As recently as Monday, representatives of the Port of Hamburg had warned the federal government against banning the planned entry of the Chinese shipping giant Cosco at a container terminal. "An entry of the Chinese into the operating company would be a huge gain for the port and not a threat, especially since Cosco will soon be the world's largest shipping company," said Axel Mattern, CEO of Port of Hamburg Marketing. "A refusal to the Chinese would be a disaster not only for the port but for Germany," he added, referring to possible Chinese reactions.

The background is that Cosco wants to take a 35 percent stake in the operator of the container terminal in Tollerort in the port of Hamburg. In mid-August, the Federal Ministry of Economics and Technology became aware of concerns about the plans of the port operator HHLA. On Tuesday, Federal Minister of Economics Robert Habeck (Greens) specified his reservations: "I tend in the direction that we will not allow that," the Vice Chancellor told the Reuters news agency on Tuesday. Although the container port of Tollerort is only a small part of the port as a whole, China could then influence trade. "That's why we checked it." But a decision by the cabinet is still missing. "But in fact, overall I think we should be more critical of Chinese investments in Europe."

Hamburg Mayor Peter Tschentscher (SPD), on the other hand, spoke out in favor of the China deal. His vote is important for HHLA, because 69 percent of its shares belong to the City of Hamburg. "There are no political guidelines for this, but what makes business sense must also be possible and done in practice," said Tschentscher in July. There are “good reasons” for shipping companies to have stakes in terminals in the Hanseatic city as well. The terminal operators can improve their capacity utilization, the shipping companies secure reliable points of contact and participate in the entire value chain beyond the sea route.” No objections were heard from the ranks of the Hamburg Greens, who form the coalition with the SPD in the state government.

The opposition sees this more critically. In a WELT guest contribution, the FDP state leader Michael Kruse demanded that the citizenry be involved in the debate, there were also warnings from the AfD and the left, who spoke of a “provocation”.

Mattern, on the other hand, considers the approval to be mandatory: "It's only about a minority stake in the operator of the Tollerort terminal - which Cosco already uses to a large extent today," he emphasized. Cosco will also not acquire any land. The Association of German Chambers of Industry and Commerce (DIHK) also warned of negative consequences in the event of a rejection: "If no clear safety criteria are comprehensible, the ban on investments in China, a trading partner that is so important for our economy, will have negative effects on the investment attractiveness of our locations", said DIHK foreign trade chief Volker Treier to Reuters.

The case is an example of how the federal government is currently struggling with the question of how to deal with the emerging, authoritarian superpower in the future. Since Russia's attack on Ukraine, the alarm bells have been ringing in politics: Where are there dependencies on China? What if the communist regime should attack Taiwan? Are German companies then in danger of being hit by sanctions – with serious repercussions for the German economy? Should or must the government therefore put pressure on companies?

Or should it only encourage them to move away from a focus on China in Asia business? Has the superpower already become too important for Germany as a trading, manufacturing and investment country? Would Germany destroy its own economic success model? After all, many of the now 5,000 German companies in China earn excellent money on the billion dollar market. According to information from Reuters from interviews with more than a dozen people working on the issue, there is heated argument behind the scenes in government and between politics and business about how to answer these questions.

A fundamental decision was made long ago: The SPD, Greens and FDP already agreed in the traffic light coalition agreement that something should change in dealing with the communist regime in Beijing - for the first time in a coalition agreement, Taiwan is mentioned, which China regards as a breakaway province becomes. The Greens in particular, who had already called for a tougher line in China policy as an opposition party, are pushing for a tougher course with Economics Minister Robert Habeck and Foreign Minister Annalena Baerbock.

Baerbock warned company representatives at a conference a few days ago: “We cannot, and I believe you cannot, afford the principle of acting according to the 'Business First' creed without taking into account the long-term risks and dependencies. "

To put it plainly: the government could withdraw the protective, supportive hand it held over companies doing business in China that it held over them during Chancellor Angela Merkel's term in office. Until the corona pandemic, Merkel had traveled to China with a business delegation once a year if possible - a clear signal to Beijing and the Asia-Pacific Committee of German business that closer cooperation is desired.

Since President Xi Jinping took office and Beijing's more aggressive domestic and foreign policy course, there had already been a gradual tightening of course under Merkel - for example when examining Chinese takeovers and investments in Germany.

With the traffic light government, human rights violations in China have moved up the agenda. The Ministry of Economics has already fired a warning shot at local companies when it rejected four applications from Volkswagen to extend state investment guarantees in the Chinese province of Xianjing - with reference to the persecution of the Muslim Uyghur minority.

According to Reuters information, a whole bundle of measures has been confidentially examined in the Ministry of Economic Affairs for weeks as to how companies could be encouraged to turn to other Asian countries instead of China. The state investment and export guarantees are up for grabs.

The KfW should also check whether it can scale back its China program and offer companies more loans for activities in other Asian countries such as Indonesia. Smaller programs such as trade fair sponsorship or manager training with China are also to be reviewed. From the Habeck Ministry there are informal indications to companies that certain events with China are no longer desired.

According to information from government circles, the federal government wants to increasingly enforce the reciprocity that has been demanded by the economy for years - i.e. insisting on the same conditions for foreign companies in China as for Chinese companies in the EU. Two people familiar with the plans said that the G7 should therefore discuss whether a complaint against China could be filed with the WTO. After fierce resistance from the economy, the ministry seems to be moving away from the review of investments by German companies in China, which is also being considered by the ministry.

Because of the growing tensions between China and Taiwan, the traffic light coalition, together with other allies, wants to show its new determination towards Beijing militarily: "In the coming year, the army will take part in a series of exercises with our value partners in Australia," announced Inspector General Eberhard Zorn .

"The Navy will also return to the Indo-Pacific, but this time with a fleet consisting of several ships." Most recently, Eurofighters had flown to Australia. Because of the new geopolitical situation, the NATO countries with Japan, Australia and South Korea are clearly moving closer together.

The harder course towards China finds cross-party support in the Bundestag. “The increasing dependency of strategically important sectors of the German economy on the Chinese market is not a problem for the private sector. In the event of a conflict, China can use this dependency as a weapon against us," says CDU foreign politician Norbert Röttgen.

It is right to reduce investment and export guarantees - but that's not enough. “Because large DAX companies can justifiably hope that the German government would still protect them in an emergency. Our strategy can therefore only consist of massively reducing the overall dependence of German companies on the Chinese market," believes the politician. "Germany must wake up and understand that in a time of systemic conflict, trade and geopolitics can no longer be separated."

SPD foreign politician Nils Schmid is similarly critical: “German business must know that things are not going to go on like this in China. There will be no political bailout if things don't go so well in China.”

After the experience with the stop of Russian gas deliveries, the question of too great a dependency on China for raw materials, such as rare earths, which are required in IT products, has also been raised. Ironically, the share of Chinese deliveries is very large in the case of preliminary products for renewable energies. "According to the International Energy Agency, China's share of the global production of key elements for solar panels, polysilicon and wafers will soon reach 95 percent," warned Foreign Minister Baerbock. For electric motors, the share is estimated at more than 60 percent.

If you look at the trade and investment figures, the politicians' appeals seem to have had little effect so far. Chancellor Olaf Scholz said that the companies had understood the message that one had to diversify both in supply chains and in exports, i.e. rely on several partners. "I am sure that the German economy has made this decision now," he added in mid-August.

But in the first half of 2022, German imports from China increased by 46 percent, albeit from a low corona level in 2021. According to Jürgen Matthes from the German Economic Institute (IW), it is even more important that investments shoot up again. "Full steam in the wrong direction" is the name of an IW study from August 19, which refers to the record investments by German companies in China of ten billion euros in the first half of 2022.

"Regardless of the immensely increased geopolitical risks, German companies are obviously continuing to dynamically implement their expansion plans in their investment commitments in China," it says. A spokeswoman for the Chinese Foreign Ministry calls this an "all-win" situation.

The director of the China Institute Merics, Mikko Huotari, also explains this increase in investment with a paradoxical effect. "Some companies are investing even more in China, but in order to make their business there more independent of their global activities." Especially with a view to possible political risks, China is increasingly being viewed as a closed business unit, with which - as a precaution for possible later sanctions - it is less exchange with company activities in other countries. Despite good business, this should dampen dependence on China as a location.

China itself has increased its pull as well as its pressure at the same time. The government in Beijing insists that more and more research and development must take place in China itself. The message is clear: Anyone who wants to benefit from the billion-dollar market in what will soon be the world's largest economy must expose themselves more there. At the same time, according to a new study by the China think tank Merics, the pressure on companies increases when they take political positions that the Chinese see as unpopular, for example in the conflict against Taiwan.

The companies reacted very differently, according to government circles. "You can distinguish three categories: The first group are corporations like VW or BASF, which consider their position to be so strong that they feel relatively secure in their commitment to China," says an insider, describing his perception. A second group would look for alternatives in addition to the China business. A third group is disillusioned with the billion dollar market.

Business circles have become more reluctant to speak openly on the subject. "Because you threaten to make yourself unpopular with either the federal government or the Chinese leadership," says a top manager of a DAX company who wants to remain anonymous. He accuses German politicians of naivety when they suggest that the German economy, which is dependent on exports and global networking, can break away from the growing billion-euro market.

The new VW boss Oliver Blume, for example, emphasizes that the group will stick to its plant in the Uyghur region of Xinjiang - even without government investment guarantees. "We are convinced that the presence of SAIC Volkswagen will have a positive effect on the people there," he told the "Tagesspiegel".

“China, with its 1.4 billion people, is a big market. From an economic point of view, it makes no sense to give up this market - even if many things are and remain difficult," warns DIHK foreign trade chief Volker Treier. "The Chinese market is of the utmost importance for many German companies, they simply cannot afford to stop investing," emphasizes Jens Hildebrandt, Managing Director of the German Chamber of Commerce in China.

Deutsche Bank boss Christian Sewing recently emphasized that China accounts for around eight percent of German exports and twelve percent of imports. "More than a tenth of the sales of all Dax companies come from China," he said. "China is a cornerstone of our economy."

Lower Saxony's Prime Minister Stephan Weil warns against too much pressure on companies. "No large German company can currently take responsibility for withdrawing from China," says the SPD politician. China certainly plays a very important role for Volkswagen, for example, admits the group's supervisory board member. “But the right answer against being too dependent is for the group to become much stronger in other markets, especially the American one. That is the best answer, especially when it comes to investments.” Chancellor Scholz also emphasizes that American demands for a “decoupling” from China are not to be followed, but that the focus is on “diversification”.

However, the companies are finding themselves in an increasingly difficult position as a result of the debate. "Some companies are more afraid of a debate in Germany and a loss of reputation as a result of their involvement in China than of problems in China itself," observed Mercis boss Huotari after numerous discussions with company representatives.

“In the short term, many companies act logically in China business. Many try to do good business in China for at least another 10, 15, maybe 20 years. But some companies not only underestimate the downward pressure on the Chinese economy, but above all the geopolitical risks of China as a location.”

Chancellor Scholz could take a new approach to the question of when and with whom he will travel to Beijing. So far, the strict corona rules in China have made the decision for him. Critics of China hailed it as a signal that the chancellor was traveling first to G-7 partner Japan. Mercis boss Huotari would find it understandable if the chancellor were to fly to Beijing in 2022. "But maybe Olaf Scholz should do this together with other EU heads of government to avoid the impression of a German special path," he says.

The SPD foreign policy expert Schmid also advises striving much more for a common EU position in relations with China. “Our most effective instrument is the attractiveness of the EU internal market – and the regulation of access. That is a powerful lever.”

In order to protect companies from becoming too dependent on the Chinese market, IW researcher Matthes proposes the following: "Companies should be required to report on geopolitical cluster risks and possible operational losses in the realization of these risks in their balance sheet reporting," he demands. "In addition, they should draw up and maintain emergency plans for this eventuality." That would make the risks of doing business in China transparent for everyone - and possibly also allow company bosses to calculate differently.

However, whether this will come about is questionable. Because not only the economy, but also politics moves on a fine line between cooperation and demarcation, between the human rights policy particularly emphasized by the Greens and the view of growth and jobs upheld in times of recession in the chancellery. Both the federal government and the EU see China as a system rival, business competitor and partner, for example in climate protection.

Even the decision to enter Cosco in the port of Hamburg will therefore be difficult. "The entry of the Chinese into the operating company would be a huge gain for the port and not a threat, especially since Cosco will soon be the world's largest shipping company," emphasizes Port of Hamburg Marketing Director Mattern. "A rejection of the Chinese would be a disaster not only for the port, but for Germany," he says, referring to possible Chinese reactions.

For example, according to industry circles, Cosco could participate in competing ports such as Gdansk. Treier, head of the DIHK foreign trade, also warns: "If no clear safety criteria are comprehensible, the ban on investments in China, a trading partner that is so important for our economy, will have a negative impact on the investment attractiveness of our locations."

In any case, China is watching the events in Germany very closely. In any case, the Chinese Foreign Ministry reacted in an unusually detailed and sensitive manner to the reports about the possible withdrawal of investment and export guarantees for German companies operating in China. In the usual flowery language, a spokeswoman in Beijing recommended that the federal government "should not pick up rocks that fall on its own feet."

In Germany, the far left wants to cap the price of “doner kebabs”

In Germany, the far left wants to cap the price of “doner kebabs” Israel-Hamas war: Gaza between hope of truce and fear of Israeli offensive in the South

Israel-Hamas war: Gaza between hope of truce and fear of Israeli offensive in the South “Mom, Dad, please don’t die”: in the United States, a nine-year-old child saves the lives of his parents injured in a tornado

“Mom, Dad, please don’t die”: in the United States, a nine-year-old child saves the lives of his parents injured in a tornado War in Ukraine: Putin orders nuclear exercises in response to Macron and “Western leaders”

War in Ukraine: Putin orders nuclear exercises in response to Macron and “Western leaders” A baby whose mother smoked during pregnancy will age more quickly

A baby whose mother smoked during pregnancy will age more quickly The euro zone economy grows in April at its best pace in almost a year but inflationary pressure increases

The euro zone economy grows in April at its best pace in almost a year but inflationary pressure increases Children born thanks to PMA do not have more cancers than others

Children born thanks to PMA do not have more cancers than others Breast cancer: less than one in two French women follow screening recommendations

Breast cancer: less than one in two French women follow screening recommendations Call for strike on Sunday at Radio France against “the repression of insolence and humor” after the suspension of Guillaume Meurice

Call for strike on Sunday at Radio France against “the repression of insolence and humor” after the suspension of Guillaume Meurice Disney: profitable streaming for the first time, after 5 years of losses

Disney: profitable streaming for the first time, after 5 years of losses “I’m going to four concerts... I spent 1,255 euros”: for Taylor Swift, these fans ready to break the bank

“I’m going to four concerts... I spent 1,255 euros”: for Taylor Swift, these fans ready to break the bank SNCF: the CEO defends the agreement on the end of career, “reasonable, balanced and useful”

SNCF: the CEO defends the agreement on the end of career, “reasonable, balanced and useful” A little something extra, signed Artus, exceeds one million entries in less than a week

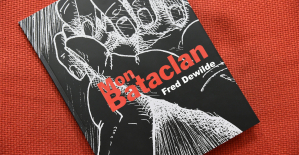

A little something extra, signed Artus, exceeds one million entries in less than a week Fred Dewilde, designer and Bataclan survivor, ended his life

Fred Dewilde, designer and Bataclan survivor, ended his life “I don’t appreciate being used as media cannon fodder”: Emmanuelle Bercot responds to Isild Le Besco

“I don’t appreciate being used as media cannon fodder”: Emmanuelle Bercot responds to Isild Le Besco Who is Deborah de Robertis, the artist who painted The Origin of the World?

Who is Deborah de Robertis, the artist who painted The Origin of the World? Omoda 7, another Chinese car that could be manufactured in Spain

Omoda 7, another Chinese car that could be manufactured in Spain BYD chooses CA Auto Bank as financial partner in Spain

BYD chooses CA Auto Bank as financial partner in Spain Tesla and Baidu sign key agreement to boost development of autonomous driving

Tesla and Baidu sign key agreement to boost development of autonomous driving Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33%

The home mortgage firm rises 3.8% in February and the average interest moderates to 3.33% This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Europeans: David Lisnard expresses his “essential and vital” support for François-Xavier Bellamy

Europeans: David Lisnard expresses his “essential and vital” support for François-Xavier Bellamy Facing Jordan Bardella, the popularity match turns to Gabriel Attal’s advantage

Facing Jordan Bardella, the popularity match turns to Gabriel Attal’s advantage Europeans: a senior official on the National Rally list

Europeans: a senior official on the National Rally list Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels

Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Mercato: Thiago Silva returns to Brazil and signs for Fluminense

Mercato: Thiago Silva returns to Brazil and signs for Fluminense Top 14: at what time and on which channel to follow the clash at the Toulouse-Stade Français summit?

Top 14: at what time and on which channel to follow the clash at the Toulouse-Stade Français summit? Tennis: Paula Badosa, former world No.2, passes the 1st round in Rome

Tennis: Paula Badosa, former world No.2, passes the 1st round in Rome Tour of Italy: Italian Jonathan Milan wins the 4th stage, Pogacar still leader

Tour of Italy: Italian Jonathan Milan wins the 4th stage, Pogacar still leader