The subject has become too important for Emmanuel Macron to refuse to mention it during his trip to Sweden. Asked about the difficulties facing certain agricultural sectors, the President of the Republic, for the first time, pointed the finger at “imports coming from Ukraine”. “Poultry has experienced difficulties in recent months. [...] in particular due to the arrival of much cheaper poultry from Ukraine. This is something that we will seek to regulate,” promised the head of state. Well before the general revolt of the agricultural world, French breeders had never stopped alerting the public authorities about the “surge” of this chicken made in Ukraine. Last September, the director of the ANVOL inter-professional association Yann Nédélec already denounced this “unfair competition” from the East. In our columns, he highlighted, with supporting figures, the boom in Ukrainian imports: in the first half of 2023, they had jumped 74% in one year.

According to the federation, today “15 to 25,000 tonnes of Ukrainian poultry” enter the European continent each month. In France, these chickens from the East now rub shoulders with contingents from Thailand and Brazil. “The volumes of chicken meat arriving directly from Ukraine have increased by 75% over 6 months,” says ANVOL. This figure is also misleading, since the Ukrainian poultry that we find on our plates is often “cut up and then processed in Dutch or Hungarian factories before arriving on national soil”. Once processed in European factories, the meat loses traceability of its origin. “You just have to look at what is happening at the community level: in 2023, Ukrainian imports jumped by 40% compared to 2022, to the point of exceeding Thai volumes,” underlines Yann Nédélec.

The massive arrival of Ukrainian poultry in the midst of the Russo-Ukrainian war is not a coincidence. In May 2022, Brussels adopted several liberalization measures under the Association Agreement which governs trade relations between Ukraine and the EU. No more customs fees, no more quotas, in the name of “economic and financial support” to the country attacked by Russia. A surge of solidarity which, however, did not take long to scald certain member countries, particularly in the East. As early as March 2023, several Polish MEPs expressed their dissatisfaction: the agreement, according to them, would have “led to serious disruptions in the EU poultry sector”. The renewal of the exceptional measures for one year last June did not help anything. The revolt has gradually spread to Western Europe. In a press release published at the beginning of September, ANVOL asked the Minister of Agriculture, Marc Fesneau, “the activation of the safeguard clause to prevent the continuation of imports at zero duty and without volume limit”.

According to the profession, Ukrainian chicken is sold “two to three times cheaper” than French poultry. “Unfair competition” in the eyes of French producers who have seen all their costs increase thanks to inflation. On the other hand, this cheap poultry is a boon for the agri-food sector which is trying, by all means, to control its costs. Under the modest label of “non-EU origin”, chicken from Ukraine is found in many ready-made meals, intended for supermarkets or collective catering.

“It’s damaging for the consumer, because this chicken does not meet the quality standards of French chicken,” storms Yann Nédélec. Anyone who calls for the introduction of “mirror clauses” between the EU and third countries has no illusions about the conditions under which chickens from Ukraine are raised. “The size of the farms can reach up to two million poultry on the same site, when a French farm has only 40,000 poultry on average…”. And that's not all. As Ukraine is not a member of the EU, the country's production "is not required to respect community rules, whether in terms of animal welfare or the use of antibiotics", maintains the representative.

The revolt of European breeders has crystallized on MHP, the largest producer in Ukrainian agriculture. The company, founded in 1998, is registered in Cyprus and listed in London. It belongs to businessman Yuriy Kosyuk, whose fortune, according to Forbes, exceeds a billion dollars. Also active in the cereals and oil market, MHP derives 61% of its turnover (2.6 billion in 2022) from exports. Last year, the group exported nearly 368,000 tonnes of poultry around the world. The group takes advantage of its gigantic chicken coops, like its Vinnystia farm, capable of producing, alone, 440 tonnes of chickens per year.

To ensure an outlet for its vast agro-industrial complex, MHP has been eyeing the European market for several years. In 2012, the group became known as an unsuccessful candidate for the Breton Doux takeover. Failing to set a foot in France, MHP acquired factories in Slovenia and the Netherlands, helped by generous loans granted by the European Development Bank (224 million euros cumulatively since 2015).

The Ukrainian first attracted the wrath of European breeders in 2019, when he sought, through subterfuge, to free himself from the community quotas protecting imports of chicken fillets. Using a very particular cutting method, called “Batman” – consisting of leaving the chest and wing bones attached – Ukrainian producers, led by MHP, had caused the prices of the most profitable piece to drop. chicken on the European continent. The affair ultimately led to the revision of the contract and new import ceilings, more advantageous for Ukraine.

The “concession” made by Brussels to the Ukrainian agribusiness giant had raised eyebrows. In a 2019 Politico article, Austrian MEP Thomas Waitz spoke of the “question marks surrounding the health and environmental standards applied by MHP”. The same year, the NGO Welfarm published an article denouncing MHP chickens “likely to be exported to the Community market without any guarantee in terms of density, access to litter or light in buildings”. Allegations that Olexandra Avramenko, spokesperson for the Ukrainian food industry federation UCAB, firmly denies. “MHP poultry are, like all imported products, certified by the European Union. Ukrainian chicken meets the same quality standards as French chicken. Recalling the perilous context in which the Ukrainian economy finds itself, the official calls for discernment. “It’s not a large group that benefits from a favorable trade regime,” she insists.

The issue is, in any case, hot. All stakeholders fear seeing the conflict escalate, like the standoff surrounding cereal imports, which now pits its Ukrainian partner Poland and Hungary against each other. “We fully support Ukraine, there is no debate,” insists Yann Nédélec. But our food sovereignty is at stake.” ANVOL would like, at a minimum, to restore the import quotas granted to Ukraine before the outbreak of war, i.e. 100,000 tonnes per year. It remains to be seen whether, after being heard by the government, the breeders will succeed in winning their case in Brussels.

B:SM will break its investment record this year with 62 million euros

B:SM will break its investment record this year with 62 million euros War in Ukraine: when kyiv attacks Russia with inflatable balloons loaded with explosives

War in Ukraine: when kyiv attacks Russia with inflatable balloons loaded with explosives United States: divided on the question of presidential immunity, the Supreme Court offers respite to Trump

United States: divided on the question of presidential immunity, the Supreme Court offers respite to Trump Maurizio Molinari: “the Scurati affair, a European injury”

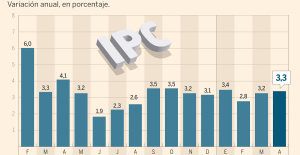

Maurizio Molinari: “the Scurati affair, a European injury” Inflation rises to 3.3% in April and core inflation moderates to 2.9%

Inflation rises to 3.3% in April and core inflation moderates to 2.9% Pedro Sánchez announces that he continues "with more strength" as president of the Government

Pedro Sánchez announces that he continues "with more strength" as president of the Government Irritable bowel syndrome: the effectiveness of low-carbohydrate diets is confirmed

Irritable bowel syndrome: the effectiveness of low-carbohydrate diets is confirmed Beware of the three main sources of poisoning in children

Beware of the three main sources of poisoning in children Relief at Bercy: Moody’s does not sanction France

Relief at Bercy: Moody’s does not sanction France More than 10 million holders, 100 billion euros: the Retirement Savings Plan is a hit

More than 10 million holders, 100 billion euros: the Retirement Savings Plan is a hit Paris 2024 Olympic Games: the extension of line 14 will open “at the end of June”, confirms Valérie Pécresse

Paris 2024 Olympic Games: the extension of line 14 will open “at the end of June”, confirms Valérie Pécresse Failing ventilators: Philips to pay $1.1 billion after complaints in the United States

Failing ventilators: Philips to pay $1.1 billion after complaints in the United States The Cannes Film Festival welcomes Omar Sy, Eva Green and Kore-Eda to its jury

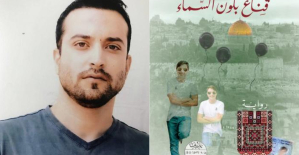

The Cannes Film Festival welcomes Omar Sy, Eva Green and Kore-Eda to its jury Prisoner in Israel, a Palestinian receives the International Prize for Arab Fiction

Prisoner in Israel, a Palestinian receives the International Prize for Arab Fiction Harvey Weinstein, the former American producer hospitalized in New York

Harvey Weinstein, the former American producer hospitalized in New York New success for Zendaya, tops the North American box office with Challengers

New success for Zendaya, tops the North American box office with Challengers Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: a senior official on the National Rally list

Europeans: a senior official on the National Rally list Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels

Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon

Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon “Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne

“Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar NBA: young Thunder coach Mark Daigneault named coach of the year

NBA: young Thunder coach Mark Daigneault named coach of the year Athletics: Noah Lyles in legs in Bermuda

Athletics: Noah Lyles in legs in Bermuda Serie A: Dumfries celebrates Inter Milan title with humiliating sign towards Hernandez

Serie A: Dumfries celebrates Inter Milan title with humiliating sign towards Hernandez Tennis: no pity for Sorribes, Swiatek is in the quarterfinals in Madrid

Tennis: no pity for Sorribes, Swiatek is in the quarterfinals in Madrid