The origins of SeedRocket date back to 2008, three years after Y Combinator took its first steps in the United States. It is no coincidence that it is the mirror in which this Spanish accelerator continues to look, as Jesús Monleón, co-founder with Vicente Arias, recognizes: "We wanted to offer young start-up founders what we would have liked to have had back in the day: the support of a group of serial entrepreneurs with experience and financing capacity. Throughout its history, it has facilitated access to the ecosystem and its network of business angels to nearly 400 companies, some of which are millionaire successes, such as Captio, Habitissimo and Deporvillage. EXPANSIÓN has analyzed, thanks to the data provided by SeedRocket, what the balance would have been of investing in all the winning projects of the 29 entrepreneurial campuses organized by the accelerator since its inception.

The results (chart on page 3) suggest that inconsistency is the greatest sin of a business angel. Of the 79 start-ups that won the program, less than a dozen can be considered exceptional cases. "It is impossible to know in advance which company is going to be, so it is essential to invest systematically and consistently over time," says Monleón. In SeedRocket's experience, between 10% and 20% of investments end up being successful, but the companies that succeed big generate multiples so attractive that they more than offset the losses of the rest.

The complexity is high and the deadlines are long. The maturation period of a start-up can last between three and five years: during this time, the future is unknown. Likewise, the fact that most projects fail can be difficult to manage psychologically and there are no cyclical patterns. The best historical streak can be succeeded by the most negative vintage of all. Monleón warns that "it is a business in which you live with uncertainty and you have to know how to manage it. It is necessary to set some rules so as not to end up living in emotionality."

The co-founder of SeedRocket emphasizes that "an investor must be very clear about the concept of diversification." In his case, he estimates the minimum number of invested companies to be between 20 and 25, which must be distributed over the years and not concentrated in a short period. "Along with consistency and diversification, it is important to always play the same game: the risk and the amount invested must be similar," he adds.

Jesús Monleón points out that making the first investment in a start-up, when there is still nothing tangible beyond the team and the market, is relatively simple. However, "the great difficulty comes later, when the company gains momentum and you have to make the decision whether or not to follow on. That's where you really risk it," he highlights. In jargon, follow on or follow-up investment is that operation in which an investor expands his position in one of the companies that he already has in his portfolio.

The final step of the business angel roadmap is exit, which is usually partial. This exit can occur through the sale of the company - between six and ten years - or through the acquisition of the shares by secondary venture capital funds - never before the first three years -. "If you want to make a lot of money, you have to endure until the end. But as a business angel, we often enter very cheap and from a certain multiple it is interesting to make cash," says Monleón. While that money can be reinvested, waiting until the end means accepting the risk of losing everything. In the case of SeedRocket, the accelerator does not take equity from the participating start-ups unless one of its business angels decides to invest personally. Entrepreneurs should not pay any forced "toll" for connecting with mentors of the caliber of Arias, Monleón, Marek Fodor, Iñaki Arrola or François Derbaix. "What they value most is that with three calls we can put them in contact with an international fund," concludes Monleón.

Beyond spectacular successes such as that achieved by Deporvillage - whose sale to the group that owns brands such as JD Sports and Sprinter multiplied its initial valuation by more than a hundred -, Jesús Monleón defines Holded as "the most emblematic case" of 'start up' on SeedRocket. She is the youngest winner to have starred in an 'exit' so far. Its founders, Javi Fondevila and Bernat Ripoll, were clear from the beginning about the product they wanted to make, and they never needed to pivot: intelligent business management software (ERP) for SMEs, capable of placing in the cloud what is necessary to manage the company. In addition, the brilliant technological and business execution drove its growth to a much earlier sale than usual for a 'start-up'. Just six months after closing a round of 15 million euros, the Norwegian company Visma acquired Holded in 2021 for over 190 million euros (bonuses included).

Andrés Casal and Efrén Álvarez launched Wetaca in 2015 to offer a healthy solution to those who do not have enough time to cook. The company proposes a weekly subscription model, in which the user chooses the recipes that they will receive at home the week following placing the order. From its kitchens in the Madrid neighborhood of Villaverde it sends more than 7,000 tupperware weekly. Jesús Monleón believes that Wetaca is "a success story in which a young team revolutionizes a business by being operationally efficient." Although it has needed to raise less than 5 million euros in financing since its founding, in 2022 it had a turnover of more than 13 million.

Computer engineers Sergio Lao and Joaquim de la Cruz had just graduated when they joined the global head of Santander's private banking business, Álvaro Morales, to found Flanks, a pioneering fintech in offering a fully-fledged securities account aggregator. digital. Since its beginnings in 2018, the start-up detected an unmet need in this area: greater agility and digitalization. This allows financial advisors to manage the portfolios of all their clients from the same platform, even if they have accounts in different entities. Jesús Monleón appreciates that "two young founders have brought disruption to this business with the help of a person with more experience." In 2021, it closed a round of 2.3 million euros, and Monleón believes that Flanks is a capital-efficient company that will transform the sector.

What is chloropicrin, the chemical agent that Washington accuses Moscow of using in Ukraine?

What is chloropicrin, the chemical agent that Washington accuses Moscow of using in Ukraine? Poland, big winner of European enlargement

Poland, big winner of European enlargement In Israel, step-by-step negotiations for a ceasefire in the Gaza Strip

In Israel, step-by-step negotiations for a ceasefire in the Gaza Strip BBVA ADRs fall almost 2% on Wall Street

BBVA ADRs fall almost 2% on Wall Street Sánchez cancels his agenda and considers resigning: "I need to stop and reflect"

Sánchez cancels his agenda and considers resigning: "I need to stop and reflect" The Federal Committee of the PSOE interrupts the event to take to the streets with the militants

The Federal Committee of the PSOE interrupts the event to take to the streets with the militants Repsol: "We want to lead generative AI to guarantee its benefits and avoid risks"

Repsol: "We want to lead generative AI to guarantee its benefits and avoid risks" Osteoarthritis: an innovation to improve its management

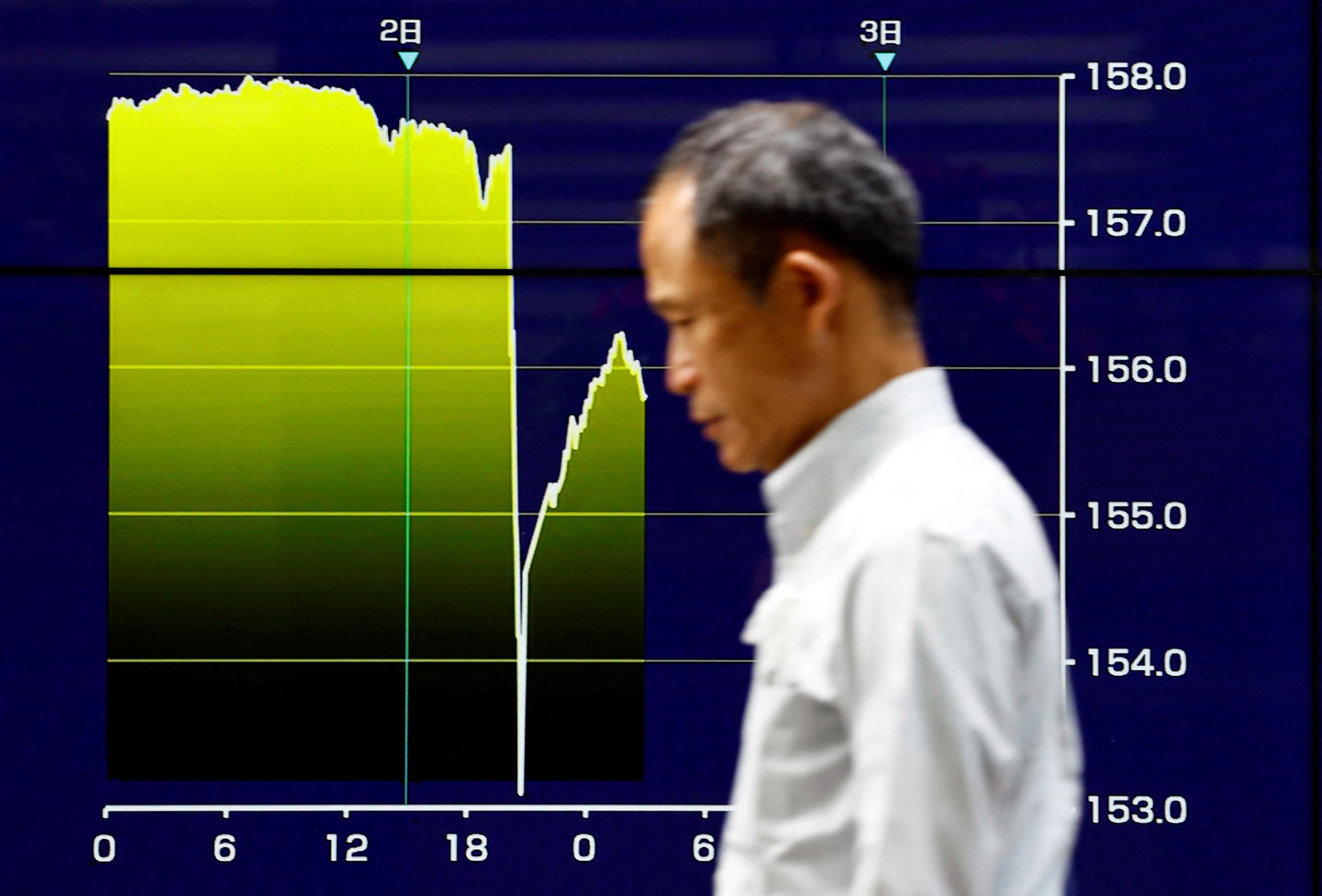

Osteoarthritis: an innovation to improve its management The yen jumps 3% then falls again, amid speculation of Japanese intervention

The yen jumps 3% then falls again, amid speculation of Japanese intervention A very busy Friday on the roads of Île-de-France before the Ascension Bridge

A very busy Friday on the roads of Île-de-France before the Ascension Bridge Fraud: the government is preparing new measures for the fall

Fraud: the government is preparing new measures for the fall Nike breaks the bank to keep the Blues jersey

Nike breaks the bank to keep the Blues jersey Madonna ends her world tour with a giant - and free - concert in Copacabana

Madonna ends her world tour with a giant - and free - concert in Copacabana Harry Potter: Daniel Radcliffe “really saddened” by his final breakup with J.K. Rowling

Harry Potter: Daniel Radcliffe “really saddened” by his final breakup with J.K. Rowling Leviathan, New York Trilogy... Five books by Paul Auster that you must have read

Leviathan, New York Trilogy... Five books by Paul Auster that you must have read Italy wins a decisive round against an American museum for the restitution of an ancient bronze

Italy wins a decisive round against an American museum for the restitution of an ancient bronze Omoda 7, another Chinese car that could be manufactured in Spain

Omoda 7, another Chinese car that could be manufactured in Spain BYD chooses CA Auto Bank as financial partner in Spain

BYD chooses CA Auto Bank as financial partner in Spain Tesla and Baidu sign key agreement to boost development of autonomous driving

Tesla and Baidu sign key agreement to boost development of autonomous driving Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33%

The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33% This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Europeans: a senior official on the National Rally list

Europeans: a senior official on the National Rally list Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels

Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon

Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon “Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne

“Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Mercato: Verratti at Barça? A track studied

Mercato: Verratti at Barça? A track studied Rugby: after the defeat during the Six Nations, the Blues will meet the English in September for a test match

Rugby: after the defeat during the Six Nations, the Blues will meet the English in September for a test match Premier League: Liverpool unveils its new jersey for next season

Premier League: Liverpool unveils its new jersey for next season Formula 1: Alpine holds its new executive technical director

Formula 1: Alpine holds its new executive technical director