be manufactured in Spain

Omoda 7, another Chinese car that could be manufactured in Spain BYD chooses CA Auto Bank as financial partner in Spain

BYD chooses CA Auto Bank as financial partner in Spain Tesla and Baidu sign key agreement to boost development of autonomous driving

Tesla and Baidu sign key agreement to boost development of autonomous driving Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33%

The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33% This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Europeans: a senior official on the National Rally list

Europeans: a senior official on the National Rally list Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels

Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon

Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon “Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne

“Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Champions Cup: Toulouse with Flament and Kinghorn against Harlequins, Ramos replacing

Champions Cup: Toulouse with Flament and Kinghorn against Harlequins, Ramos replacing Tennis: still injured in the arm, Alcaraz withdraws from the Masters 1000 in Rome

Tennis: still injured in the arm, Alcaraz withdraws from the Masters 1000 in Rome Sailing: “Like a house that threatens to collapse”, Clarisse Crémer exhausted and in tears aboard her damaged boat

Sailing: “Like a house that threatens to collapse”, Clarisse Crémer exhausted and in tears aboard her damaged boat NBA: Patrick Beverley loses his temper and throws balls at Pacers fans

NBA: Patrick Beverley loses his temper and throws balls at Pacers fans