Many of the investors who decided to bet on start-ups at the moment of greatest euphoria in the history of the ecosystem, which reached its peak between 2021 and the first half of 2022, have seen how the valuations of these companies plummet a few months later. The perfect storm unleashed by rising interest rates, uncertainty in the markets and the stagnation of IPOs has had a considerable impact on the technology sector in the last year.

However, this period marked by a strong correction in start-up valuations could have begun to be left behind. This is indicated by the latest report published by CB Insights, which suggests the beginning of a recovery in valuations, especially in the most advanced phases of investment.

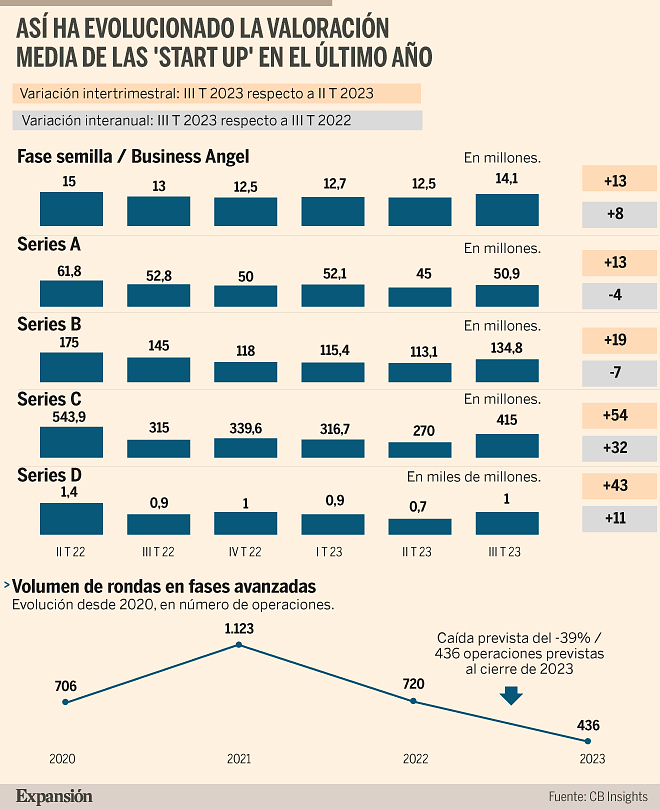

The study, which analyzes the scenario at the end of the third quarter of 2023, reveals that in recent months start-up valuations have experienced a rebound in each and every one of the financing stages.

This change in trend is reflected in an increase in the average valuation of those technology companies that raised funds in this period compared to those that did so in the second quarter of the year. This increase is particularly pronounced both in the Series C and D rounds, which recorded growth of 54% and 43% respectively, and in the subsequent phases.

However, the number of operations remains low when compared to the results of recent years, and forecasts indicate that this figure will fall at the end of the year in all stages.

In this way, the increase that has taken place in valuations in this third quarter may be, to a certain extent, a consequence of some start-ups not being able to raise financing even at low valuations. The search for quality over quantity by investors seeking a limited risk approach is a trend that appears to be here to stay.

This is a logical response to the market situation, with widespread volatility and even bankruptcies carried out by high-profile start-ups that had large volumes of financing behind them. Although the number of rounds in advanced stages grew by 6% in the third quarter of this year compared to the second, forecasts indicate that the number of operations at the end of 2023 will suffer a decrease of approximately 39% compared to last year .

In the case of those rounds that do close, investors increasingly seek to protect themselves against risk. 65% of the rounds in advanced stages that were closed during the third quarter of the year in the United States included the negotiation of clauses such as liquidation preference, which gives priority to investors recovering their investment, 48% more than in the previous quarter.

On the other hand, the CB Insights report highlights that the average valuations of start-ups in Series A and B rounds decreased in this period compared to the data for the same quarter in 2022, while those companies that closed operations in the seed phase, from Series C and from Series D increased in comparison with the same period.

According to the latest European report on the technology sector launched a few weeks ago by the venture capital firm Atomico, 80% of entrepreneurs on the Old Continent agree that it is more difficult for them to raise capital and that they have had no choice but to adjust their expectations for financing rounds.

In this context, the study reveals a significant reduction in rounds starting at $100 million in Europe: there have only been 36 operations of this type compared to 163 in 2022 and 200 in 2021.

In any case, and despite the fact that the number of downward rounds - those that close at a valuation lower than that established in the immediately previous round - has increased in the last year, the Atomico report clarifies that this This circumstance has only occurred in 21% of all operations closed in Europe so far in 2023.

One of the segments that has suffered most intensely from the downward adjustment of valuations in the last year is, paradoxically, those made up of the most valued companies in the world.

Around 90% of the 128 companies that achieved unicorn status in 2021 have since experienced a drop in their valuation, according to data published by Bloomberg in recent days. In fact, estimates indicate that around a third of these companies have lost unicorn status, as their valuation has once again fallen below $1 billion.

This represents a loss of status and perceived value for start-ups, since the market tends to attribute to unicorns greater possibilities of achieving an exit, whether through going public or via merger or acquisition. Faced with this scenario of generalized fall in valuations, caution on the part of companies has led to a significant drought in the pace of IPOs that have occurred in the last year.

In the case of Europe, only a handful of start-ups have managed to break the barrier of $1 billion valuation in 2023, among which DeepL, Helsing.ai, Synthesia and Quantexa stand out.

What is chloropicrin, the chemical agent that Washington accuses Moscow of using in Ukraine?

What is chloropicrin, the chemical agent that Washington accuses Moscow of using in Ukraine? Poland, big winner of European enlargement

Poland, big winner of European enlargement In Israel, step-by-step negotiations for a ceasefire in the Gaza Strip

In Israel, step-by-step negotiations for a ceasefire in the Gaza Strip BBVA ADRs fall almost 2% on Wall Street

BBVA ADRs fall almost 2% on Wall Street Sánchez cancels his agenda and considers resigning: "I need to stop and reflect"

Sánchez cancels his agenda and considers resigning: "I need to stop and reflect" The Federal Committee of the PSOE interrupts the event to take to the streets with the militants

The Federal Committee of the PSOE interrupts the event to take to the streets with the militants Repsol: "We want to lead generative AI to guarantee its benefits and avoid risks"

Repsol: "We want to lead generative AI to guarantee its benefits and avoid risks" Osteoarthritis: an innovation to improve its management

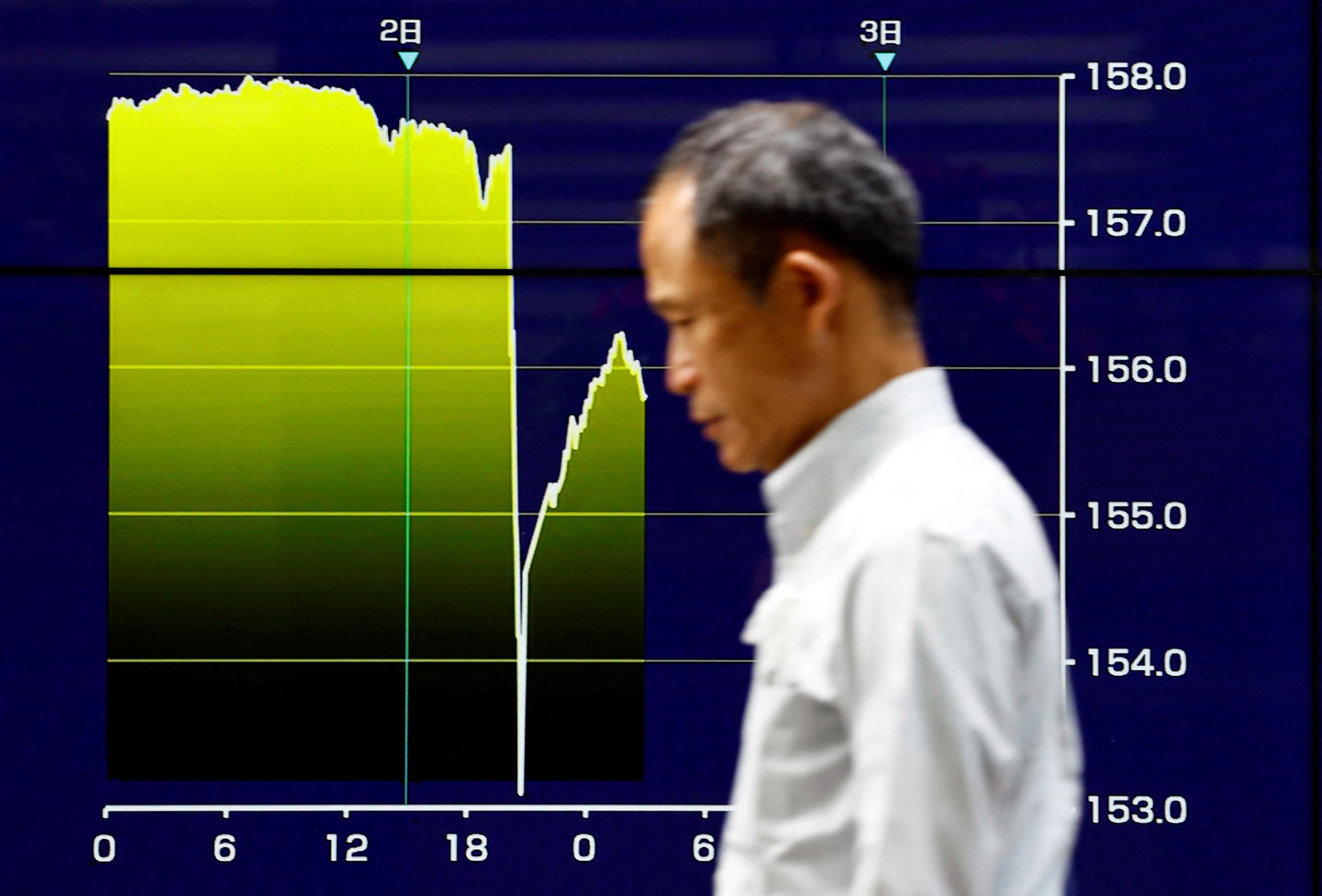

Osteoarthritis: an innovation to improve its management The yen jumps 3% then falls again, amid speculation of Japanese intervention

The yen jumps 3% then falls again, amid speculation of Japanese intervention A very busy Friday on the roads of Île-de-France before the Ascension Bridge

A very busy Friday on the roads of Île-de-France before the Ascension Bridge Fraud: the government is preparing new measures for the fall

Fraud: the government is preparing new measures for the fall Nike breaks the bank to keep the Blues jersey

Nike breaks the bank to keep the Blues jersey Madonna ends her world tour with a giant - and free - concert in Copacabana

Madonna ends her world tour with a giant - and free - concert in Copacabana Harry Potter: Daniel Radcliffe “really saddened” by his final breakup with J.K. Rowling

Harry Potter: Daniel Radcliffe “really saddened” by his final breakup with J.K. Rowling Leviathan, New York Trilogy... Five books by Paul Auster that you must have read

Leviathan, New York Trilogy... Five books by Paul Auster that you must have read Italy wins a decisive round against an American museum for the restitution of an ancient bronze

Italy wins a decisive round against an American museum for the restitution of an ancient bronze Omoda 7, another Chinese car that could be manufactured in Spain

Omoda 7, another Chinese car that could be manufactured in Spain BYD chooses CA Auto Bank as financial partner in Spain

BYD chooses CA Auto Bank as financial partner in Spain Tesla and Baidu sign key agreement to boost development of autonomous driving

Tesla and Baidu sign key agreement to boost development of autonomous driving Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33%

The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33% This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Europeans: a senior official on the National Rally list

Europeans: a senior official on the National Rally list Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels

Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon

Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon “Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne

“Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Mercato: Verratti at Barça? A track studied

Mercato: Verratti at Barça? A track studied Rugby: after the defeat during the Six Nations, the Blues will meet the English in September for a test match

Rugby: after the defeat during the Six Nations, the Blues will meet the English in September for a test match Premier League: Liverpool unveils its new jersey for next season

Premier League: Liverpool unveils its new jersey for next season Formula 1: Alpine holds its new executive technical director

Formula 1: Alpine holds its new executive technical director