The attack by Gotham City Research on Grifols and the emergence of Saudi Telecom Company (STC) on Telefónica have brought to the surface a significant activity for the markets that normally develops stealthily in the pipes of the financial system: the lending of company shares quoted.

These assignments allow bearish investors to carry out their operations: they take the borrowed securities, sell them quickly in the market and trust in a drop in prices to repurchase them cheaper when it is time to return them. This is what Gotham did at Grifols in January.

It also allows you to quickly take stakes in companies without shaking up stock market prices much: part of the Telefónica shares raised by STC in September 2023 were initially borrowed through Morgan Stanley.

For these transactions to take place, there must be an investor who acts as a lender. This operation is triggered on dividend payment dates, since some shareholders transfer their securities for a few days to avoid collecting remuneration, normally for tax reasons.

Another reason for lending is that stable shareholders want to get a return on their securities (in addition to the potential stock market appreciation or dividends), lending them temporarily in exchange for interest.

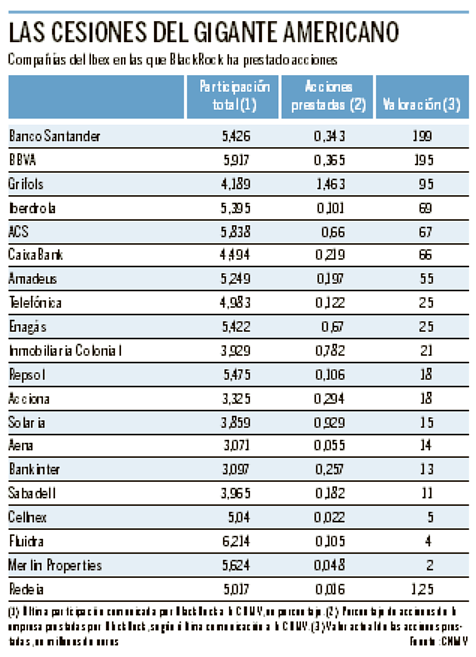

Several of the large foreign investors in the Spanish stock market are among the entities that lend shares of the large Ibex 35 companies. Two of the most prominent, BlackRock and the Norwegian sovereign fund (Norges Bank Investment Management), have securities borrowed from the Spanish listed companies for around one billion euros, according to the latest statements to the National Securities Market Commission (CNMV).

The American giant BlackRock adds shares lent for 932 million euros, including in groups such as Santander, BBVA, Iberdrola, ACS and CaixaBank. But the company in which a greater percentage of the capital has been assigned (almost 1.5%) is Grifols, one of the Spanish firms with the most activity of bearish short sellers.

Norway, for its part, has borrowed almost 1% of Solaria, and a small block of shares in Unicaja. The number of companies in which you have lent shares may be greater, since there is only an obligation to report shares to the CNMV when they exceed 3%.

Other large international funds also provide shares to bears or other investors. This is the case of Capital Research at IAG and BBVA (it also did it last month at Grifols); Invesco on Amadeus and Solaria; T Rowe at Fluidra; Fidelity in Indra and the Singapore entity GIC in Cellnex.

In Applus, banks such as Morgan Stanley and Jefferies have lent shares, surely to provide coverage for hedge funds that are betting on price increases in the outcome of the takeover battle for that company.

Market sources explain that it is usual for large funds to lend only a small portion of their total holdings, with the aforementioned objective of generating some return. A hedge fund or short seller that takes these securities can pay interest of more than 10%.

The dilemma arises when the investor lends shares in companies subject to attack by bearish investors, such as Grifols. If a substantial number of securities are sold, the investor may be throwing stones at his own roof by facilitating an avalanche of short selling that depresses the price of the shares.

In the case of the pharmaceutical company, according to data from S

Short sellers, for their part, suffer the risk of a rebound in the stock they have sold short, since they have to buy it back at a higher price to return it to its original owner.

In the end, investors like BlackRock play a delicate game by balancing the interest they receive for lending the shares, the expectations of the price and the volume of securities that, if sold, can move the price negatively. From the market they point out that, for listed companies, having an intense operation of securities on loan is positive to attract shareholders who want to have that option.

Although the attention of the bears seems focused on Grifols, it is not the Spanish company with the most shares on loan today. According to data from S

Behind those listed companies, Solaria and Grifols appear as the firms with the most borrowed shares, around 5% in each case.

In the case of Solaria, BlackRock itself (which again acts as a lender), Squarepoint and Helikon Investments have borrowed more than 0.5%, a percentage above which must be reported to the CNMV.

Qube Research

The ACS and Acciona Energías Renovables groups, for their part, have around 4% of the capital on loan. The bears Millennium International Management and AKO Capital have each shorted more than 0.5% of the company chaired by Florentino Pérez.

AKO Capital, along with Kintbury Capital and Fosse Capital Partners, appear among the bears of Fluidra, a firm where the bears have borrowed 3.68% of the capital, according to S

In Unicaja, a bank with 2.6% loaned, the Capital Fund Management firm has sold 0.5% short.

B:SM will break its investment record this year with 62 million euros

B:SM will break its investment record this year with 62 million euros War in Ukraine: when kyiv attacks Russia with inflatable balloons loaded with explosives

War in Ukraine: when kyiv attacks Russia with inflatable balloons loaded with explosives United States: divided on the question of presidential immunity, the Supreme Court offers respite to Trump

United States: divided on the question of presidential immunity, the Supreme Court offers respite to Trump Maurizio Molinari: “the Scurati affair, a European injury”

Maurizio Molinari: “the Scurati affair, a European injury” Irritable bowel syndrome: the effectiveness of low-carbohydrate diets is confirmed

Irritable bowel syndrome: the effectiveness of low-carbohydrate diets is confirmed Beware of the three main sources of poisoning in children

Beware of the three main sources of poisoning in children First three cases of “native” cholera confirmed in Mayotte

First three cases of “native” cholera confirmed in Mayotte Meningitis: compulsory vaccination for babies will be extended in 2025

Meningitis: compulsory vaccination for babies will be extended in 2025 Thanks to intelligent cameras, RATP will indicate the least crowded trains on line 14

Thanks to intelligent cameras, RATP will indicate the least crowded trains on line 14 Dubai begins the transformation of Al-Maktoum to make it the future “largest airport in the world”

Dubai begins the transformation of Al-Maktoum to make it the future “largest airport in the world” When traveling abroad, money is a source of stress for seven out of ten French people

When traveling abroad, money is a source of stress for seven out of ten French people Elon Musk arrives in China to negotiate data transfer and deployment of Tesla autopilot

Elon Musk arrives in China to negotiate data transfer and deployment of Tesla autopilot Two people arrested for attempted damage to classified property at the Musée d’Orsay

Two people arrested for attempted damage to classified property at the Musée d’Orsay Death of composer Jean Musy, at 76, author of the music of Papy fait de la resistance, Les Champs-Élysées

Death of composer Jean Musy, at 76, author of the music of Papy fait de la resistance, Les Champs-Élysées Fanny Ardant prodigious in The Wound and the Thirst

Fanny Ardant prodigious in The Wound and the Thirst Hospitalized for pneumonia, Véronique Sanson cancels her concert in Nantes

Hospitalized for pneumonia, Véronique Sanson cancels her concert in Nantes Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: a senior official on the National Rally list

Europeans: a senior official on the National Rally list Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels

Blockade of Sciences Po: the right denounces a “drift”, the government charges the rebels Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon

Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon “Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne

“Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Mercato: Fonseca coach of AC Milan? The Lille coach speaks

Mercato: Fonseca coach of AC Milan? The Lille coach speaks Ligue 1: OM with a three-way defense, Lens changes almost nothing

Ligue 1: OM with a three-way defense, Lens changes almost nothing Ligue 1: PSG officially crowned champion of France for the 12th time

Ligue 1: PSG officially crowned champion of France for the 12th time Ligue 1: Lyon offers Monaco and gets closer to a European place

Ligue 1: Lyon offers Monaco and gets closer to a European place