Property owners in Hamburg who have not yet submitted a property tax return can expect to receive mail from the tax office. Six weeks after the expiry of the already extended period, reminders would be sent from Tuesday, said Finance Senator Andreas Dressel (SPD) on Monday.

According to the information, around 389,000 declarations have been made in Hamburg so far, which corresponds to a rate of around 91 percent. "Hamburg is still in the top group among the states in terms of the submission rate for property tax returns," said Dressel. "Ultimately, however, we need all the feedback."

In the Hanseatic city, more than 420,000 properties have to be revalued to recalculate the property tax. For 35 percent of the declarations received, notifications of property tax values have already been sent. The notices on measurement amounts and property tax, which then make it clear what will have to be paid to the tax authorities in the future, should be sent out at the end of 2024 at the earliest. The new property tax will apply from 2025.

In 2018, the Federal Constitutional Court declared the previously applicable regulation to be unconstitutional because the calculation was based on partly completely outdated data. In the statements already made in Hamburg, it was noticed that some of the data sets came from the 1960s and had never been adjusted.

The deadline for submitting property tax returns in Hamburg, as in most other federal states, expired at the end of January. Due to the sluggish reception, the finance ministers of the federal and state governments had decided on a one-off basis for a three-month extension until the end of January. Unlike Bavaria, however, the Hanseatic city did not extend the deadline again. "Anyone who has still not submitted should do so as soon as possible," said Hamburg's Finance Senator on Monday.

In the reminder letters, reference is again made to the city's information and support material for property tax returns, said Dressel. "But the letter also states very clearly what the consequences of non-delivery or late delivery can be: Anyone who wants to avoid late surcharges, fines or an estimate by the tax office should take action immediately and submit their declaration," Dressel warned. The reminder letter also does not extend the submission deadline that has already expired.

B:SM will break its investment record this year with 62 million euros

B:SM will break its investment record this year with 62 million euros War in Ukraine: when kyiv attacks Russia with inflatable balloons loaded with explosives

War in Ukraine: when kyiv attacks Russia with inflatable balloons loaded with explosives United States: divided on the question of presidential immunity, the Supreme Court offers respite to Trump

United States: divided on the question of presidential immunity, the Supreme Court offers respite to Trump Maurizio Molinari: “the Scurati affair, a European injury”

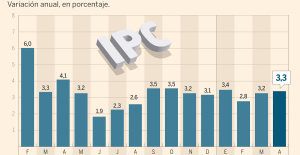

Maurizio Molinari: “the Scurati affair, a European injury” Inflation rises to 3.3% in April and core inflation moderates to 2.9%

Inflation rises to 3.3% in April and core inflation moderates to 2.9% Pedro Sánchez announces that he continues "with more strength" as president of the Government

Pedro Sánchez announces that he continues "with more strength" as president of the Government Irritable bowel syndrome: the effectiveness of low-carbohydrate diets is confirmed

Irritable bowel syndrome: the effectiveness of low-carbohydrate diets is confirmed Beware of the three main sources of poisoning in children

Beware of the three main sources of poisoning in children Relief at Bercy: Moody’s does not sanction France

Relief at Bercy: Moody’s does not sanction France More than 10 million holders, 100 billion euros: the Retirement Savings Plan is a hit

More than 10 million holders, 100 billion euros: the Retirement Savings Plan is a hit Paris 2024 Olympic Games: the extension of line 14 will open “at the end of June”, confirms Valérie Pécresse

Paris 2024 Olympic Games: the extension of line 14 will open “at the end of June”, confirms Valérie Pécresse Failing ventilators: Philips to pay $1.1 billion after complaints in the United States

Failing ventilators: Philips to pay $1.1 billion after complaints in the United States The Cannes Film Festival welcomes Omar Sy, Eva Green and Kore-Eda to its jury

The Cannes Film Festival welcomes Omar Sy, Eva Green and Kore-Eda to its jury Prisoner in Israel, a Palestinian receives the International Prize for Arab Fiction

Prisoner in Israel, a Palestinian receives the International Prize for Arab Fiction Harvey Weinstein, the former American producer hospitalized in New York

Harvey Weinstein, the former American producer hospitalized in New York New success for Zendaya, tops the North American box office with Challengers

New success for Zendaya, tops the North American box office with Challengers Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: a senior official on the National Rally list

Europeans: a senior official on the National Rally list Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels

Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon

Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon “Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne

“Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar NBA: young Thunder coach Mark Daigneault named coach of the year

NBA: young Thunder coach Mark Daigneault named coach of the year Athletics: Noah Lyles in legs in Bermuda

Athletics: Noah Lyles in legs in Bermuda Serie A: Dumfries celebrates Inter Milan title with humiliating sign towards Hernandez

Serie A: Dumfries celebrates Inter Milan title with humiliating sign towards Hernandez Tennis: no pity for Sorribes, Swiatek is in the quarterfinals in Madrid

Tennis: no pity for Sorribes, Swiatek is in the quarterfinals in Madrid