Potential beneficiaries of this measure can fill out a form on the Agency's website that will allow them to manage their requests without having to provide additional information, informs the Tax Agency,

In this way, pensioners of mutual societies will be able to recover the excess tax paid in the period 2019-2023, although, the Agency points out, in most cases the amounts corresponding to 2023 will appear in the draft of the Income Tax return. that year, which can be presented from April 3.

According to the Supreme Court ruling, retirees who receive retirement or disability pensions from the former mutual societies can reduce their work income in the Income Tax return, with the aim of avoiding double taxation in cases in which the contributions to the mutualities could not be deducted at the time.

The second transitional provision (DT 2) of the Personal Income Tax Law offers the possibility of reducing the amount to be included as work income in the income tax return for each financial year when retirement or disability pensions are received by those mutual members whose contributions could not be be subject to a reduction or reduction in the tax base at the time. In this way, double taxation for these contributions is avoided.

To do this, it is necessary to have made contributions to mutual societies, in any case on a date prior to January 1, 1999, which have not been reduced or reduced in the tax base of the tax in accordance with the legislation in force at any given time.

The reduction to be applied varies depending on the date on which the contributions were made and the type of mutual fund to which they were made.

The pensions that may be entitled to reduction are the following:

Satisfied by the INSS or the Social Institute of the Navy.

The reduction may be applied:

Supplementary pensions

Pensions complementary to the Social Security pension or Passive Classes, which derive from contributions to mutual societies, are currently paid by pension plans or by the mutual societies to which said contributions were made.

In these cases, the part of the benefit that corresponds to contributions made prior to January 1, 1995, will be reduced by 25%: only 75% of this part of the pension will be taxed.

Satisfied by special funds from public entities

These pensions can be obtained by some officials as a complement to their main pension.

Regardless of whether or not your main pension is entitled to the application of the 2nd DT, these pension supplements can give the right to the application of the 2nd DT in the event that the mutual societies to which the contributions were made had integrated into the different special funds of the INSS, Muface, Mugeju and Isfas, which are the ones who now pay this supplement.

Thus, explains the Treasury, the 25% reduction for the part of the pension derived from contributions made to mutual societies until 01/07 is applicable to the "complement" of retirement or disability pension paid by the INSS special fund. /1987 (date of integration into the special fund). That is, only 75% of this part of the pension will be taxed.

The 25% reduction for the part of the pension derived from contributions made up to the date of integration of each of the mutual societies in the special fund, or until 12/31/1978 if the integration date was earlier. That is, only 75% of this part of the pension will be taxed.

A widow can apply the 2nd DT for her own retirement or disability pension in the terms indicated in the previous questions. Only the widow's pension is excluded.

Not applicable for those who receive pensions:

B:SM will break its investment record this year with 62 million euros

B:SM will break its investment record this year with 62 million euros War in Ukraine: when kyiv attacks Russia with inflatable balloons loaded with explosives

War in Ukraine: when kyiv attacks Russia with inflatable balloons loaded with explosives United States: divided on the question of presidential immunity, the Supreme Court offers respite to Trump

United States: divided on the question of presidential immunity, the Supreme Court offers respite to Trump Maurizio Molinari: “the Scurati affair, a European injury”

Maurizio Molinari: “the Scurati affair, a European injury” Irritable bowel syndrome: the effectiveness of low-carbohydrate diets is confirmed

Irritable bowel syndrome: the effectiveness of low-carbohydrate diets is confirmed Beware of the three main sources of poisoning in children

Beware of the three main sources of poisoning in children First three cases of “native” cholera confirmed in Mayotte

First three cases of “native” cholera confirmed in Mayotte Meningitis: compulsory vaccination for babies will be extended in 2025

Meningitis: compulsory vaccination for babies will be extended in 2025 Thanks to intelligent cameras, RATP will indicate the least crowded trains on line 14

Thanks to intelligent cameras, RATP will indicate the least crowded trains on line 14 Dubai begins the transformation of Al-Maktoum to make it the future “largest airport in the world”

Dubai begins the transformation of Al-Maktoum to make it the future “largest airport in the world” When traveling abroad, money is a source of stress for seven out of ten French people

When traveling abroad, money is a source of stress for seven out of ten French people Elon Musk arrives in China to negotiate data transfer and deployment of Tesla autopilot

Elon Musk arrives in China to negotiate data transfer and deployment of Tesla autopilot Two people arrested for attempted damage to classified property at the Musée d’Orsay

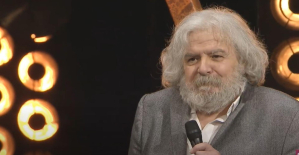

Two people arrested for attempted damage to classified property at the Musée d’Orsay Death of composer Jean Musy, at 76, author of the music of Papy fait de la resistance, Les Champs-Élysées

Death of composer Jean Musy, at 76, author of the music of Papy fait de la resistance, Les Champs-Élysées Fanny Ardant prodigious in The Wound and the Thirst

Fanny Ardant prodigious in The Wound and the Thirst Hospitalized for pneumonia, Véronique Sanson cancels her concert in Nantes

Hospitalized for pneumonia, Véronique Sanson cancels her concert in Nantes Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: a senior official on the National Rally list

Europeans: a senior official on the National Rally list Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels

Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon

Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon “Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne

“Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Mercato: Fonseca coach of AC Milan? The Lille coach speaks

Mercato: Fonseca coach of AC Milan? The Lille coach speaks Ligue 1: OM with a three-way defense, Lens changes almost nothing

Ligue 1: OM with a three-way defense, Lens changes almost nothing Ligue 1: PSG officially crowned champion of France for the 12th time

Ligue 1: PSG officially crowned champion of France for the 12th time Ligue 1: Lyon offers Monaco and gets closer to a European place

Ligue 1: Lyon offers Monaco and gets closer to a European place