Is this finally the epilogue of the BNP Paribas toxic real estate loan affair? Fifteen years after marketing its “Helvet Immo” via its Personal Finance subsidiary, the leading European bank has decided to sign an amicable agreement with the consumer association Consumption, Housing and Living Environment (CLCV), as revealed our colleagues from Le Parisien. The approximately 4,400 injured customers will therefore be able to see their loan contract canceled. BNP Paribas preferred to give up several hundred million euros of loan repayments rather than seeing the group action launched in 2016 by the CLCV succeed. Le Figaro helps you see things more clearly.

“Generally speaking, toxic loan contracts are loan contracts denominated in foreign currency”, according to the law firm Constantin-Vallet, which represents the collective of victims Helvet Immo. In 2008 and 2009, BNP Paribas, via its subsidiary BNP Personal Finance (BNP-PF), marketed real estate loans taken out in Swiss francs but repayable in euros. “The toxicity of these loan contracts is due to the difference in currency in which the borrower's assets and liabilities are denominated: while his assets (his assets, his income, etc.) are in euros, his liabilities ( the debt resulting from the loan) is in foreign currency. This currency difference between the borrower's assets and liabilities exposes him to a currency risk,” the firm continues. Indeed, when the exchange rate evolves unfavorably for the borrower, the amount of his debt in euros increases.

These loans are generally offered at attractive rates, due to the greater risk involved. Except that in the case of “Helvet Immo”, BNP-PF assured “borrowers that the euro/Swiss franc rate was very stable”, specifies UFC-Que Choisir. However, the Swiss franc “has climbed 60% against the euro in five years”, continues this other consumer association formed as a civil party in the criminal part of the case. The borrowers therefore had to repay a much larger sum than the amount initially stipulated in the contract. “All individuals who took out Helvet Immo loans saw the interest rate on their loan explode in 2011, due to the depreciation of the euro against the Swiss franc in the wake of the subprime crisis,” specifies the 'UFC-Que Choisir. “These loans quickly turned out to be toxic since they made consumers bear an unlimited foreign exchange risk alone, the realization of which caused them particularly significant financial harm, without having properly informed them,” explains Maître Constantin-Vallet, the lawyer for certain victims, on the Village de la justice website.

The amicable contract, proposed by the BNP-PF, is the accomplishment of several proceedings initiated by the CVLC, plaintiffs and other associations such as the UFC-Que Choisir constituted civil parties. The latter had seized the Paris High Court in 2013, as part of a voluntary intervention, before becoming a civil party in the criminal trial in 2015, just like the CLCV. In 2020, the subsidiary was found guilty of deceptive commercial practice and concealment of an offense by the Paris Criminal Court. A maximum fine of 187,500 euros and 127 million euros in damages accompanied this sentence, confirmed last November by the Paris Court of Appeal. In addition to this criminal aspect, the CLCV had also initiated “an action to cease unfair clauses during the year 2017 relating in particular to indexation to the Swiss franc, as well as a group action from 2016”, specifies the association in a press release.

“According to the terms of the agreement concluded, BNP Paribas Personal Finance undertakes to offer a solution in the coming months to all borrowers,” explains the association. If the details have not been revealed, it would be a cancellation of the loan contract, according to a source close to the matter. Erasing the contract means that the bank will sit on several hundred million euros in interest repayments. In the order of 400 to 600 million euros, according to the same source. The bank would also have to reimburse the borrower for any surplus received via excessive interest. On the other hand, borrowers will still owe the bank the entire amount received at the time, so as to completely wipe the slate clean.

Nothing obliges the victims to sign the agreement reached by the CVLC and BNP Personal Finance, for whom "the amicable agreement proposed to all customers is part of the continuity of the group's actions, namely finding solutions adapted to each situation. Those who wish can continue their legal proceedings alone.

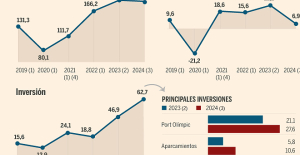

B:SM will break its investment record this year with 62 million euros

B:SM will break its investment record this year with 62 million euros War in Ukraine: when kyiv attacks Russia with inflatable balloons loaded with explosives

War in Ukraine: when kyiv attacks Russia with inflatable balloons loaded with explosives United States: divided on the question of presidential immunity, the Supreme Court offers respite to Trump

United States: divided on the question of presidential immunity, the Supreme Court offers respite to Trump Maurizio Molinari: “the Scurati affair, a European injury”

Maurizio Molinari: “the Scurati affair, a European injury” Irritable bowel syndrome: the effectiveness of low-carbohydrate diets is confirmed

Irritable bowel syndrome: the effectiveness of low-carbohydrate diets is confirmed Beware of the three main sources of poisoning in children

Beware of the three main sources of poisoning in children First three cases of “native” cholera confirmed in Mayotte

First three cases of “native” cholera confirmed in Mayotte Meningitis: compulsory vaccination for babies will be extended in 2025

Meningitis: compulsory vaccination for babies will be extended in 2025 When traveling abroad, money is a source of stress for seven out of ten French people

When traveling abroad, money is a source of stress for seven out of ten French people Elon Musk arrives in China to negotiate data transfer and deployment of Tesla autopilot

Elon Musk arrives in China to negotiate data transfer and deployment of Tesla autopilot Patrick Pouyanné, CEO of TotalEnergies, is very reserved about the rapid growth of green hydrogen

Patrick Pouyanné, CEO of TotalEnergies, is very reserved about the rapid growth of green hydrogen In the United States, a Boeing 767 loses its emergency slide shortly after takeoff

In the United States, a Boeing 767 loses its emergency slide shortly after takeoff A charred papyrus from Herculaneum reveals its secrets about Plato

A charred papyrus from Herculaneum reveals its secrets about Plato The watch of the richest passenger on the Titanic sold for 1.175 million pounds at auction

The watch of the richest passenger on the Titanic sold for 1.175 million pounds at auction Youn Sun Nah: jazz with nuance and delicacy

Youn Sun Nah: jazz with nuance and delicacy Paris Globe, a new international theater festival

Paris Globe, a new international theater festival Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

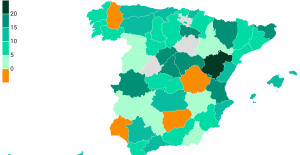

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon

Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon “Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne

“Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne Sale of Biogaran: The Republicans write to Emmanuel Macron

Sale of Biogaran: The Republicans write to Emmanuel Macron Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar MLS: new double for Messi who offers victory to Miami

MLS: new double for Messi who offers victory to Miami PSG-Le Havre: Ramos on his way, Kolo Muani at the bottom of the hole… Favorites and scratches

PSG-Le Havre: Ramos on his way, Kolo Muani at the bottom of the hole… Favorites and scratches Football: Vasco da Gama separates from its Argentinian coach Ramon Diaz

Football: Vasco da Gama separates from its Argentinian coach Ramon Diaz F1: for the French, Ayrton Senna is the 2nd best driver in history ahead of Prost

F1: for the French, Ayrton Senna is the 2nd best driver in history ahead of Prost