The global tax plan that will bring a minimum tax of 15% to multinationals still generates doubts in several countries. In the final stretch of the negotiation, the income that the international reform will generate nor the implications for the companies are still unclear.

Five European countries have already formally requested an extension to apply the measure and Switzerland has paused it. Furthermore, pressure from lobbies in the United States and the lack of consensus among legislators have delayed the implementation of the reform. The lack of consensus and the slowness in negotiations has been used by the United Nations (UN) to pressure the OECD. The least developed countries have promoted a declaration within the organization for the organization to take charge of the design of global fiscal rules, taking center stage from the OECD. In turn, the African Group and the countries of the Global South want more weight.

The OECD, after several years of conversations between its partners and changes in its fiscal leadership, managed in December 2022 to unblock positions and advance implementation. The Member States of the European Union then reached a historic agreement that has allowed negotiations to be unblocked to implement a minimum tax of 15% for multinationals throughout the community territory. The pact came after more than a year of talks between the different countries.

The European rules will apply to multinational groups of companies and large national groups present in the EU that have a combined financial income of more than 750 million euros per year. They will apply to any large group, both national and international, that has a parent company or a subsidiary in an EU Member State.

However, problems have arisen again in the European Union. A few days ago, five partners officially informed the European Commission that they will delay the implementation of the global minimum tax due to the small number of companies included in the scope based in their territories. They are Estonia, Latvia, Lithuania, Malta and Slovakia.

The reform, which must begin to be applied throughout the European territory as of January 1, nevertheless authorizes the Member States that have opted for the repeal not to apply the rule of inclusion of income and the rule of insufficiently taxed profits. in the six consecutive tax years starting December 31, 2023. "Member States that choose this option must, however, transpose all other relevant provisions of the Directive to allow taxpayers and other Member States and jurisdictions to apply the system correctly," says European legislation.

Switzerland, for its part, has paused the implementation of the minimum tax although in June Swiss voters approved the constitutional reform necessary for its adoption. The Economic Affairs and Taxation Committee of the Swiss Senate has recommended postponing it for at least a year. It argues that many other countries are not ready to implement the agreement in 2024 and that only a quarter of the 138 countries that signed the OECD minimum tax agreement in October 2021 plan to implement it next year.

In the United States, problems continue to adopt the agreement. The North American Chamber of Commerce has sent a letter to the Treasury Department in which it considers that the multilateral tax treaty that is part of the international tax agreement led by the OECD "does not meet its objectives of providing more stability and certainty in the international tax system ".

The OECD has increased its collection forecasts due to the future reform and now assures that the reallocation of tax revenues from the transactions of the main multinationals will allow an annual increase in global collection of up to 32 billion dollars.

"The international community has been working closely to resolve the remaining technical issues behind its historic agreement to reform international taxation," says OECD Secretary-General Mathias Cormann. "This text provides governments with the basis for the coordinated implementation of this fundamental reform of the international tax system and represents significant progress towards opening the agreement for signature," adds the Secretary General about this tax.

Poland, big winner of European enlargement

Poland, big winner of European enlargement In Israel, step-by-step negotiations for a ceasefire in the Gaza Strip

In Israel, step-by-step negotiations for a ceasefire in the Gaza Strip BBVA ADRs fall almost 2% on Wall Street

BBVA ADRs fall almost 2% on Wall Street Ukraine has lost 10 million inhabitants since 2001... and could lose as many by 2050

Ukraine has lost 10 million inhabitants since 2001... and could lose as many by 2050 Sánchez cancels his agenda and considers resigning: "I need to stop and reflect"

Sánchez cancels his agenda and considers resigning: "I need to stop and reflect" The Federal Committee of the PSOE interrupts the event to take to the streets with the militants

The Federal Committee of the PSOE interrupts the event to take to the streets with the militants Repsol: "We want to lead generative AI to guarantee its benefits and avoid risks"

Repsol: "We want to lead generative AI to guarantee its benefits and avoid risks" Osteoarthritis: an innovation to improve its management

Osteoarthritis: an innovation to improve its management Ukraine gets a spokesperson generated by artificial intelligence

Ukraine gets a spokesperson generated by artificial intelligence The French will take advantage of the May bridges to explore France

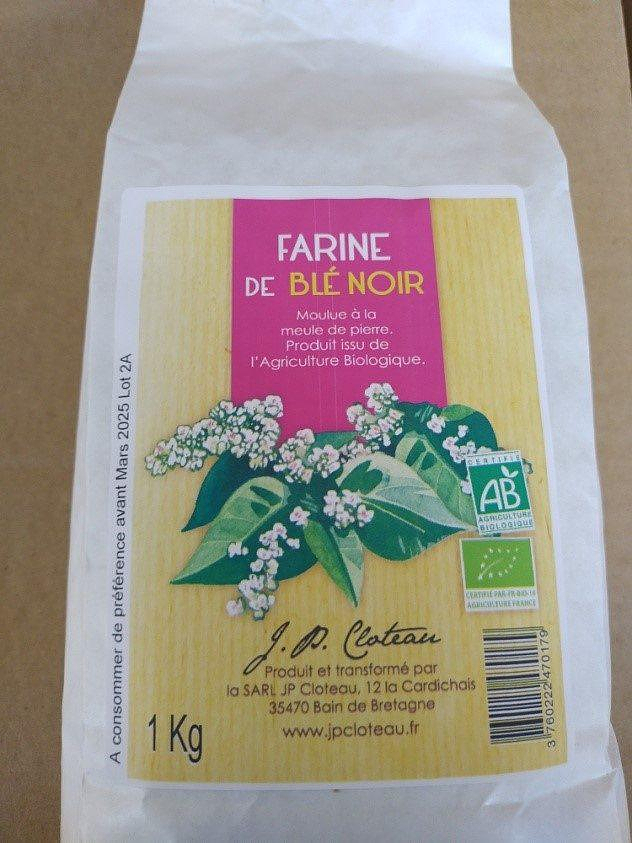

The French will take advantage of the May bridges to explore France Organic flour contaminated by a recalled toxic plant

Organic flour contaminated by a recalled toxic plant 2024 Olympics: Parisian garbage collectors have filed a strike notice

2024 Olympics: Parisian garbage collectors have filed a strike notice Actor Laurent Lafitte leaves the Comédie-Française

Actor Laurent Lafitte leaves the Comédie-Française Death of Paul Auster: Actes Sud says he is “lucky” to have been his publisher in France

Death of Paul Auster: Actes Sud says he is “lucky” to have been his publisher in France Lang Lang, the most French of Chinese pianists

Lang Lang, the most French of Chinese pianists Author of the “New York Trilogy”, American novelist Paul Auster has died at the age of 77

Author of the “New York Trilogy”, American novelist Paul Auster has died at the age of 77 Omoda 7, another Chinese car that could be manufactured in Spain

Omoda 7, another Chinese car that could be manufactured in Spain BYD chooses CA Auto Bank as financial partner in Spain

BYD chooses CA Auto Bank as financial partner in Spain Tesla and Baidu sign key agreement to boost development of autonomous driving

Tesla and Baidu sign key agreement to boost development of autonomous driving Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33%

The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33% This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Europeans: a senior official on the National Rally list

Europeans: a senior official on the National Rally list Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels

Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon

Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon “Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne

“Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Top 14: Fijian hooker Narisia leaves Racing 92 and signs for Oyonnax

Top 14: Fijian hooker Narisia leaves Racing 92 and signs for Oyonnax Europa League: Jean-Louis Gasset is “wary” of Atalanta, an “atypical team”

Europa League: Jean-Louis Gasset is “wary” of Atalanta, an “atypical team” Europa League: “I don’t believe it…”, Gasset jokes about Aubameyang’s age

Europa League: “I don’t believe it…”, Gasset jokes about Aubameyang’s age Foot: Rupture of the cruciate ligaments for Sergino Dest (PSV), absent until 2025

Foot: Rupture of the cruciate ligaments for Sergino Dest (PSV), absent until 2025