in Principle, the IMF Switzerland in its annual country-from exam in good grades. As in previous years, he recommends Switzerland to increase the state expenditure. Thus the monetary policy could be relieved, said Rachel van Elkaan, the head of the IMF Delegation, on the Monday before the media in Bern.

The counter-cyclical role of the debt brake should be strengthened, calls for the IMF. Specifically: Surpluses should be invested in the investments and does not lead to tax cuts. Additional public expenditure would be an investment in the future of Switzerland, and would be financed by boosting growth - in part itself.

The Federal government is in this Punk with the IMF does not agree, such as Serge Gaillard, head of the Federal Finance administration, explained. From his point of view, the IMF underestimated the public expenditure.

In the past ten years had been created in the health sector, in education and in the management of 200'000, was Gaillard to keep in mind. The expenditure on education had annually grown by 2.5 per cent, the expenditure on roads by 3 per cent, and those for the railway by 2.5 percent. The have had a stabilizing effect.

measures to prevent real estate bubble

risks, the IMF sees the high indebtedness of private households - one of the world's highest - and in the real estate and mortgage market, including residential investment property. The demand remain, despite record high prices, driven by low mortgage rates, the high interest margin of the banks, and the expectation of future profits, writes of the IMF.

About 85 percent of the domestic assets of the banks are mortgages, the IMF. Also pension funds and insurance companies were affected. A price collapse could have a serious impact on the economy and significant social costs.

The IMF welcomes the fact that the bankers Association is considering to tighten the measures for self-regulation in mortgage lending. Proposals should be in the summer on the table. It could be a shortening of the amortisation period, and a reduction in the loan-to-value ratio.

Independent Finma

Positive side, the IMF mentioned improvements in the regulation of the financial market and of supervision. It remained but deficiencies, he writes. Rachel van Elkaan highlighted the importance of the independence of the financial market Supervisory authority (Finma). This should be strengthened to call upon you.

The Finma should be empowered, in addition, from the point of view of the IMF, auditing companies, directly employ in order to take banks under the magnifying glass. You should carry out more spot checks, especially at the big banks. Further, the IMF recommends the creation of a Bank Deposit insurance, in line with international standards. The planned Revision of the Deposit protection is deemed insufficient.

The IMF is also reflected to the Wage differentials between Switzerland and neighbouring countries. This seemed to have given the international mobility of Labour is not reduced, he says. The increase of foreign workers have contributed to the creation of new Jobs for native workers and to the growth of the average wages, what ankurble, in turn, productivity growth.

business taxation

Further, the IMF commends the solid position of public finances and the monetary policy stance. And he encourages Switzerland to make further progress in the international Commitment, in particular in the taxation of businesses. The international obligations is vital to avoid uncertainty and reputational risk, he says. The Federal Council writes in its report, the IMF see risks in the event of a rejection of the corporate tax reform by the people.

The Delegation of the IMF, the countries of examination from the 21. March to 1. April in Bern and Zurich. The regular assessment of the economic and financial situation of its member States is a core element of the work of the IMF.

In terms of economic negative Numbers also come from the other side. The purchasing Manager of the Swiss industrial companies are much more pessimistic than in the previous month. The decline is not for Economists, but not unexpected.

The so-called Purchasing Managers' Index (PMI, on a seasonally adjusted basis) fell in March, month-on-month by 5.1 points to 50.3 counter. This is the lowest level since December 2015, and the strongest decline since November 2008. The PMI recorded only a little above the growth threshold of 50 points and under the long-term average of 55 points. All sub-indicators lost in the March of Terrain. The decrease was probably the consequence of the growth slowdown abroad, especially the European industry, say it in a message to the Credit Suisse on Monday. The Bank calculates the Index, together with the specialist Association for purchasing and Supply Management.

Switzerland right in the middle of Europe

The March decline was severe. "Surprisingly it is not, however, when we see the strong dependence of the Switzerland of Europe," said Renato Flückiger, chief economist of the Valiant Bank. In the Euro-Zone, the PMIs have fallen with 47.5 points below the growth threshold.

Valiant is expected to decline. "But not quite on this scale," said Flückiger. Because of Switzerland's foreign trade was held in January and February very well. Striking was, that would have worsened all of the subcomponents. "Such surveys are often heavily influenced by a General feeling and individual values must not read too much into animals," said Thomas Stucki, chief investment officer of St. Galler Kantonalbank. The decrease was also due to the "General feeling of insecurity" caused by the Brexit and the difficulties for Switzerland in a very important German auto industry.

A rapid change in the current situation is not to be expected, writes the CS. The company had already responded to the downturn and their stocks to lower demand. This is also a sign that the decline in production should not exacerbate significantly. Positive is the fact that the companies hired to staff, if less widespread than in the previous months voice.

No recession

the Swiss economy is likely to remain robust on the whole, the authors of the study. The before, around a year "Mini-Boom" of the Swiss economy was faster than expected.

Also, the last Friday released the KOF economic barometer signaled for the Swiss economy, weak growth in the coming months. The ETH Zurich's leading economic indicator rose in March, but remained below average. After all, the recent downward trend has stopped, at least for now.

The signs are growing that is to be expected until the third quarter, significantly less momentum from the equipment investment and foreign trade, said Valiant Economist Flückiger.

"We go according to a slowing of growth but no recession, in this country," said the CS-Economists. The domestic consumption should remain solid, because the labour market situation remained good. The service sector, delight, also, of a still-solid demand.

support could come from small and medium-sized enterprises (SMEs). These show up after a difficult February and again more optimistic. The so-called Raiffeisen SMEs PMI increased in March by 3.7 to 55.1 points, and is thus clearly above the growth threshold of 50 meters. (Dec/sda)

Created: 01.04.2019, 12:18 PM

United States: divided on the question of presidential immunity, the Supreme Court offers respite to Trump

United States: divided on the question of presidential immunity, the Supreme Court offers respite to Trump Maurizio Molinari: “the Scurati affair, a European injury”

Maurizio Molinari: “the Scurati affair, a European injury” Hamas-Israel war: US begins construction of pier in Gaza

Hamas-Israel war: US begins construction of pier in Gaza Israel prepares to attack Rafah

Israel prepares to attack Rafah First three cases of “native” cholera confirmed in Mayotte

First three cases of “native” cholera confirmed in Mayotte Meningitis: compulsory vaccination for babies will be extended in 2025

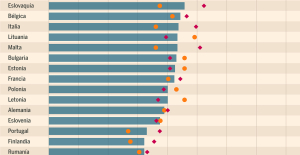

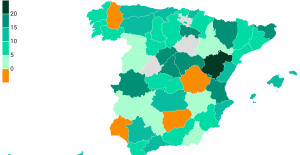

Meningitis: compulsory vaccination for babies will be extended in 2025 Spain is the country in the European Union with the most overqualified workers for their jobs

Spain is the country in the European Union with the most overqualified workers for their jobs Parvovirus alert, the “fifth disease” of children which has already caused the death of five babies in 2024

Parvovirus alert, the “fifth disease” of children which has already caused the death of five babies in 2024 Falling wings of the Moulin Rouge: who will pay for the repairs?

Falling wings of the Moulin Rouge: who will pay for the repairs? “You don’t sell a company like that”: Roland Lescure “annoyed” by the prospect of a sale of Biogaran

“You don’t sell a company like that”: Roland Lescure “annoyed” by the prospect of a sale of Biogaran Insults, threats of suicide, violence... Attacks by France Travail agents will continue to soar in 2023

Insults, threats of suicide, violence... Attacks by France Travail agents will continue to soar in 2023 TotalEnergies boss plans primary listing in New York

TotalEnergies boss plans primary listing in New York La Pléiade arrives... in Pléiade

La Pléiade arrives... in Pléiade In Japan, an animation studio bets on its creators suffering from autism spectrum disorders

In Japan, an animation studio bets on its creators suffering from autism spectrum disorders Terry Gilliam, hero of the Annecy Festival, with Vice-Versa 2 and Garfield

Terry Gilliam, hero of the Annecy Festival, with Vice-Versa 2 and Garfield François Hollande, Stéphane Bern and Amélie Nothomb, heroes of one evening on the beach of the Cannes Film Festival

François Hollande, Stéphane Bern and Amélie Nothomb, heroes of one evening on the beach of the Cannes Film Festival Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon

Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon “Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne

“Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne Sale of Biogaran: The Republicans write to Emmanuel Macron

Sale of Biogaran: The Republicans write to Emmanuel Macron Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Medicine, family of athletes, New Zealand…, discovering Manae Feleu, the captain of the Bleues

Medicine, family of athletes, New Zealand…, discovering Manae Feleu, the captain of the Bleues Football: OM wants to extend Leonardo Balerdi

Football: OM wants to extend Leonardo Balerdi Six Nations F: France-England shatters the attendance record for women’s rugby in France

Six Nations F: France-England shatters the attendance record for women’s rugby in France Judo: eliminated in the 2nd round of the European Championships, Alpha Djalo in full doubt

Judo: eliminated in the 2nd round of the European Championships, Alpha Djalo in full doubt