The cucumber has now made it to social media star. Videos and photos on TikTok, Twitter and other platforms show how the long green vegetables are being offered at increasingly absurd prices. In some supermarkets, copies have already been photographed for 3.29 euros. Even the standard cucumber at Kaufland, Rewe, Lidl

The social media vegetable phenomenon is representative of consumer frustration at ever-increasing food prices. While energy costs appear to have been contained thanks in part to government price controls, prices at the supermarket checkout are galloping away.

In February, food inflation was 21.8 percent. That's how much the prices have risen compared to the same month last year. This is an increase from January, when inflation in this category was still at 20.2 percent. Since the start of the all-German statistics in 1992, food prices have never risen so sharply compared to the previous year.

The sharp increase in prices at the supermarket checkout contributed to the fact that, contrary to expectations, overall inflation did not fall in February 2022. Inflation remained at 8.7 percent, as the Federal Statistical Office announced on Wednesday. Analysts had expected a decline to 8.5 percent.

"However, we are seeing a continuous increase in the cost of groceries, which is causing lower income groups to worry more and more when they go to the supermarket," says Christoph Swonke, economic analyst at DZ Bank. Food contributes around ten percent to the so-called "shopping basket", on the basis of which the inflation rate is determined.

This means that one tenth of the price increase of 21.8 percent is included in the total number, so that it pushes the inflation rate up by 2.2 points. Price increases have not only accelerated in the supermarket. In the meantime, services are also becoming significantly more expensive. Services such as travel, education, transport and insurance cost an average of 4.7 percent more than in February 2022.

In January the value was still 4.5 percent, in December it was 3.9 percent. It didn't help that the price pressure on energy was easing significantly. "Inflation is not falling as quickly as hoped," says Jörg Zeuner, chief economist at Union Investment. Inflation has remained at a sharply elevated level since September.

This is bad news for workers too. Their wages rose above average in 2022, namely by 3.5 percent. After deducting the depreciation of the currency, employees were left with a minus of 3.1 percent in their wallets. This was not just the third annual real wage decline in a row. That was also the biggest decline in purchasing power in the post-war history of the Federal Republic. In this constellation, the pending collective bargaining conflicts gain additional explosiveness. Several unions are entering collective bargaining with demands for double-digit wage increases.

This increases the risk of a wage-price spiral for the economy as a whole. There already seem to be second-round effects: Especially in the labour-intensive service sectors, higher labor costs result in higher prices for consumers. These second-round effects are also reflected in core inflation, which is an inflation rate adjusted for volatile energy and food prices.

"The underlying price pressure has probably increased even more recently," says Ralph Solveen, economist at Commerzbank. According to Commerzbank estimates based on the figures available so far, the core inflation rate (excluding energy and food prices) rose from 5.6 percent to 5.8 percent. This indicates that pressure remains on the boiler.

“Companies are passing their higher costs on to consumers, and wages will continue to rise as well. In this respect, we do not expect the core rate to fall quickly,” says Ulrike Kastens, European economist at the investment company DWS. That applies to Germany, but also to the euro zone as a whole.

This increases the pressure on the European Central Bank (ECB) to continue raising key interest rates significantly beyond March. The new figures from Germany and Europe should alarm the monetary watchdogs.

"Everything on shares" is the daily stock exchange shot from the WELT business editorial team. Every morning from 7 a.m. with our financial journalists. For stock market experts and beginners. Subscribe to the podcast on Spotify, Apple Podcast, Amazon Music and Deezer. Or directly via RSS feed.

What is chloropicrin, the chemical agent that Washington accuses Moscow of using in Ukraine?

What is chloropicrin, the chemical agent that Washington accuses Moscow of using in Ukraine? Poland, big winner of European enlargement

Poland, big winner of European enlargement In Israel, step-by-step negotiations for a ceasefire in the Gaza Strip

In Israel, step-by-step negotiations for a ceasefire in the Gaza Strip BBVA ADRs fall almost 2% on Wall Street

BBVA ADRs fall almost 2% on Wall Street Sánchez cancels his agenda and considers resigning: "I need to stop and reflect"

Sánchez cancels his agenda and considers resigning: "I need to stop and reflect" The Federal Committee of the PSOE interrupts the event to take to the streets with the militants

The Federal Committee of the PSOE interrupts the event to take to the streets with the militants Repsol: "We want to lead generative AI to guarantee its benefits and avoid risks"

Repsol: "We want to lead generative AI to guarantee its benefits and avoid risks" Osteoarthritis: an innovation to improve its management

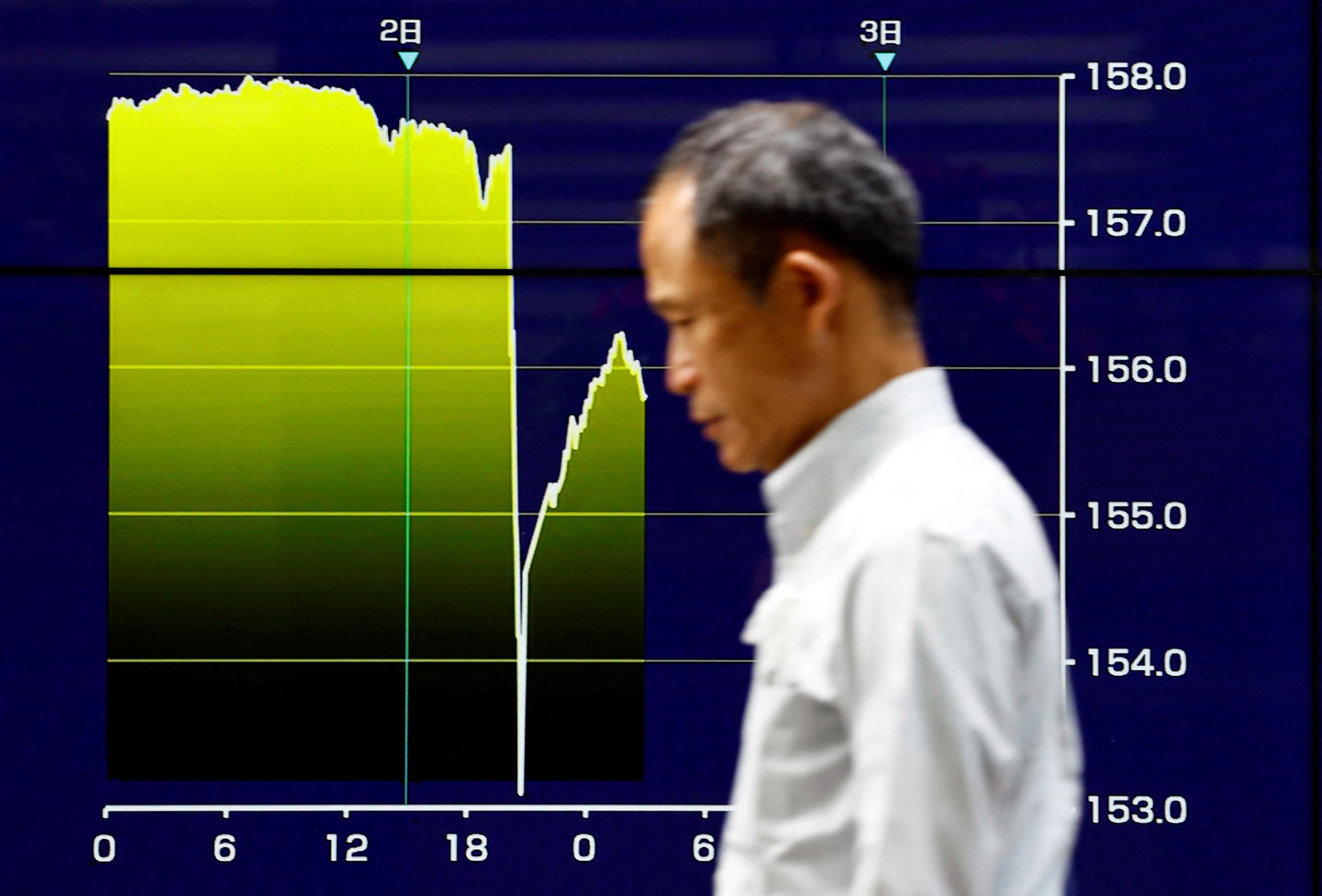

Osteoarthritis: an innovation to improve its management The yen jumps 3% then falls again, amid speculation of Japanese intervention

The yen jumps 3% then falls again, amid speculation of Japanese intervention A very busy Friday on the roads of Île-de-France before the Ascension Bridge

A very busy Friday on the roads of Île-de-France before the Ascension Bridge Fraud: the government is preparing new measures for the fall

Fraud: the government is preparing new measures for the fall Nike breaks the bank to keep the Blues jersey

Nike breaks the bank to keep the Blues jersey Madonna ends her world tour with a giant - and free - concert in Copacabana

Madonna ends her world tour with a giant - and free - concert in Copacabana Harry Potter: Daniel Radcliffe “really saddened” by his final breakup with J.K. Rowling

Harry Potter: Daniel Radcliffe “really saddened” by his final breakup with J.K. Rowling Leviathan, New York Trilogy... Five books by Paul Auster that you must have read

Leviathan, New York Trilogy... Five books by Paul Auster that you must have read Italy wins a decisive round against an American museum for the restitution of an ancient bronze

Italy wins a decisive round against an American museum for the restitution of an ancient bronze Omoda 7, another Chinese car that could be manufactured in Spain

Omoda 7, another Chinese car that could be manufactured in Spain BYD chooses CA Auto Bank as financial partner in Spain

BYD chooses CA Auto Bank as financial partner in Spain Tesla and Baidu sign key agreement to boost development of autonomous driving

Tesla and Baidu sign key agreement to boost development of autonomous driving Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33%

The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33% This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Europeans: a senior official on the National Rally list

Europeans: a senior official on the National Rally list Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels

Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon

Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon “Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne

“Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Mercato: Verratti at Barça? A track studied

Mercato: Verratti at Barça? A track studied Rugby: after the defeat during the Six Nations, the Blues will meet the English in September for a test match

Rugby: after the defeat during the Six Nations, the Blues will meet the English in September for a test match Premier League: Liverpool unveils its new jersey for next season

Premier League: Liverpool unveils its new jersey for next season Formula 1: Alpine holds its new executive technical director

Formula 1: Alpine holds its new executive technical director