Small-company stocks declined and the Dow Jones Industrial Average fell. The 0.4% increase in S&P 500 index was mainly driven by gains for a few Big Tech companies. Stocks fell slightly than they rose. Apple, Amazon, and Facebook all saw increases of 2% or greater. Tech-rich Nasdaq gained 0.9%. Affirm surged 47% following the announcement by payments company Affirm that it had partnered with Amazon to offer customers a buy-now, pay-later option without credit cards.

THIS IS A BREAKING NEWS UPDATE. Below is the original story by AP.

Wall Street stocks were mostly higher Monday, and they remained close to record highs last week after investors received an update from Federal Reserve.

The central bank indicated that it would continue to maintain low interest rates while the economy recovers from the pandemic. As investors tried to determine how fast and how much the Fed would reduce its support, markets have been volatile. Low interest rates will not change for the foreseeable future, according to a speech Friday by Fed Chair Jerome Powell.

"When you look at the situation, it gives the impression that things are good, and Powell basically said he wasn't going to take away the punch bowl," stated Brad McMillan chief investment officer of Commonwealth Financial Network.

As of 2:40 pm, the S&P 500 had risen 0.6%. The Dow Jones Industrial Average fell less than 0.1%, while the Nasdaq composite grew 1%.

Technology stocks, which have low interest rates, did a lot of the heavy lifting in the wider market. The benchmark S&P 500 was also lifted by solid gains from health care companies.

The yields on bonds edged down. The 10-year Treasury yield fell to 1.28%, from 1.31% on Friday.

Energy prices were mixed as the the full impact of Hurricane Ida is still being assessed. Economists suggest that although the storm could have a significant impact on the shipping, energy and chemical industries along the Gulf Coast, the overall economic impact should be minimal so long as the damage estimates don’t rise significantly and the refinery shut downs are not prolonged.

Crude oil prices rose 0.8% while natural gas prices fell 2.5% after Colonial Pipeline stopped deliveries to the south, until it could assess the damage caused by the storm.

Stocks rose after deal news. Affirm soared 47% after the payments company announced a deal last week with Amazon to offer shoppers a buy-now-pay-later option that doesn't involve credit cards. Hill-Rom Holdings rose 9.9% after reports that Baxter International was interested in purchasing the medical technology company.

Investors can look forward to several important economic reports this week, including consumer confidence on Tuesday, and the Labor Department's monthly employment survey on Friday. These reports could be used to help investors gauge the path of economic recovery, as the latter is subject to resistance from the more contagious Delta variant.

Poland, big winner of European enlargement

Poland, big winner of European enlargement In Israel, step-by-step negotiations for a ceasefire in the Gaza Strip

In Israel, step-by-step negotiations for a ceasefire in the Gaza Strip BBVA ADRs fall almost 2% on Wall Street

BBVA ADRs fall almost 2% on Wall Street Ukraine has lost 10 million inhabitants since 2001... and could lose as many by 2050

Ukraine has lost 10 million inhabitants since 2001... and could lose as many by 2050 Sánchez cancels his agenda and considers resigning: "I need to stop and reflect"

Sánchez cancels his agenda and considers resigning: "I need to stop and reflect" The Federal Committee of the PSOE interrupts the event to take to the streets with the militants

The Federal Committee of the PSOE interrupts the event to take to the streets with the militants Repsol: "We want to lead generative AI to guarantee its benefits and avoid risks"

Repsol: "We want to lead generative AI to guarantee its benefits and avoid risks" Osteoarthritis: an innovation to improve its management

Osteoarthritis: an innovation to improve its management Ukraine gets a spokesperson generated by artificial intelligence

Ukraine gets a spokesperson generated by artificial intelligence The French will take advantage of the May bridges to explore France

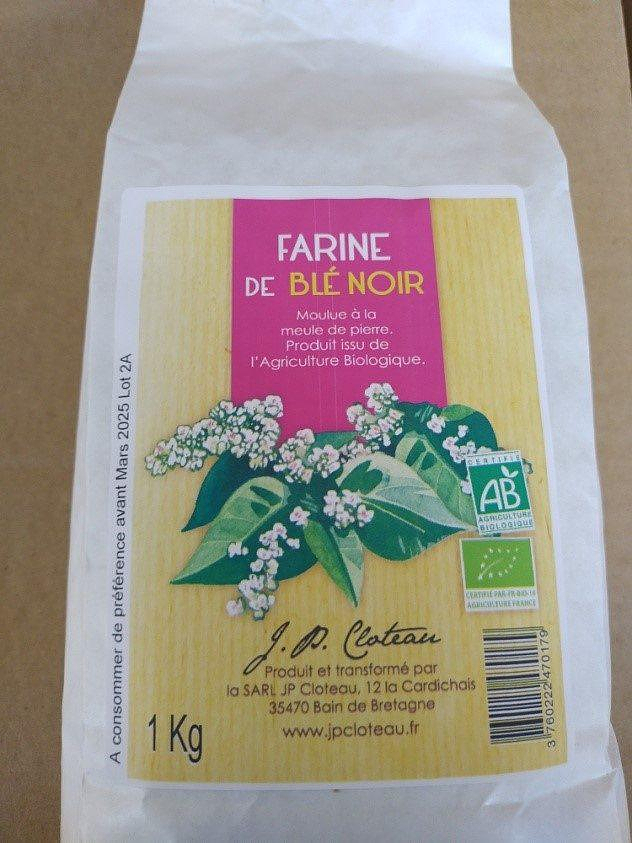

The French will take advantage of the May bridges to explore France Organic flour contaminated by a recalled toxic plant

Organic flour contaminated by a recalled toxic plant 2024 Olympics: Parisian garbage collectors have filed a strike notice

2024 Olympics: Parisian garbage collectors have filed a strike notice Death of Paul Auster: Actes Sud says he is “lucky” to have been his publisher in France

Death of Paul Auster: Actes Sud says he is “lucky” to have been his publisher in France Lang Lang, the most French of Chinese pianists

Lang Lang, the most French of Chinese pianists Author of the “New York Trilogy”, American novelist Paul Auster has died at the age of 77

Author of the “New York Trilogy”, American novelist Paul Auster has died at the age of 77 To the End of the World, The Stolen Painting, Border Line... Films to watch this week

To the End of the World, The Stolen Painting, Border Line... Films to watch this week Omoda 7, another Chinese car that could be manufactured in Spain

Omoda 7, another Chinese car that could be manufactured in Spain BYD chooses CA Auto Bank as financial partner in Spain

BYD chooses CA Auto Bank as financial partner in Spain Tesla and Baidu sign key agreement to boost development of autonomous driving

Tesla and Baidu sign key agreement to boost development of autonomous driving Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33%

The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33% This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Europeans: a senior official on the National Rally list

Europeans: a senior official on the National Rally list Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels

Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon

Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon “Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne

“Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Top 14: Fijian hooker Narisia leaves Racing 92 and signs for Oyonnax

Top 14: Fijian hooker Narisia leaves Racing 92 and signs for Oyonnax Europa League: Jean-Louis Gasset is “wary” of Atalanta, an “atypical team”

Europa League: Jean-Louis Gasset is “wary” of Atalanta, an “atypical team” Europa League: “I don’t believe it…”, Gasset jokes about Aubameyang’s age

Europa League: “I don’t believe it…”, Gasset jokes about Aubameyang’s age Foot: Rupture of the cruciate ligaments for Sergino Dest (PSV), absent until 2025

Foot: Rupture of the cruciate ligaments for Sergino Dest (PSV), absent until 2025