Finland is a controversial fertility impact of the decrease of the pension system financing. Discussed the declining birth rate in Finland is a common phenomenon in prosperous countries. Surprisingly often I hear young people speak, they don't want to make kids miserable world or to increase their climate footprints, and more. Housing prices have pulled to the clouds, inter alia, the pension insurance companies act. That attitude is the different ways downright stir up.

But how it relates to the pension scheme? In finland as in other countries, the bulk of pensions paid to future generations for payment. In finland, they are formally the pension payments, but still counts on the public sector and taxes. The future cost of ensuring it is central.

***

in finland, the earnings-related pension system is part of the public sector, whose implementation is handled by private insurance companies. Fixture is against EU laws, but Finland got to the exception of the EU-accession treaty.

the Position to give earnings-related pension scheme, for the dominant EK, SAK, JURISTS, labour market and employment pension companies a huge degree of freedom to manage things. The parliament does not their activities have just dared to intervene. Now, if you declare the earnings-related pension system was in trouble, the responsible authorities do not need to look far.

***

What has gone wrong with those system lords? Earnings-related pension scheme was introduced originally by prefunding, which is the basic pension system generally.

the Funds should be in Finnish business use. They have job security and pension payments paid by in the future. Earnings-related pension system funding, 75% comes from pension payments and 25% of the fund. Therefore, the jobs in Finland producing investments provide pension institutions double the return.

***

That thought has been forgotten, apparently, the power use of the building. Earnings-related pension system power use suuyritykset, although 60% of the workforce is in smes, and there arise new jobs.

the Last decade has to live with the direct investment slump. In 2000, the employment pension companies ' investment in Finland amounted to 28.5% of GDP when they 2016 were no longer to 22.5% of GDP. The pension system itself has been destroying its own cost base.

***

the availability of Labour should not be an obstacle to jobs growth in Finland, because Finland is part of the EU's 500 million people in the labour market. There I think you'll find labour for the Finnish needs, if your own labor is not enough.

But Finland has not been able to attract sufficient labour from the EU. Such a labour could be of relevance for the pension system point of view.

***

the Finland in 2017 of about 23,000 immigrants over 6000 came from the EU. A huge part of it was practically unskilled, tongue, unskilled and often illiterate developing countries tulllee. Their employment is miserable.

If you combine the 2017 entrants of the data centre for Pensions in 2016, the study of immigrants in connection with employment and income developments, the result is unattractive.

the Average employment rate was 35% four years after admission and the level of income after 15 years of 17,000 euros per year. Therefore, a large part of this crowd remains permanently tax money maintained.

confederation of Finnish industries EK requires extensive work-related immigration, which the taxpayers would support. OUTI JÄRVINEN/KL***

EK require extensive ”work-related” immigration, now as a pretext for pension saving. But Finland is not a trained workforce to attract, Estonian however the proportion of migrants is in serious decline. In practice, interveners would be the same people as the year 2015 exodus, now under various pretexts.

EK has demanded that the society pay in the early days of their salaries to 70%. So, in reality, require a society subsidies ”occupational pension” to saving. Subsidies should be in hidden form, in order not to wake up too many questions of the system administration. Such a plan end up in a belly flop than the year 2015 hike.

***

earnings-related pension system is a public activity. The limit is shaky.

in the 1990s the employment pension system to capture for himself the people's pension, which in the past were funded by other tax funds. The effect of the costs is billions of years.

Now, apparently, afraid to bite too big pieces and require state money in it. A decade ago were already billion annual subvention from the government, when corporate reel-payment to the state was transferred as payment for the occupational pension scheme.

in Reality, the limit state and the earnings-related pension system between has always been shaky. When the earnings-related pension system officially is a public social security system, its power transfer, for example, the parliament is quite possible. Needed only the law of the pension system administration.

the society you ultimately have to pay the earnings-related pension system the failure of the bill. I think it's time to launch a debate on the pension system of power

author Olli Pusa is a social science doctor of social welfare policy associate professor and actuary.

Poland, big winner of European enlargement

Poland, big winner of European enlargement In Israel, step-by-step negotiations for a ceasefire in the Gaza Strip

In Israel, step-by-step negotiations for a ceasefire in the Gaza Strip BBVA ADRs fall almost 2% on Wall Street

BBVA ADRs fall almost 2% on Wall Street Ukraine has lost 10 million inhabitants since 2001... and could lose as many by 2050

Ukraine has lost 10 million inhabitants since 2001... and could lose as many by 2050 Sánchez cancels his agenda and considers resigning: "I need to stop and reflect"

Sánchez cancels his agenda and considers resigning: "I need to stop and reflect" The Federal Committee of the PSOE interrupts the event to take to the streets with the militants

The Federal Committee of the PSOE interrupts the event to take to the streets with the militants Repsol: "We want to lead generative AI to guarantee its benefits and avoid risks"

Repsol: "We want to lead generative AI to guarantee its benefits and avoid risks" Osteoarthritis: an innovation to improve its management

Osteoarthritis: an innovation to improve its management Ukraine gets a spokesperson generated by artificial intelligence

Ukraine gets a spokesperson generated by artificial intelligence The French will take advantage of the May bridges to explore France

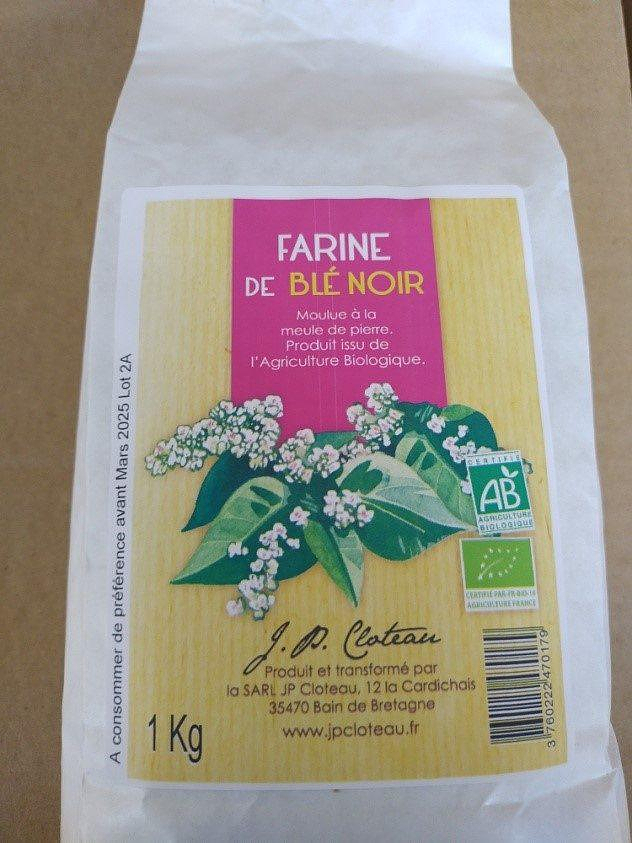

The French will take advantage of the May bridges to explore France Organic flour contaminated by a recalled toxic plant

Organic flour contaminated by a recalled toxic plant 2024 Olympics: Parisian garbage collectors have filed a strike notice

2024 Olympics: Parisian garbage collectors have filed a strike notice Death of Paul Auster: Actes Sud says he is “lucky” to have been his publisher in France

Death of Paul Auster: Actes Sud says he is “lucky” to have been his publisher in France Lang Lang, the most French of Chinese pianists

Lang Lang, the most French of Chinese pianists Author of the “New York Trilogy”, American novelist Paul Auster has died at the age of 77

Author of the “New York Trilogy”, American novelist Paul Auster has died at the age of 77 To the End of the World, The Stolen Painting, Border Line... Films to watch this week

To the End of the World, The Stolen Painting, Border Line... Films to watch this week Omoda 7, another Chinese car that could be manufactured in Spain

Omoda 7, another Chinese car that could be manufactured in Spain BYD chooses CA Auto Bank as financial partner in Spain

BYD chooses CA Auto Bank as financial partner in Spain Tesla and Baidu sign key agreement to boost development of autonomous driving

Tesla and Baidu sign key agreement to boost development of autonomous driving Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33%

The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33% This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Europeans: a senior official on the National Rally list

Europeans: a senior official on the National Rally list Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels

Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon

Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon “Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne

“Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Top 14: Fijian hooker Narisia leaves Racing 92 and signs for Oyonnax

Top 14: Fijian hooker Narisia leaves Racing 92 and signs for Oyonnax Europa League: Jean-Louis Gasset is “wary” of Atalanta, an “atypical team”

Europa League: Jean-Louis Gasset is “wary” of Atalanta, an “atypical team” Europa League: “I don’t believe it…”, Gasset jokes about Aubameyang’s age

Europa League: “I don’t believe it…”, Gasset jokes about Aubameyang’s age Foot: Rupture of the cruciate ligaments for Sergino Dest (PSV), absent until 2025

Foot: Rupture of the cruciate ligaments for Sergino Dest (PSV), absent until 2025