The continuous increases in interest rates in the last year have triggered the pressure on banks to remunerate deposits. This has caused a revolution in the storefront of savings products. Especially in the one aimed at paying the best clients of the banks, those with the greatest wealth.

International banks have taken the lead in the market for large fortunes in Spain and are competing fiercely in a deposit war, with offers outside the market.

The big American banks, like JPMorgan, Citi, or Goldman Sachs; Swiss banks, such as Edmond de Roths-child, Julius Baer, Safra Sarasin, Lombard Odier or Mirabaud; and even some Europeans, such as BNP Paribas, which only provide services in Spain to clients of large fortunes, very competitively transfer the rise in interest rates from the ECB and the Fed to more traditional savings products, such as deposits.

Although banks have been paying for savings in this customer segment for months, in recent weeks an offensive has been launched to attract liquidity and the remuneration of high net worth individuals has skyrocketed to percentages above 4% per year for their deposits, according to sources From the market. The most generous move even above 4.5%.

The hook is even greater in some entities that have broken the market with offers that move around 5.75% in one-year deposits in dollars. In the United States, the official rates are at 5.25%. The reason why the return on deposits in dollars is higher than those referenced to the euro lies in the exchange rate. The saver can greatly increase the performance with the appreciation of the currency against the euro.

The strategies depending on the entity are varied. In private banking, this is not the same as in the commercial banking segment, in which banks design standard offers for all customers, but it varies depending on different parameters.

While the final objective is the same, to attract new clients or increase the liquidity positions of clients with whom they already work, some entities apply these offers generally to all their clients, and others are being selective, offering the best conditions in depending on the client's assets, the type of products they have contracted with the bank or the amounts to be paid.

These entities have opened a commercial war in Spain for increasing the positions of their clients at the expense of their most direct competitors.

In private banking it is easier to compete for these balances (the operation is simpler), since high net worth clients usually work with several banks, in most cases, with at least one national entity and another of international origin. For this reason, customers who claim a return for their liquidity and cannot find it in their reference entity do not need to open a new account in another bank, just transfer the money.

Spanish banks with powerful private banking divisions are also paying their high net worth clients on time. However, the remuneration does not reach the levels at which foreign entities move. Offers slightly exceed 3%.

On the other hand, although they have experienced significant increases from the historical lows of last year, the returns on individual deposits are still far from significant levels. The weighted average rate at the end of April stood at 1.33% for a term of up to 12 months, very far from the average of 2.27% in the euro zone.

These stark figures are far from covering the sharp rise in inflation. To achieve significant returns, you have to go to foreign medium-sized banks or digital entities.

Yesterday, EBN Banco launched an express offer for current bank clients that will last from July 1 to July 17. It pays 2.5% for four months, 3% for six months, 3.15% for nine months and 3.20% for one year.

In the case of offers to companies, banks are being much more diligent in transferring the rise in official interest rates to the remuneration of their clients. Until April, they were paying 2.60% on deposits up to one year, one percentage point above the 1.60% at the end of 2022. It must be remembered that until March of last year companies were paying to deposit their money in the banks.

In the case of deposits to companies, remunerations are much more in line with the euro zone average, which at the end of April stood at 2.79%. Above this figure is the 2.80% that, for example, EBN Banco offers in its non-cancellable deposit for companies.

B:SM will break its investment record this year with 62 million euros

B:SM will break its investment record this year with 62 million euros War in Ukraine: when kyiv attacks Russia with inflatable balloons loaded with explosives

War in Ukraine: when kyiv attacks Russia with inflatable balloons loaded with explosives United States: divided on the question of presidential immunity, the Supreme Court offers respite to Trump

United States: divided on the question of presidential immunity, the Supreme Court offers respite to Trump Maurizio Molinari: “the Scurati affair, a European injury”

Maurizio Molinari: “the Scurati affair, a European injury” Irritable bowel syndrome: the effectiveness of low-carbohydrate diets is confirmed

Irritable bowel syndrome: the effectiveness of low-carbohydrate diets is confirmed Beware of the three main sources of poisoning in children

Beware of the three main sources of poisoning in children First three cases of “native” cholera confirmed in Mayotte

First three cases of “native” cholera confirmed in Mayotte Meningitis: compulsory vaccination for babies will be extended in 2025

Meningitis: compulsory vaccination for babies will be extended in 2025 Thanks to intelligent cameras, RATP will indicate the least crowded trains on line 14

Thanks to intelligent cameras, RATP will indicate the least crowded trains on line 14 Dubai begins the transformation of Al-Maktoum to make it the future “largest airport in the world”

Dubai begins the transformation of Al-Maktoum to make it the future “largest airport in the world” When traveling abroad, money is a source of stress for seven out of ten French people

When traveling abroad, money is a source of stress for seven out of ten French people Elon Musk arrives in China to negotiate data transfer and deployment of Tesla autopilot

Elon Musk arrives in China to negotiate data transfer and deployment of Tesla autopilot Two people arrested for attempted damage to classified property at the Musée d’Orsay

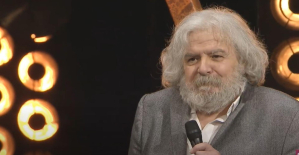

Two people arrested for attempted damage to classified property at the Musée d’Orsay Death of composer Jean Musy, at 76, author of the music of Papy fait de la resistance, Les Champs-Élysées

Death of composer Jean Musy, at 76, author of the music of Papy fait de la resistance, Les Champs-Élysées Fanny Ardant prodigious in The Wound and the Thirst

Fanny Ardant prodigious in The Wound and the Thirst Hospitalized for pneumonia, Véronique Sanson cancels her concert in Nantes

Hospitalized for pneumonia, Véronique Sanson cancels her concert in Nantes Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: a senior official on the National Rally list

Europeans: a senior official on the National Rally list Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels

Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon

Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon “Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne

“Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Mercato: Fonseca coach of AC Milan? The Lille coach speaks

Mercato: Fonseca coach of AC Milan? The Lille coach speaks Ligue 1: OM with a three-way defense, Lens changes almost nothing

Ligue 1: OM with a three-way defense, Lens changes almost nothing Ligue 1: PSG officially crowned champion of France for the 12th time

Ligue 1: PSG officially crowned champion of France for the 12th time Ligue 1: Lyon offers Monaco and gets closer to a European place

Ligue 1: Lyon offers Monaco and gets closer to a European place