Jerome Powell went on Wednesday evening beyond the letter of the press release that the United States central bank had just published. During the press conference which followed the meeting of the monetary committee, the head of the Federal Reserve dared to say explicitly what many of his colleagues on the monetary committee of the Federal Reserve have been implying for several days: yes, the central bank The American bank is preparing to reduce its key rate, although it is unlikely that it will do so on March 20, the date of its next regular meeting.

“I don't think it's likely that the committee will reach a level of confidence in time for the March 20 meeting,” said Jerome Powell in response to a question from a journalist. For several minutes he explained that the level of “confidence” in the effective and sustainable return to an average price increase rate of 2% had not yet been reached. The message is important because it feels like a promise. The Fed believes that it is not urgent to lower the fed funds rate today, because it knows that such a shift will commit it for several months.

This rate at which it lets banks lend each other very short-term liquidity has been set between 5.25 and 5.50% since July. It would be extremely troubling for the financial system if the central bank were caught on the wrong foot by a resumption of inflation, or even simply by a pause in disinflation to a still unacceptable level. Its medium-term objective remains a price increase of 2%. The Fed's press release on Wednesday evening eliminated the reference, still present in the mid-December press release, to the possibility of an increase in its key rate. The “open market” committee therefore has its finger on the trigger but it judges, not without reason, that it has the luxury of still waiting until May 1, the date of its third ordinary meeting of the year.

By going off script in the Monetary Committee's press release, Jerome Powell also wanted to correct traders who for weeks have been betting on a rate cut from March, and even on a continuation of the downward movement at each Fed meeting in 2024. He succeeded because in a few minutes, the futures markets absorbed the message. From more than 60% probability of a drop in the "fed funds" rate at the beginning of March, we have gone to 35%, according to the Fedwatch Tool indicator from the CME, a large American derivatives market. The Fed, by giving itself the time to act, only takes into account the fact that the fear of recession has subsided. All the recent signals given by the economy actually show that consumption is more solid than expected, that hiring is weakening but remains strong, that the labor shortage has not been resolved, and that prices are becoming reasonable again. By May 1, she expects further signs that inflation is under control. Measured over twelve months, the core of inflation, if we do not take into account energy prices and the prices of food products, returned to 2.9% at the end of 2023. On the other hand, measured over the six In recent months, this core has already fallen to 1.9%. “A few more months at this level, and we can say with confidence that our objective of returning to 2% has been achieved,” says Jerome Powell in substance. What’s still holding Jerome Powell and his colleagues back? The head of the Fed tried to explain it on Wednesday evening. The Fed's fear is that successful disinflation in goods will not be followed by sufficient disinflation in services. A large part of the drop in inflation comes from a better alignment of the supply of goods with demand. The fortunate fall in energy prices also contributed. The supply chain problems caused by the pandemic are being resolved, which is improving the supply of goods, while at the same time demand is less strong than at the end of confinement and is mainly shifting towards services. However, on the supply and demand side of services, the alignment still leaves something to be desired. Particularly in terms of housing. If, moreover, the job market showed worrying signs of deterioration, the Fed would be in greater pressure to reduce its key rate. But at the moment, this is not the case. Strong growth of 2.5% on an annual basis in the fourth quarter and the unemployment rate of 3.7% observed in December convinced Jerome Powell that he had room before pivoting towards interest rate cuts .

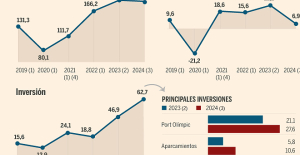

B:SM will break its investment record this year with 62 million euros

B:SM will break its investment record this year with 62 million euros War in Ukraine: when kyiv attacks Russia with inflatable balloons loaded with explosives

War in Ukraine: when kyiv attacks Russia with inflatable balloons loaded with explosives United States: divided on the question of presidential immunity, the Supreme Court offers respite to Trump

United States: divided on the question of presidential immunity, the Supreme Court offers respite to Trump Maurizio Molinari: “the Scurati affair, a European injury”

Maurizio Molinari: “the Scurati affair, a European injury” First three cases of “native” cholera confirmed in Mayotte

First three cases of “native” cholera confirmed in Mayotte Meningitis: compulsory vaccination for babies will be extended in 2025

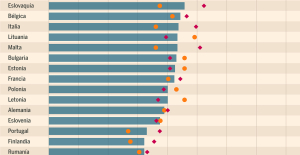

Meningitis: compulsory vaccination for babies will be extended in 2025 Spain is the country in the European Union with the most overqualified workers for their jobs

Spain is the country in the European Union with the most overqualified workers for their jobs Parvovirus alert, the “fifth disease” of children which has already caused the death of five babies in 2024

Parvovirus alert, the “fifth disease” of children which has already caused the death of five babies in 2024 The A13 motorway will not reopen on May 1

The A13 motorway will not reopen on May 1 More than 1,500 items for less than 1 euro: the Dutch discounter Action opens a third store in Paris

More than 1,500 items for less than 1 euro: the Dutch discounter Action opens a third store in Paris 100 million euros in loans, water storage, Ecophyto plan… New measures from the executive towards farmers

100 million euros in loans, water storage, Ecophyto plan… New measures from the executive towards farmers “He is greatly responsible”: Philippe Martinez accuses Emmanuel Macron of having raised the RN

“He is greatly responsible”: Philippe Martinez accuses Emmanuel Macron of having raised the RN Les Galons de la BD dedicates War Photographers, a virtuoso album on the Spanish War

Les Galons de la BD dedicates War Photographers, a virtuoso album on the Spanish War Theater: Kevin, or the example of an academic failure

Theater: Kevin, or the example of an academic failure The eye of the INA: Jean Carmet, the thirst for life of a great actor

The eye of the INA: Jean Carmet, the thirst for life of a great actor The Nuc plus ultra: St Vincent the Texane and Neil Young the return

The Nuc plus ultra: St Vincent the Texane and Neil Young the return Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

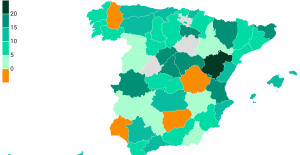

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon

Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon “Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne

“Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne Sale of Biogaran: The Republicans write to Emmanuel Macron

Sale of Biogaran: The Republicans write to Emmanuel Macron Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Paris 2024 Olympic Games: “It’s up to us to continue to honor what the Games are,” announces Estanguet

Paris 2024 Olympic Games: “It’s up to us to continue to honor what the Games are,” announces Estanguet MotoGP: Marc Marquez takes pole position in Spain

MotoGP: Marc Marquez takes pole position in Spain Ligue 1: Brest wants to play the European Cup at the Stade Francis-Le Blé

Ligue 1: Brest wants to play the European Cup at the Stade Francis-Le Blé Tennis: Tsitsipas released as soon as he entered the competition in Madrid

Tennis: Tsitsipas released as soon as he entered the competition in Madrid