It is a far-reaching decision. At the end of July, the Federal court of the Swiss Federal tax administration (FTA) gave the green light: The office may provide information to 45’000 UBS clients in France to the local tax authorities. The decision was short: Three judges voted in favor, two against.

Today, the written judgment of the Federal court, is published. It gives an insight into how the judges came to their decision. Both the FTA and the UBS is not in a comment. You want to look at the judgment, only in more detail. Therefore, the data are not yet in France. "The Federal Department of Finance (FDF) will analyze the written grounds of judgment and thereafter the further steps are," said a spokesman.

The judgment sums up to 39 pages of the decision of the judges. It shows why you agree with in spite of the large concerns of the data delivery to France. However, an important question, even after reading the justification of the verdict remains: How to ensure the principle of Specialty? This internationally recognized rule that prohibits the recipient government uses the data for other things than for tax purposes. Say: France is allowed to use the data from Switzerland only to defaulting tax payers to make. The data may, however, be used in the ongoing criminal trial against UBS in France.

Billion-dollar buses

The Bank was convicted in Paris in the first instance, to a penalty of 4.5 billion euros, because the UBS is said to have helped the French in the case of tax evasion. In contrast, the Bank defends itself with all legal means.

in July, after the Federal court had approved the request for administrative assistance from France, moved to the big Bank and the bankers Association therefore, the Federal Steuerverwaltungzur responsibility: "The Swiss Federal tax administration needs to ensure that the data of the criminal proceedings against UBS are not used in the before in France." The bankers ' Association, said: "We expect the Federal authorities to give priority to the observance of this principle by France's top priority."

UBS General counsel Markus Diethelm, according to the judge's decision in Paris. Photo: Ian Langsdon (Epa)

In the written judgment of the Federal court, it is said that the French authorities had not agreed to need the data in a different method. Any use in another context, it is the prior approval by the competent requested authority. But solid as a rock, this promise does not seem to be. Currently, no use is planned of the transmitted information against the Respondent (the UBS), means there is something vague in the judgment.

To France in the hope

legal experts are sceptical as to whether this works. "I am personally rather critical of the Federal-court decision, because the principle of Speciality convinced dogmatic, but in practice it is not really enforceable, even against friendly States, such as France," said business law Professor Peter V. Kunz. Hence the slogan: "Hope and Fear, nor with respect to the French behavior simple".

the reasoning of The judge is therefore to be understood according to the lawyers as a Signal to. To the outside, as a reminder to France that the authorities really keep in mind. But also inside that the FTA meets further investigations and from the French side further assurances catches up. The question remains open of whether the FTA with the French authorities have already sought once again to contact. "Any ongoing discussions with the French authorities, we do not give any information," said a spokesman.

lawyers suggest that the FTA seeks re-assurance. Because it had come in the past to violations of the principle of Speciality. For legal experts, it is clear that the assistance data of Taxpayers may not be in a criminal case used. But what is with the information to the alleged accessaries? So information to the Bank and to the Bank employees. Can this be used in other proceedings?

fish trains accepted

The decision will also reverberate for another reason. Lawyers fear that the ruling so-called Fishing Expeditions will make it possible. As fish trains per day travelling assistance will be referred to the requests of foreign tax authorities, where there is no concrete evidence to individual customers or groups of customers are based on. There is no better example of such a RAID, so a legal expert.

In the written judgment of the Federal court, it does not mean that it was in this case is a Fishing Expedition, since France knowledge of French UBS-have already enough customers. However, the justification for this is extremely vague and could lead to further requests from abroad, the fear in the financial space.

Created: 04.12.2019, 13:35 PM

Poland, big winner of European enlargement

Poland, big winner of European enlargement In Israel, step-by-step negotiations for a ceasefire in the Gaza Strip

In Israel, step-by-step negotiations for a ceasefire in the Gaza Strip BBVA ADRs fall almost 2% on Wall Street

BBVA ADRs fall almost 2% on Wall Street Ukraine has lost 10 million inhabitants since 2001... and could lose as many by 2050

Ukraine has lost 10 million inhabitants since 2001... and could lose as many by 2050 Sánchez cancels his agenda and considers resigning: "I need to stop and reflect"

Sánchez cancels his agenda and considers resigning: "I need to stop and reflect" The Federal Committee of the PSOE interrupts the event to take to the streets with the militants

The Federal Committee of the PSOE interrupts the event to take to the streets with the militants Repsol: "We want to lead generative AI to guarantee its benefits and avoid risks"

Repsol: "We want to lead generative AI to guarantee its benefits and avoid risks" Osteoarthritis: an innovation to improve its management

Osteoarthritis: an innovation to improve its management Ukraine gets a spokesperson generated by artificial intelligence

Ukraine gets a spokesperson generated by artificial intelligence The French will take advantage of the May bridges to explore France

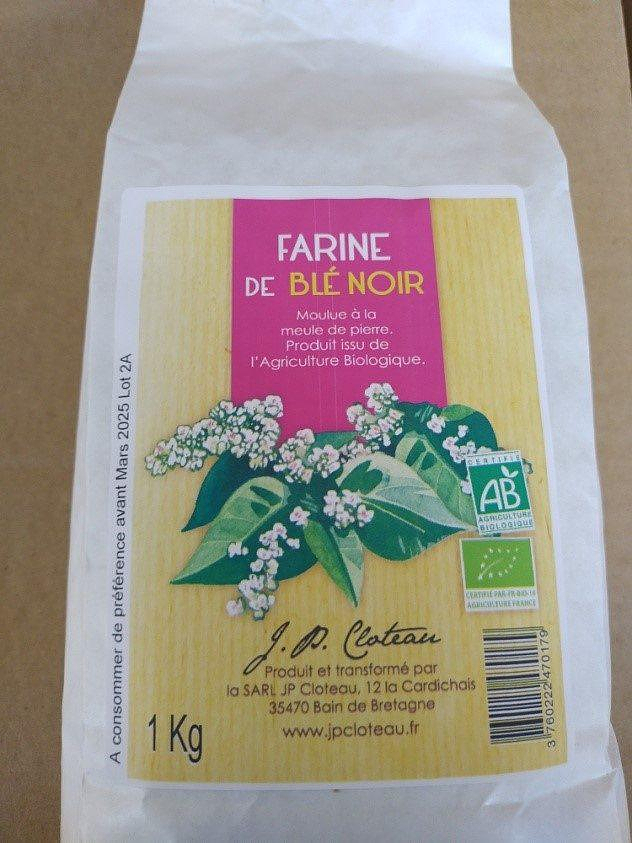

The French will take advantage of the May bridges to explore France Organic flour contaminated by a recalled toxic plant

Organic flour contaminated by a recalled toxic plant 2024 Olympics: Parisian garbage collectors have filed a strike notice

2024 Olympics: Parisian garbage collectors have filed a strike notice Death of Paul Auster: Actes Sud says he is “lucky” to have been his publisher in France

Death of Paul Auster: Actes Sud says he is “lucky” to have been his publisher in France Lang Lang, the most French of Chinese pianists

Lang Lang, the most French of Chinese pianists Author of the “New York Trilogy”, American novelist Paul Auster has died at the age of 77

Author of the “New York Trilogy”, American novelist Paul Auster has died at the age of 77 To the End of the World, The Stolen Painting, Border Line... Films to watch this week

To the End of the World, The Stolen Painting, Border Line... Films to watch this week Omoda 7, another Chinese car that could be manufactured in Spain

Omoda 7, another Chinese car that could be manufactured in Spain BYD chooses CA Auto Bank as financial partner in Spain

BYD chooses CA Auto Bank as financial partner in Spain Tesla and Baidu sign key agreement to boost development of autonomous driving

Tesla and Baidu sign key agreement to boost development of autonomous driving Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33%

The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33% This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Europeans: a senior official on the National Rally list

Europeans: a senior official on the National Rally list Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels

Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon

Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon “Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne

“Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Top 14: Fijian hooker Narisia leaves Racing 92 and signs for Oyonnax

Top 14: Fijian hooker Narisia leaves Racing 92 and signs for Oyonnax Europa League: Jean-Louis Gasset is “wary” of Atalanta, an “atypical team”

Europa League: Jean-Louis Gasset is “wary” of Atalanta, an “atypical team” Europa League: “I don’t believe it…”, Gasset jokes about Aubameyang’s age

Europa League: “I don’t believe it…”, Gasset jokes about Aubameyang’s age Foot: Rupture of the cruciate ligaments for Sergino Dest (PSV), absent until 2025

Foot: Rupture of the cruciate ligaments for Sergino Dest (PSV), absent until 2025