The year 2024 opens with a gloomy projection for the global economy, according to the new panorama from the World Bank, published Tuesday. Certainly, underline its experts, “the global economy is in a better position than it risked being and has avoided a global recession mainly due to the solidity of the American economy”. But the renewal of geopolitical tensions in the short term and the prospects in the majority of emerging countries in the medium term raise fears that “the 2020s will become a decade of missed opportunities”, estimates the chief economist, Indermit Gill.

Also read: Global trade is slowing down and fragmenting

The forecast for this year for global growth is 2.4%, down for the third consecutive year, after 2.6% in 2023. “Nearly three-quarters of a percentage point below the average of the 2010s », Underlines the funder in a press release. With the exception of 2020, the sharp recession caused by the pandemic and the closure of large parts of the global economy, this would be the weakest global growth recorded over a year since the 2008 financial crisis.

“The post-Covid global economy has been very uneven,” comments Indermit Gill. It was better for the richest countries. So, by the end of this year, we expect advanced economies to have higher per capita income than in 2019.” This will only be the case for two out of three emerging countries and even fewer for low-income countries.

Global trade is of particular concern to the institution. “This engine of economic growth will be much better in 2024 than last year but it should only represent half of the average of the past decade before the pandemic.” The outlook is clouded by multiple risks: political tensions, financial stress linked to high interest rates, the possibility of persistent inflation, weaker growth than expected in China, trade fragmentation and disasters linked to climate change.

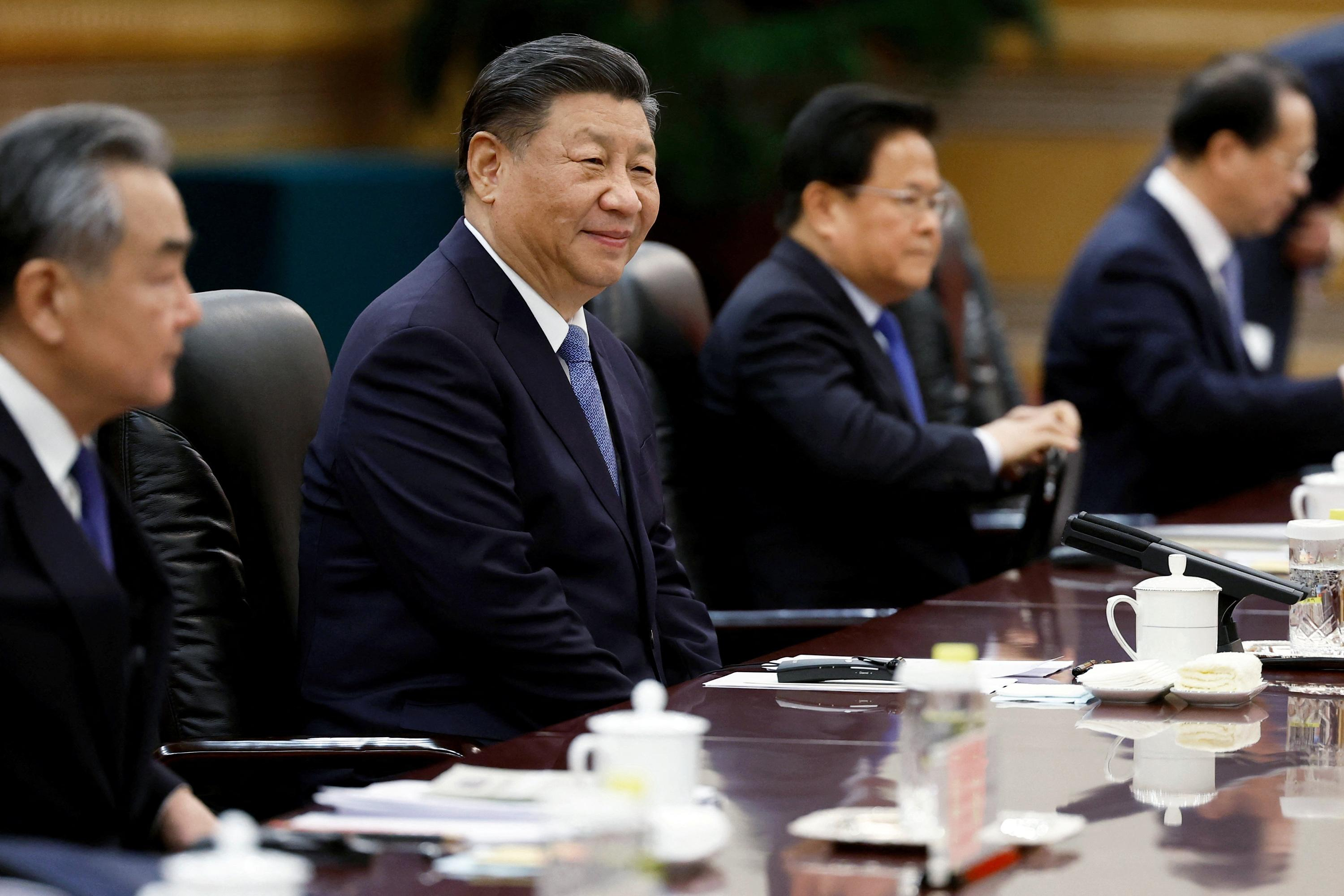

The World Bank forecasts a slight increase in GDP, of 1.2%, for advanced economies, down year-on-year, and of 4% for emerging countries, which are seeing private and public investments slow down. The world's second largest economy, China is expected to fall from 5.2% in 2023 to 4.5% this year, then to 4.3% in 2025, the lowest level since 1990. This slowdown reflects a sharp drop in consumption. domestically, as the momentum provided by the country's reopening dissipates and consumer morale weakens.

More generally, China “is a reflection of the global economy”. The Middle Kingdom is on the path to lower growth, which is likely to continue due to the aging and decline of the population as well as an increase in debt. The real estate crisis which has spread in the country is also weighing on this slowdown which “constitutes a headwind for other developing economies, specifies the World Bank, in particular those for which China is a major trading partner.” In a pessimistic scenario, the institution explains that “if China's growth is one percentage point lower than we forecast in 2024, and this is a possibility given the risks mentioned, global growth could be reduced by around 0.2 percentage points, with significant negative spillovers for emerging countries in particular.”

Finally, the report looked at the case of countries exporting raw materials (two-thirds of developing countries). A significant part of their revenue comes from these exports subject to price volatility. However, price instability leads these economies to periods which alternate between prosperity and recession. “The governments of these countries often adopt fiscal policies that intensify these cycles,” note the economists. They tend to increase their spending when commodity prices are rising and then, when prices fall, they spend less, which has the effect of slowing growth.

“This brake can be reduced by putting in place a fiscal framework that disciplines public spending, adopting flexible exchange rate regimes and avoiding restrictions on international capital movements,” the specialists recommend. These measures could help these states increase their per capita GDP growth by one percentage point every four to five years on average.

Here are the detailed growth projections by region:

B:SM will break its investment record this year with 62 million euros

B:SM will break its investment record this year with 62 million euros War in Ukraine: when kyiv attacks Russia with inflatable balloons loaded with explosives

War in Ukraine: when kyiv attacks Russia with inflatable balloons loaded with explosives United States: divided on the question of presidential immunity, the Supreme Court offers respite to Trump

United States: divided on the question of presidential immunity, the Supreme Court offers respite to Trump Maurizio Molinari: “the Scurati affair, a European injury”

Maurizio Molinari: “the Scurati affair, a European injury” Irritable bowel syndrome: the effectiveness of low-carbohydrate diets is confirmed

Irritable bowel syndrome: the effectiveness of low-carbohydrate diets is confirmed Beware of the three main sources of poisoning in children

Beware of the three main sources of poisoning in children First three cases of “native” cholera confirmed in Mayotte

First three cases of “native” cholera confirmed in Mayotte Meningitis: compulsory vaccination for babies will be extended in 2025

Meningitis: compulsory vaccination for babies will be extended in 2025 Thanks to intelligent cameras, RATP will indicate the least crowded trains on line 14

Thanks to intelligent cameras, RATP will indicate the least crowded trains on line 14 Dubai begins the transformation of Al-Maktoum to make it the future “largest airport in the world”

Dubai begins the transformation of Al-Maktoum to make it the future “largest airport in the world” When traveling abroad, money is a source of stress for seven out of ten French people

When traveling abroad, money is a source of stress for seven out of ten French people Elon Musk arrives in China to negotiate data transfer and deployment of Tesla autopilot

Elon Musk arrives in China to negotiate data transfer and deployment of Tesla autopilot Two people arrested for attempted damage to classified property at the Musée d’Orsay

Two people arrested for attempted damage to classified property at the Musée d’Orsay Death of composer Jean Musy, at 76, author of the music of Papy fait de la resistance, Les Champs-Élysées

Death of composer Jean Musy, at 76, author of the music of Papy fait de la resistance, Les Champs-Élysées Fanny Ardant prodigious in The Wound and the Thirst

Fanny Ardant prodigious in The Wound and the Thirst Hospitalized for pneumonia, Véronique Sanson cancels her concert in Nantes

Hospitalized for pneumonia, Véronique Sanson cancels her concert in Nantes Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: a senior official on the National Rally list

Europeans: a senior official on the National Rally list Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels

Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon

Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon “Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne

“Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Mercato: Fonseca coach of AC Milan? The Lille coach speaks

Mercato: Fonseca coach of AC Milan? The Lille coach speaks Ligue 1: OM with a three-way defense, Lens changes almost nothing

Ligue 1: OM with a three-way defense, Lens changes almost nothing Ligue 1: PSG officially crowned champion of France for the 12th time

Ligue 1: PSG officially crowned champion of France for the 12th time Ligue 1: Lyon offers Monaco and gets closer to a European place

Ligue 1: Lyon offers Monaco and gets closer to a European place