An unsurprising but expected decision: the Paris commercial court validated on Monday the rescue plan for the distributor Casino, the last major step before the restructuring of its debt and its takeover by Czech billionaire Daniel Kretinsky. “There is reason to adopt the draft accelerated safeguard plan presented by the company” Distribution Casino France, judged the court, which had to rule on a total of seven companies belonging to the Casino group and which had entered into proceedings at the end of October accelerated backup.

“It was that or legal redress,” reacted Laurent Milazzo, CFDT union delegate to the CSEC (Central Social Economic Committee) of DCF. The group, which employed 50,000 people in France at the end of 2022 under well-known brands such as Casino, Franprix or Monoprix, could no longer meet its debt repayments. In its judgment, the commercial court indicates that the group's debt is estimated at nearly 8 billion euros in total in 2023, including 3.7 with banks.

The restructuring of Casino's debt plans to wipe out around 5 billion euros of debts, and is made possible by the provision of new money to the tune of 1.2 billion euros, including more than 900 million by a consortium buyers including billionaires Daniel Kretinsky and Marc Ladreit de Lacharrière as well as the Attestor investment fund. “After such uncertain weeks, where the threat was to disappear, the time will now come to restore the means and therefore the breath to the Casino group, resized, reorganized and deleveraged,” reacted Daniel Kretinsky in a press release from these buyers. . He indicates that “the road will still be long, with difficult moments and will require a lot of effort from everyone”.

Concretely, the capital increases must take place in March, at the end of which the current shareholders of the distributor, starting with the first of them Jean-Charles Naouri, will be very massively diluted. The future of the man who has been CEO of this former retail flagship since 2005 is not known.

“Starting in April, the management team, led by its general manager Philippe Palazzi”, a former member of Metro and the agroindustrial company Lactalis, “will implement an ambitious plan of reorganization, investment and modernization to support the development of the group's brands", notably Monoprix and Franprix, according to the consortium. Philippe Palazzi indicated in mid-January that an investment program was planned to the tune of 300 million euros per year until 2028. Asked about the future of the current team, he indicated that he was planning “changes” but that it will also “keep competent people”.

These investments will be made in particular in Monoprix, since almost all of the large stores, supermarkets and hypermarkets, which bear the historic brand of the distributor of Saint-Etienne origin, will leave the fold of Casino. The latter “topped” with its competitors Auchan, Intermarché and Carrefour to sell them 288 stores and their more than 12,000 employees, in three successive waves between the end of April and the beginning of July.

The operation is highly criticized by employees because this departure of almost all of the stores bearing the historic brand of the distributor of Saint-Etienne origin will have serious consequences on employment in support functions. On the side of the consortium of buyers, the commitments made are to “preserve employment as much as possible”, to maintain a headquarters in Saint-Etienne and, concerning employees who will change brands, a “specific mission to measure monitoring of social consequences.

The Casino group will also have, in addition to Monoprix which also includes the Naturalia brand, a network of more than 6,000 local stores in the regions under the Spar, Vival or Le Petit Casino brands, the e-retailer CDiscount, and a thousand Franprix stores (including 75% franchise). “We reserve the right to appeal the court's decision within 10 days, before the constitution next month of the new board of directors which will be an opportunity to get rid of Jean-Charles Naouri,” reacted Jean Pastor, central CGT union delegate of the group.

Poland, big winner of European enlargement

Poland, big winner of European enlargement In Israel, step-by-step negotiations for a ceasefire in the Gaza Strip

In Israel, step-by-step negotiations for a ceasefire in the Gaza Strip BBVA ADRs fall almost 2% on Wall Street

BBVA ADRs fall almost 2% on Wall Street Ukraine has lost 10 million inhabitants since 2001... and could lose as many by 2050

Ukraine has lost 10 million inhabitants since 2001... and could lose as many by 2050 Sánchez cancels his agenda and considers resigning: "I need to stop and reflect"

Sánchez cancels his agenda and considers resigning: "I need to stop and reflect" The Federal Committee of the PSOE interrupts the event to take to the streets with the militants

The Federal Committee of the PSOE interrupts the event to take to the streets with the militants Repsol: "We want to lead generative AI to guarantee its benefits and avoid risks"

Repsol: "We want to lead generative AI to guarantee its benefits and avoid risks" Osteoarthritis: an innovation to improve its management

Osteoarthritis: an innovation to improve its management Ukraine gets a spokesperson generated by artificial intelligence

Ukraine gets a spokesperson generated by artificial intelligence The French will take advantage of the May bridges to explore France

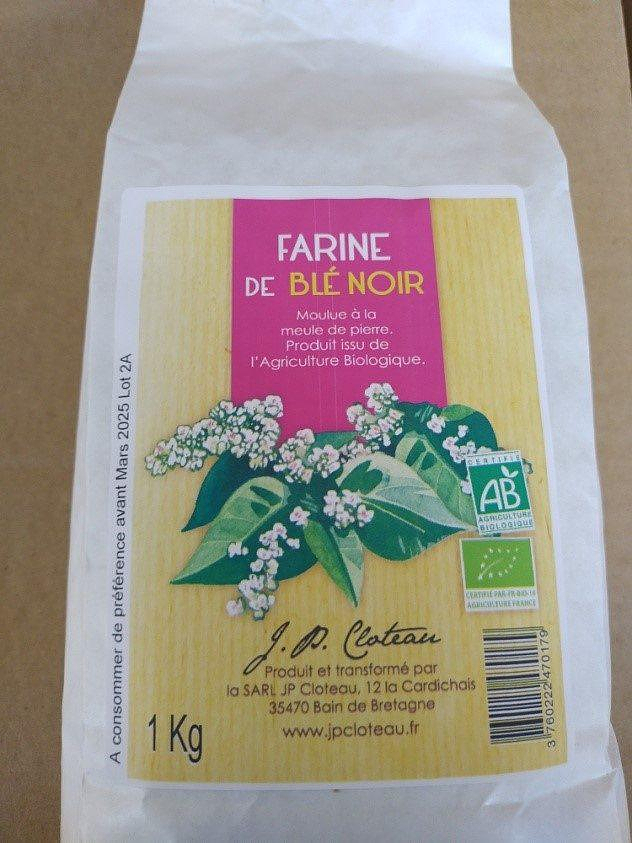

The French will take advantage of the May bridges to explore France Organic flour contaminated by a recalled toxic plant

Organic flour contaminated by a recalled toxic plant 2024 Olympics: Parisian garbage collectors have filed a strike notice

2024 Olympics: Parisian garbage collectors have filed a strike notice Actor Laurent Lafitte leaves the Comédie-Française

Actor Laurent Lafitte leaves the Comédie-Française Death of Paul Auster: Actes Sud says he is “lucky” to have been his publisher in France

Death of Paul Auster: Actes Sud says he is “lucky” to have been his publisher in France Lang Lang, the most French of Chinese pianists

Lang Lang, the most French of Chinese pianists Author of the “New York Trilogy”, American novelist Paul Auster has died at the age of 77

Author of the “New York Trilogy”, American novelist Paul Auster has died at the age of 77 Omoda 7, another Chinese car that could be manufactured in Spain

Omoda 7, another Chinese car that could be manufactured in Spain BYD chooses CA Auto Bank as financial partner in Spain

BYD chooses CA Auto Bank as financial partner in Spain Tesla and Baidu sign key agreement to boost development of autonomous driving

Tesla and Baidu sign key agreement to boost development of autonomous driving Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33%

The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33% This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Europeans: a senior official on the National Rally list

Europeans: a senior official on the National Rally list Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels

Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon

Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon “Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne

“Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Champions League: video summary of PSG's frustrating defeat in Dortmund

Champions League: video summary of PSG's frustrating defeat in Dortmund Champions League: Germany secures additional place for next edition

Champions League: Germany secures additional place for next edition Champions League: “everyone tried to help their teammate to produce their best game”, appreciates Mats Hummels

Champions League: “everyone tried to help their teammate to produce their best game”, appreciates Mats Hummels “We have nothing left to lose, we will go for this final”: Luis Enrique offensive and ambitious after Dortmund-PSG

“We have nothing left to lose, we will go for this final”: Luis Enrique offensive and ambitious after Dortmund-PSG