What is the climb you will then have the quotes? Now 85% of self-employed pay their contributions according to a minimum contribution base, which are of 932 euros in 2018. On this amount, the autonomous each month is disbursed by a percentage (the type) that goes from 29.8% to 30.8%. To agree on the rise of 2019, the Government and the self-employed, has spent weeks debating what to boost to apply to each part, that is to say, to the base and to the type. According to the major associations of the collective, in today's meeting have agreed that the base will rise 1.25%, and the rate at 30%.

MORE INFORMATION The autonomous approach positions the Government to raise contributions, The Government is now saying that the rise of the higher fees is not closed Work proposes to raise the share of self employed in 2019 and to postpone the reform to 2020Lorenzo Love, president of the association of autonomous ATA, is the one who has announced that there is a definitive agreement, and that this implies an increase of 6.5 euros per month for the majority of self-employed persons and of 7 euros for the self-employed and corporate. The covenant would have been met by three of the four associations present at the meeting, has pointed Love.

The agreement, signed by three associations of self-employed workers (UPTA, ATA, CEAT) which is clear UATAE, also an increase of the flat fee that you now pay the self-employed during the first stages of their activity, which goes from 50 to 60 euros a month.

To improve the situation of protection, the percentage of the type of contribution of own-account workers will Bahis Siteleri increase progressively in the next four years to reach 31% in 2022. The self-employed who now choose not to pay to have the right to charge if they fall low, have a type of 26.5%. On the other hand, if they do, the type reaches 29.5%, and arrives at 29.8 per cent if you also want to receive support in case you have to cease an activity.

This modest increase linked to the jump of 22.3% of the basis of lowest quote in the general regime (it is linked to the minimum wage) has a consequence: for the first time since the eighties the minimum reference used to calculate what quoted the self-employed will be below that used for employees.

In recent decades, this reference for the own account workers was higher. Is set so as to compensate for the freedom that the self-employed to choose the contribution basis, which gives rise to the 85% choose the minimum base of contribution. In contrast, the wage earners do not have that option because the fees are directly tied to salary. To reverse the situation, it generates a new incentive to outsourcing, as is reducing the costs of self-employment, and, by extension, to the increase of fraud through the false self-employed. The Ministry intends that this situation is prolonged for only a few months but, given the situation of political instability, there is a clear risk that the situation may be stretched.

Poland, big winner of European enlargement

Poland, big winner of European enlargement In Israel, step-by-step negotiations for a ceasefire in the Gaza Strip

In Israel, step-by-step negotiations for a ceasefire in the Gaza Strip BBVA ADRs fall almost 2% on Wall Street

BBVA ADRs fall almost 2% on Wall Street Ukraine has lost 10 million inhabitants since 2001... and could lose as many by 2050

Ukraine has lost 10 million inhabitants since 2001... and could lose as many by 2050 Sánchez cancels his agenda and considers resigning: "I need to stop and reflect"

Sánchez cancels his agenda and considers resigning: "I need to stop and reflect" The Federal Committee of the PSOE interrupts the event to take to the streets with the militants

The Federal Committee of the PSOE interrupts the event to take to the streets with the militants Repsol: "We want to lead generative AI to guarantee its benefits and avoid risks"

Repsol: "We want to lead generative AI to guarantee its benefits and avoid risks" Osteoarthritis: an innovation to improve its management

Osteoarthritis: an innovation to improve its management Ukraine gets a spokesperson generated by artificial intelligence

Ukraine gets a spokesperson generated by artificial intelligence The French will take advantage of the May bridges to explore France

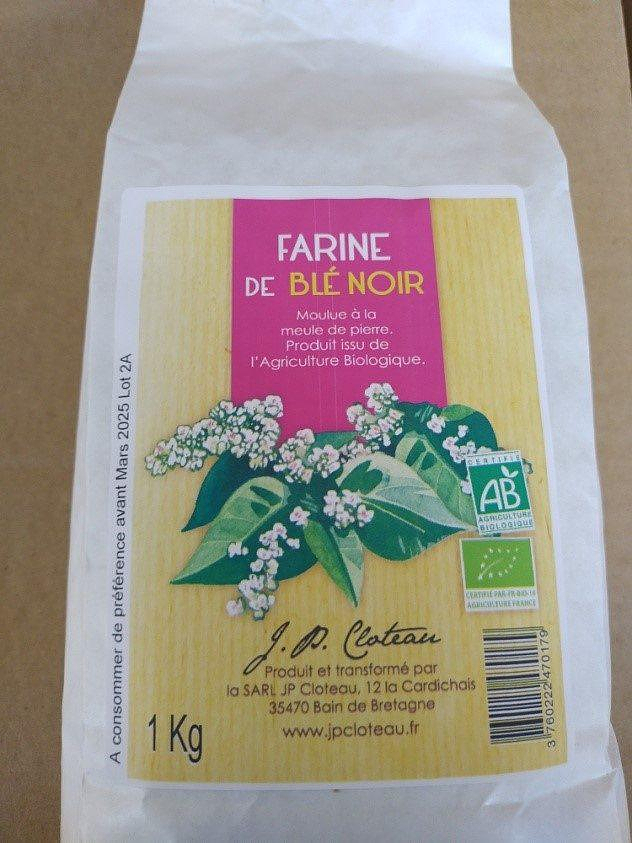

The French will take advantage of the May bridges to explore France Organic flour contaminated by a recalled toxic plant

Organic flour contaminated by a recalled toxic plant 2024 Olympics: Parisian garbage collectors have filed a strike notice

2024 Olympics: Parisian garbage collectors have filed a strike notice Death of Paul Auster: Actes Sud says he is “lucky” to have been his publisher in France

Death of Paul Auster: Actes Sud says he is “lucky” to have been his publisher in France Lang Lang, the most French of Chinese pianists

Lang Lang, the most French of Chinese pianists Author of the “New York Trilogy”, American novelist Paul Auster has died at the age of 77

Author of the “New York Trilogy”, American novelist Paul Auster has died at the age of 77 To the End of the World, The Stolen Painting, Border Line... Films to watch this week

To the End of the World, The Stolen Painting, Border Line... Films to watch this week Omoda 7, another Chinese car that could be manufactured in Spain

Omoda 7, another Chinese car that could be manufactured in Spain BYD chooses CA Auto Bank as financial partner in Spain

BYD chooses CA Auto Bank as financial partner in Spain Tesla and Baidu sign key agreement to boost development of autonomous driving

Tesla and Baidu sign key agreement to boost development of autonomous driving Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33%

The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33% This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Europeans: a senior official on the National Rally list

Europeans: a senior official on the National Rally list Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels

Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon

Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon “Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne

“Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Top 14: Fijian hooker Narisia leaves Racing 92 and signs for Oyonnax

Top 14: Fijian hooker Narisia leaves Racing 92 and signs for Oyonnax Europa League: Jean-Louis Gasset is “wary” of Atalanta, an “atypical team”

Europa League: Jean-Louis Gasset is “wary” of Atalanta, an “atypical team” Europa League: “I don’t believe it…”, Gasset jokes about Aubameyang’s age

Europa League: “I don’t believe it…”, Gasset jokes about Aubameyang’s age Foot: Rupture of the cruciate ligaments for Sergino Dest (PSV), absent until 2025

Foot: Rupture of the cruciate ligaments for Sergino Dest (PSV), absent until 2025