to strengthen the company's financial flexibility, has English now secured three billion in equity through a guaranteed rights issue oversubscribed, write English in a press release.

the Company has in recent years invested significantly in new aircraft and launched a variety of routes, not least the intercontinental. Now will the growth slow down and profitability up.

It led to a crimson opening on the Oslo stock exchange. At one point was the rate down to 30 per cent. Right before the clock hours of 09: 30 it had risen a little, but was still down 15 per cent.

Measures thethe Company writes in the press release that these measures should lead to that the costs be reduced:

Sales of aircraft and the possible establishment of a new holding company for part of the flyparkenUtsettelse of flyleveranserKostnadsprogrammet #Focus2019, where the aim is to reduce costs by at least two billion in 2019Optimalisering of basestruktur and ruteprogramKompensasjon from the engine manufacturer Rolls Royce related to the engine trouble on the company's Dreamliner-operationEnglish has been through a prolonged period of heavy expansion. Growth will now slow down, and the company will have an increased focus on reducing costs and investeringsforpliktelsene, writes chief executive Bjørn Kjos.

Through the rights issue will the company's balance sheet strengthened and the company will have increased flexibility to support this development forward. We are very pleased that our largest shareholders supports the company's plans and strategy in an increasingly competitive market. Now we are going to concentrate on to optimize our international operations and reduce costs to increase profitability, " says ceo Bjørn Kjos.

Extraordinary general meetingKapitaløkningen occurs through a guaranteed rights issue oversubscribed, which ensures Norwegian three billion in equity. Placement to be discussed at an extraordinary general meeting 19. February. The company's presentation of fourth quarter 2018 speeded up to 7. February.

English has received a proposal from certain major shareholders that the representation by the company's shareholders should be increased in the committee at the next annual general meeting, and that the statutes should be changed so that the chairman is no longer a permanent member of the committee, type TDN.

It means that the shareholders will throw the company's chairman of the board, Bjørn Kise, out of the committee.

HBK Holding AS, the company's largest shareholder, supports the proposal, outlined in a statement from the company Tuesday.

According to the DN has Bjørn Kise long as both have been guaranteed a place in the committee, but also as the chairman of the committee. On the way, he has been responsible for proposing himself as chairman of the board.

United States: divided on the question of presidential immunity, the Supreme Court offers respite to Trump

United States: divided on the question of presidential immunity, the Supreme Court offers respite to Trump Maurizio Molinari: “the Scurati affair, a European injury”

Maurizio Molinari: “the Scurati affair, a European injury” Hamas-Israel war: US begins construction of pier in Gaza

Hamas-Israel war: US begins construction of pier in Gaza Israel prepares to attack Rafah

Israel prepares to attack Rafah First three cases of “native” cholera confirmed in Mayotte

First three cases of “native” cholera confirmed in Mayotte Meningitis: compulsory vaccination for babies will be extended in 2025

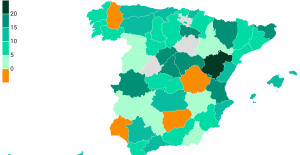

Meningitis: compulsory vaccination for babies will be extended in 2025 Spain is the country in the European Union with the most overqualified workers for their jobs

Spain is the country in the European Union with the most overqualified workers for their jobs Parvovirus alert, the “fifth disease” of children which has already caused the death of five babies in 2024

Parvovirus alert, the “fifth disease” of children which has already caused the death of five babies in 2024 Falling wings of the Moulin Rouge: who will pay for the repairs?

Falling wings of the Moulin Rouge: who will pay for the repairs? “You don’t sell a company like that”: Roland Lescure “annoyed” by the prospect of a sale of Biogaran

“You don’t sell a company like that”: Roland Lescure “annoyed” by the prospect of a sale of Biogaran Insults, threats of suicide, violence... Attacks by France Travail agents will continue to soar in 2023

Insults, threats of suicide, violence... Attacks by France Travail agents will continue to soar in 2023 TotalEnergies boss plans primary listing in New York

TotalEnergies boss plans primary listing in New York La Pléiade arrives... in Pléiade

La Pléiade arrives... in Pléiade In Japan, an animation studio bets on its creators suffering from autism spectrum disorders

In Japan, an animation studio bets on its creators suffering from autism spectrum disorders Terry Gilliam, hero of the Annecy Festival, with Vice-Versa 2 and Garfield

Terry Gilliam, hero of the Annecy Festival, with Vice-Versa 2 and Garfield François Hollande, Stéphane Bern and Amélie Nothomb, heroes of one evening on the beach of the Cannes Film Festival

François Hollande, Stéphane Bern and Amélie Nothomb, heroes of one evening on the beach of the Cannes Film Festival Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon

Even on a mission for NATO, the Charles-de-Gaulle remains under French control, Lecornu responds to Mélenchon “Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne

“Deadly Europe”, “economic decline”, immigration… What to remember from Emmanuel Macron’s speech at the Sorbonne Sale of Biogaran: The Republicans write to Emmanuel Macron

Sale of Biogaran: The Republicans write to Emmanuel Macron Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Medicine, family of athletes, New Zealand…, discovering Manae Feleu, the captain of the Bleues

Medicine, family of athletes, New Zealand…, discovering Manae Feleu, the captain of the Bleues Football: OM wants to extend Leonardo Balerdi

Football: OM wants to extend Leonardo Balerdi Six Nations F: France-England shatters the attendance record for women’s rugby in France

Six Nations F: France-England shatters the attendance record for women’s rugby in France Judo: eliminated in the 2nd round of the European Championships, Alpha Djalo in full doubt

Judo: eliminated in the 2nd round of the European Championships, Alpha Djalo in full doubt