I will not go into these lines to assess what would be the fair level of tax collection for each citizen, or, what amounts to the same thing, the greater or lesser greed of the Tax Administration.

But what must go ahead is that the control of tax management is the last link in a chain that connects with an efficient fiscal policy, which in turn is part of an efficient economic policy, which is included in an efficient public policy. . The key to good public services lies in this taxation, so any improvement in its management results in a benefit for all.

The definition of the Tax Control Plan, as well as all its actions and management procedures, are included in article 116 and following of the General Tax Law. This control consists of the power granted to the Tax Administration to check the data on goods, rights, income or economic activities of those obliged to declare, and that can be obtained from the declarations presented by the latter or through selective collection actions. of information. Thanks to this, the detection of fiscal risks is facilitated, as well as an optimal selection of the obligors that will be verified.

Until the year 2000, the data obtained from these census and tax declarations were crossed with practically manual systems, relying on the efficiency and criteria of the Administration's workers. Since then, the evolution of technology and digital services has been constant, offering ever greater facilities (and automation) in tax control processes, encompassing:

A whole series of technologies at the service of the Tax Administration that, clearly, had to be regulated. For this reason, in January the general guidelines of the Annual Tax and Customs Control Plan for 2022 were published in the BOE, which basically includes the lines of action in this area. There are the so-called Comprehensive Digital Assistance Administrations (ADI), the platforms aimed at providing non-face-to-face information and assistance services through the use of different digital communication channels (virtual assistants, chat, video call, email, specialized outgoing call ...) with the aim of personalizing the service to the profile of each taxpayer. In addition, in the field of the digital economy, the Tax Agency wants to expand the verification of digital commerce, as well as implement both the new tax on certain digital services and greater control over transactions with virtual currencies.

To all of the above we must add that, thanks to the technological improvement of the rest of the Public Administrations, it is now possible to cross databases. An example of this would be the use of the information contained in the bases of the Mercantile Registry, the Property Registry, the Notarial Computerized Single Index... From the latter, the AEAT would obtain information contained in the Beneficial Ownership Database, that is, on the ownership of the shares of commercial companies and other legal entities, as well as data referring to the real ownership of all types of entities.

However, technological facilities not only benefit the Tax Administration, but also the filers themselves, making compliance with tax obligations more affordable (and understandable) and, therefore, promoting it. In the same way that they open the door to a transformation of the confrontational thinking between companies and AEAT, by promoting cooperation between both and the creation of a code of good practices that must be accompanied by social awareness plans on how the contribution benefits to the community.

Are we under greater scrutiny than before by the Administration? Yes we are. Are we therefore less likely to hide our tax data? Of course, but that is what it is about: that we gain more and more transparency, and make it progressively more difficult for those who refuse to contribute to the common good. Public services are the backbone of a strong and healthy country, capable of providing support to its citizens when needed. And its financing depends on tax collection, which we should stop conceiving as a decrease in our income, and rather as an investment to strengthen the Welfare State.

In Germany, the far left wants to cap the price of “doner kebabs”

In Germany, the far left wants to cap the price of “doner kebabs” Israel-Hamas war: Gaza between hope of truce and fear of Israeli offensive in the South

Israel-Hamas war: Gaza between hope of truce and fear of Israeli offensive in the South “Mom, Dad, please don’t die”: in the United States, a nine-year-old child saves the lives of his parents injured in a tornado

“Mom, Dad, please don’t die”: in the United States, a nine-year-old child saves the lives of his parents injured in a tornado War in Ukraine: Putin orders nuclear exercises in response to Macron and “Western leaders”

War in Ukraine: Putin orders nuclear exercises in response to Macron and “Western leaders” A baby whose mother smoked during pregnancy will age more quickly

A baby whose mother smoked during pregnancy will age more quickly The euro zone economy grows in April at its best pace in almost a year but inflationary pressure increases

The euro zone economy grows in April at its best pace in almost a year but inflationary pressure increases Children born thanks to PMA do not have more cancers than others

Children born thanks to PMA do not have more cancers than others Breast cancer: less than one in two French women follow screening recommendations

Breast cancer: less than one in two French women follow screening recommendations Call for strike on Sunday at Radio France against “the repression of insolence and humor” after the suspension of Guillaume Meurice

Call for strike on Sunday at Radio France against “the repression of insolence and humor” after the suspension of Guillaume Meurice Disney: profitable streaming for the first time, after 5 years of losses

Disney: profitable streaming for the first time, after 5 years of losses “I’m going to four concerts... I spent 1,255 euros”: for Taylor Swift, these fans ready to break the bank

“I’m going to four concerts... I spent 1,255 euros”: for Taylor Swift, these fans ready to break the bank SNCF: the CEO defends the agreement on the end of career, “reasonable, balanced and useful”

SNCF: the CEO defends the agreement on the end of career, “reasonable, balanced and useful” A little something extra, signed Artus, exceeds one million entries in less than a week

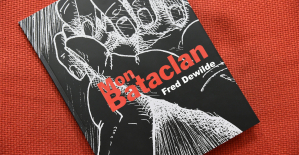

A little something extra, signed Artus, exceeds one million entries in less than a week Fred Dewilde, designer and Bataclan survivor, ended his life

Fred Dewilde, designer and Bataclan survivor, ended his life “I don’t appreciate being used as media cannon fodder”: Emmanuelle Bercot responds to Isild Le Besco

“I don’t appreciate being used as media cannon fodder”: Emmanuelle Bercot responds to Isild Le Besco Who is Deborah de Robertis, the artist who painted The Origin of the World?

Who is Deborah de Robertis, the artist who painted The Origin of the World? Omoda 7, another Chinese car that could be manufactured in Spain

Omoda 7, another Chinese car that could be manufactured in Spain BYD chooses CA Auto Bank as financial partner in Spain

BYD chooses CA Auto Bank as financial partner in Spain Tesla and Baidu sign key agreement to boost development of autonomous driving

Tesla and Baidu sign key agreement to boost development of autonomous driving Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33%

The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33% This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Europeans: David Lisnard expresses his “essential and vital” support for François-Xavier Bellamy

Europeans: David Lisnard expresses his “essential and vital” support for François-Xavier Bellamy Facing Jordan Bardella, the popularity match turns to Gabriel Attal’s advantage

Facing Jordan Bardella, the popularity match turns to Gabriel Attal’s advantage Europeans: a senior official on the National Rally list

Europeans: a senior official on the National Rally list Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels

Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Mercato: Thiago Silva returns to Brazil and signs for Fluminense

Mercato: Thiago Silva returns to Brazil and signs for Fluminense Top 14: at what time and on which channel to follow the clash at the Toulouse-Stade Français summit?

Top 14: at what time and on which channel to follow the clash at the Toulouse-Stade Français summit? Tennis: Paula Badosa, former world No.2, passes the 1st round in Rome

Tennis: Paula Badosa, former world No.2, passes the 1st round in Rome Tour of Italy: Italian Jonathan Milan wins the 4th stage, Pogacar still leader

Tour of Italy: Italian Jonathan Milan wins the 4th stage, Pogacar still leader