The governor of the Bank of France, François Villeroy de Galhau, indicated to the JDD to be published on Sunday that the European Central Bank (ECB) would, “barring any surprises”, decide to lower its rates on June 6, estimating that the battle against inflation was about to be won. “Unless there is a surprise, we should decide on a first reduction at our next meeting on June 6,” declared François Villeroy de Galhau, who sits on the ECB Governing Council.

The governor of the Bank of France justifies this approach by “increasing confidence in the trajectory of disinflation”. Inflation is getting closer to the ECB's medium-term target of 2%: it continued to decline in March in the euro zone, to 2.4% over one year, according to the latest figures from Eurostat. In France, the consumer price index increased by 2.3% year-on-year last month according to INSEE, a clear slowdown compared to February. “We are winning the battle against inflation,” says François Villeroy de Galhau.

While maintaining its interest rates at their historic high, the ECB prepared the ground on Thursday for a first cut from June. This decline “should be followed by other declines between now and the end of the year,” estimates the governor who “pleads for pragmatic gradualism – according to economic data – and sufficiently agile.”

François Villeroy de Galhau also returned to the weight of the French debt, while the government seeks to make savings to limit the public deficit, now expected at 5.1% of GDP for 2024. “The weight of debt interest that we have to pay every year (...) will increase by almost 50 billion between 2020 and 2027", notes the governor, "this is as much as we cannot devote to our future expenses, such as climate or education”. François Villeroy de Galhau also defended the “common sense” criteria governing the French real estate loan market, at its lowest level in almost 10 years. A bill from Renaissance MP Lionel Causse aimed at reforming the High Financial Stability Council (HCSF), which lays down, among other things, rules governing the granting of real estate loans, will be examined in the National Assembly on April 29.

B:SM will break its investment record this year with 62 million euros

B:SM will break its investment record this year with 62 million euros War in Ukraine: when kyiv attacks Russia with inflatable balloons loaded with explosives

War in Ukraine: when kyiv attacks Russia with inflatable balloons loaded with explosives United States: divided on the question of presidential immunity, the Supreme Court offers respite to Trump

United States: divided on the question of presidential immunity, the Supreme Court offers respite to Trump Maurizio Molinari: “the Scurati affair, a European injury”

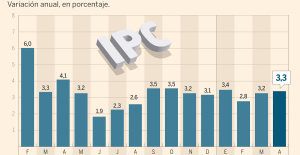

Maurizio Molinari: “the Scurati affair, a European injury” Inflation rises to 3.3% in April and core inflation moderates to 2.9%

Inflation rises to 3.3% in April and core inflation moderates to 2.9% Pedro Sánchez announces that he continues "with more strength" as president of the Government

Pedro Sánchez announces that he continues "with more strength" as president of the Government Irritable bowel syndrome: the effectiveness of low-carbohydrate diets is confirmed

Irritable bowel syndrome: the effectiveness of low-carbohydrate diets is confirmed Beware of the three main sources of poisoning in children

Beware of the three main sources of poisoning in children Relief at Bercy: Moody’s does not sanction France

Relief at Bercy: Moody’s does not sanction France More than 10 million holders, 100 billion euros: the Retirement Savings Plan is a hit

More than 10 million holders, 100 billion euros: the Retirement Savings Plan is a hit Paris 2024 Olympic Games: the extension of line 14 will open “at the end of June”, confirms Valérie Pécresse

Paris 2024 Olympic Games: the extension of line 14 will open “at the end of June”, confirms Valérie Pécresse Failing ventilators: Philips to pay $1.1 billion after complaints in the United States

Failing ventilators: Philips to pay $1.1 billion after complaints in the United States The Cannes Film Festival welcomes Omar Sy, Eva Green and Kore-Eda to its jury

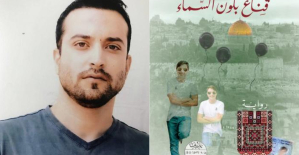

The Cannes Film Festival welcomes Omar Sy, Eva Green and Kore-Eda to its jury Prisoner in Israel, a Palestinian receives the International Prize for Arab Fiction

Prisoner in Israel, a Palestinian receives the International Prize for Arab Fiction Harvey Weinstein, the former American producer hospitalized in New York

Harvey Weinstein, the former American producer hospitalized in New York New success for Zendaya, tops the North American box office with Challengers

New success for Zendaya, tops the North American box office with Challengers Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: a senior official on the National Rally list

Europeans: a senior official on the National Rally list Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels

Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon

Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon “Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne

“Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar NBA: young Thunder coach Mark Daigneault named coach of the year

NBA: young Thunder coach Mark Daigneault named coach of the year Athletics: Noah Lyles in legs in Bermuda

Athletics: Noah Lyles in legs in Bermuda Serie A: Dumfries celebrates Inter Milan title with humiliating sign towards Hernandez

Serie A: Dumfries celebrates Inter Milan title with humiliating sign towards Hernandez Tennis: no pity for Sorribes, Swiatek is in the quarterfinals in Madrid

Tennis: no pity for Sorribes, Swiatek is in the quarterfinals in Madrid