Mallorca/Obi.en: - the Housing market slowed at the end of 2018. There are several bruktboliger for sale than of nine years. The next quarters are completed, many homes, especially in Oslo, says Harald Magnus Andreassen, from Sparebank 1 Markets.

He predicts zero-growth in the housing market next year.

Sjeføkonomen points out that population and income growth are low.

Debt and house prices have risen too muchrecent years have interest rates been plummeted to a new low without the economy has been weak. It has led to that debt and house prices have risen a lot. Either the interest rate up, or as to the economy "down". None of that is okay for the housing market.

the Price level is also so high that it over time will lead to overbygging because it is too profitable to build, believe Andreassen, who also point out that rental prices are very low compared to house prices.

- the Norwegian housing is the last thing I recommend as an investment, along with Swedish, canadian and australian homes. The return is low, the downside is huge, the upside limited, says Harald Magnus Andreassen.

Then, house prices for november was ticking into 5. December, with a decrease sesongkorrigert of 0.5 per cent, was even Andreassen surprised.

It was weaker than I had expected, he said to HegnarTV earlier in December.

Now I have been uneasy for the house as long as anyone can remember, and that they can fall is quite obvious.

- We have come to the end of the roadHe thinks we look the same in Norway, as is now happening in Sweden, in Canada and Australia.

The past few years have boligmarkedene been much more uneven, and they are down from the top mostly the whole bunch, at least in realpriser, " says Andreassen.

He points out that there is something going on in those countries, where the debt after the financial crisis, increased sharply.

" We got low interest rates, we had no special problems on the labour market, house prices and residential construction fell not much. We were still just as low interest rates as the countries where it went completely wrong. In Norway, the cuts gunpowder in the economist, and we continued gjeldsfesten and boligprisen step further and now we have come to the end, and the period is over, " says Andreassen.

More økonomisaker:Petter Stordalen: - Never had more exciting things on the blokkaToppforvalter: - the Stock is leveraged from here to evighetenNorsk oljeekspert: - Opec should not cut

Poland, big winner of European enlargement

Poland, big winner of European enlargement In Israel, step-by-step negotiations for a ceasefire in the Gaza Strip

In Israel, step-by-step negotiations for a ceasefire in the Gaza Strip BBVA ADRs fall almost 2% on Wall Street

BBVA ADRs fall almost 2% on Wall Street Ukraine has lost 10 million inhabitants since 2001... and could lose as many by 2050

Ukraine has lost 10 million inhabitants since 2001... and could lose as many by 2050 Sánchez cancels his agenda and considers resigning: "I need to stop and reflect"

Sánchez cancels his agenda and considers resigning: "I need to stop and reflect" The Federal Committee of the PSOE interrupts the event to take to the streets with the militants

The Federal Committee of the PSOE interrupts the event to take to the streets with the militants Repsol: "We want to lead generative AI to guarantee its benefits and avoid risks"

Repsol: "We want to lead generative AI to guarantee its benefits and avoid risks" Osteoarthritis: an innovation to improve its management

Osteoarthritis: an innovation to improve its management Ukraine gets a spokesperson generated by artificial intelligence

Ukraine gets a spokesperson generated by artificial intelligence The French will take advantage of the May bridges to explore France

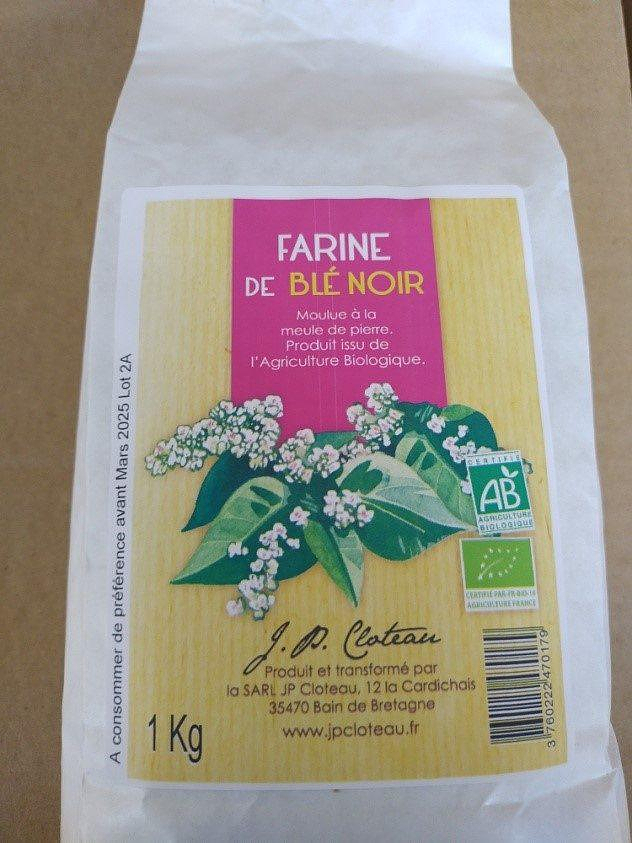

The French will take advantage of the May bridges to explore France Organic flour contaminated by a recalled toxic plant

Organic flour contaminated by a recalled toxic plant 2024 Olympics: Parisian garbage collectors have filed a strike notice

2024 Olympics: Parisian garbage collectors have filed a strike notice Death of Paul Auster: Actes Sud says he is “lucky” to have been his publisher in France

Death of Paul Auster: Actes Sud says he is “lucky” to have been his publisher in France Lang Lang, the most French of Chinese pianists

Lang Lang, the most French of Chinese pianists Author of the “New York Trilogy”, American novelist Paul Auster has died at the age of 77

Author of the “New York Trilogy”, American novelist Paul Auster has died at the age of 77 To the End of the World, The Stolen Painting, Border Line... Films to watch this week

To the End of the World, The Stolen Painting, Border Line... Films to watch this week Omoda 7, another Chinese car that could be manufactured in Spain

Omoda 7, another Chinese car that could be manufactured in Spain BYD chooses CA Auto Bank as financial partner in Spain

BYD chooses CA Auto Bank as financial partner in Spain Tesla and Baidu sign key agreement to boost development of autonomous driving

Tesla and Baidu sign key agreement to boost development of autonomous driving Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33%

The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33% This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Europeans: a senior official on the National Rally list

Europeans: a senior official on the National Rally list Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels

Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon

Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon “Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne

“Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Top 14: Fijian hooker Narisia leaves Racing 92 and signs for Oyonnax

Top 14: Fijian hooker Narisia leaves Racing 92 and signs for Oyonnax Europa League: Jean-Louis Gasset is “wary” of Atalanta, an “atypical team”

Europa League: Jean-Louis Gasset is “wary” of Atalanta, an “atypical team” Europa League: “I don’t believe it…”, Gasset jokes about Aubameyang’s age

Europa League: “I don’t believe it…”, Gasset jokes about Aubameyang’s age Foot: Rupture of the cruciate ligaments for Sergino Dest (PSV), absent until 2025

Foot: Rupture of the cruciate ligaments for Sergino Dest (PSV), absent until 2025