there are Few things stressed out as much as monetary problems. If you need to constantly think about, enough money to all mandatory spending, it makes sense to look at their own economic situation with a critical eye.

And even if major problems had not, it is a new year, always a good place to go through spending and consumption habits and make any changes.

1. Combine a small loan,This tip is very important if you have several loans, consumer credit or hire-purchase, where you shorten a monthly basis. Pienlainoissa is often surprisingly high interest rates, so the more the smaller the loan, the costs will be relatively more expensive than one larger loan shortening, which will also pay only one loan hoitokulut.

Instabank is a Norwegian electronic means servant of the bank, whose most popular product is the just refinancing to take out a loan. Many finns have already received it with the help of reduced monthly expenses in the tens, even hundreds of euros.

consolidation loan have you can acknowledge the old debt, and pay future only one, larger and matalakorkoisempia loan. It saves time and nerves, and most importantly, you're left with a month more money to use.

2. Book expenditure upa Good way to start economic setting up, it is record expenditure, for example, months. This includes, of course, mandatory living expenses, loans and bills, but also all the big and small purchases, hobbies and food store and restaurant costs.

When you see concretely where your money is going, you will be easier to think about where you could give up, so that your economy stays better under control.

3. Pruning of small thingsthe Small, daily or weekly spending can unnoticed make a large cutout in the budget.

Three euro breakfast bread jobs in the cafeteria every weekday can feel like a small investment, but makes a month up to 60 euros. The same is true of take-away coffee or a bottle of water, when with a little effort you could make coffee at home or fill a plastic bottle with tap water.

we Live in a disposable society, where it is easier to buy a new sweater on the cheap than to maintain the old so that it remains good for as long as possible. When you want to buy something new, the first cabinet through and think about whether you need it really.

4. Make yourself a budgetWhen you get into more detail there about where your money is going, make yourself a budget. Calculate how much money will be left for you after you paid the mandatory expenses, bills and loans. Also estimates how much money goes on food and other necessities.

When sharing the remaining sum of four, get the orientation week budget. It is also good to leave some money aside for unexpected expenditure in case.

5. Take a loan considerAlmost everyone had to take his life during a loan for larger purchases, which are not able to pay at once. Loan taken so don't be afraid or ashamed of, but it must be justified and prudent.

you Should also pay attention to where the loan or credit applicant, for the grant between players can be large differences, for example, interest rates, conditions and service charges.

applying for a Loan Instabank is easy and reliable. This is mainly through the network to electronically serve the banks, which focus their resources on their customer-oriented service. You can get Instabank service personal service easily and flexibly via the web, email and telephone.

instabank of you get a competitive interest rate, and you can choose either an ordinary annuity loan or a flexible credit where you can actually define how much you shorten the loan from a month.

loan the application instabank's website only takes a few minutes, and the initial loan offer you can usually immediately. You can apply for a loan here. The loan application need not cost you anything and you get to decide whether to accept your loan offer.

Check loan calculator, how much you can save by combining small loans and credit.

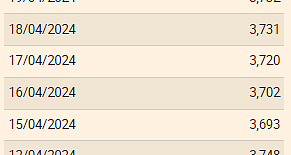

The Euribor today remains at 3.734%

The Euribor today remains at 3.734% Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday

Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations

New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations What is Akila, the mission in which the Charles de Gaulle is participating under NATO command?

What is Akila, the mission in which the Charles de Gaulle is participating under NATO command? What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France Food additives suspected of promoting cardiovascular diseases

Food additives suspected of promoting cardiovascular diseases “Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic

“Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic MEPs validate reform of EU budgetary rules

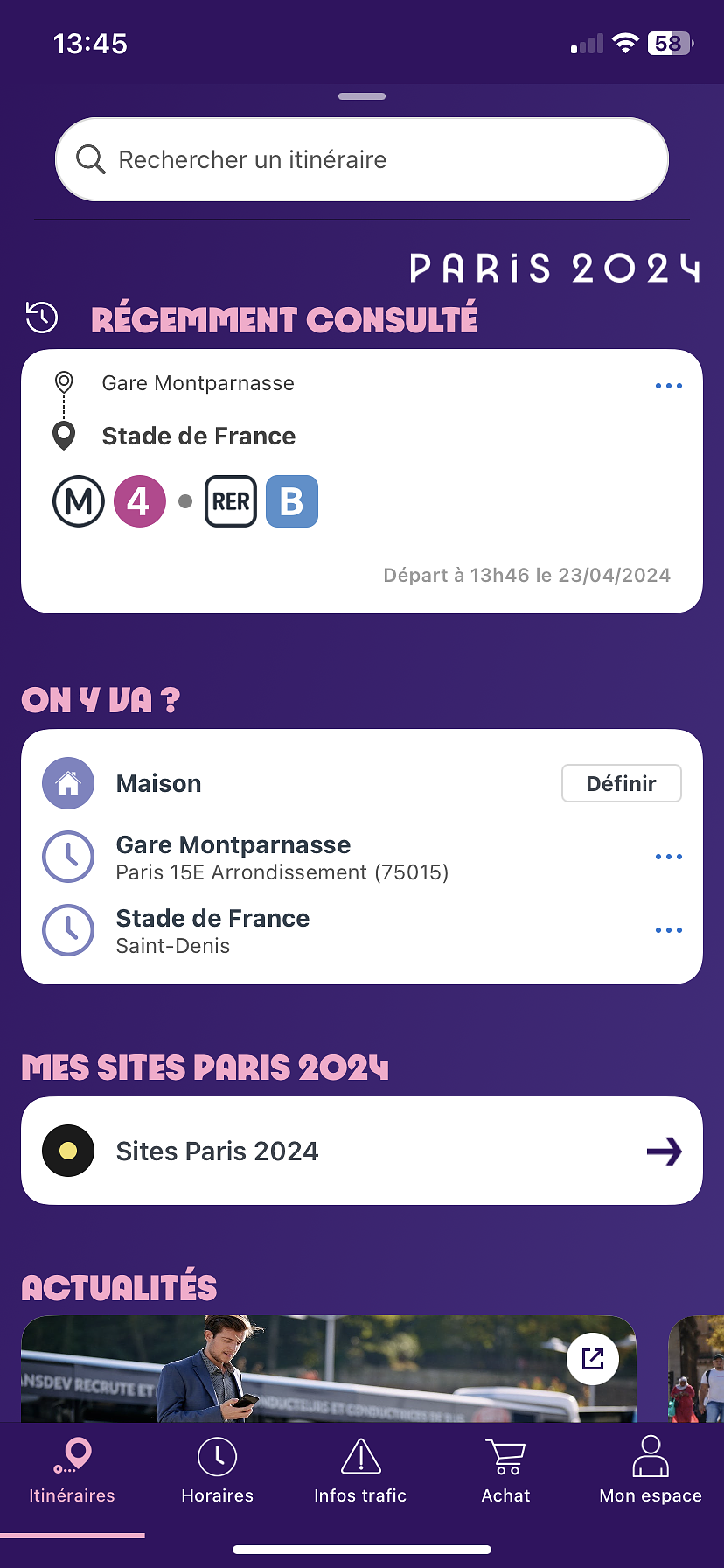

MEPs validate reform of EU budgetary rules “Public Transport Paris 2024”, the application for Olympic Games spectators, is available

“Public Transport Paris 2024”, the application for Olympic Games spectators, is available Spotify goes green in the first quarter and sees its number of paying subscribers increase

Spotify goes green in the first quarter and sees its number of paying subscribers increase Xavier Niel finalizes the sale of his shares in the Le Monde group to an independent fund

Xavier Niel finalizes the sale of his shares in the Le Monde group to an independent fund Owner of Blondie and Shakira catalogs in favor of $1.5 billion offer

Owner of Blondie and Shakira catalogs in favor of $1.5 billion offer Cher et Ozzy Osbourne rejoignent le Rock and Roll Hall of Fame

Cher et Ozzy Osbourne rejoignent le Rock and Roll Hall of Fame Three months before the Olympic Games, festivals and concert halls fear paying the price

Three months before the Olympic Games, festivals and concert halls fear paying the price With Brigitte Macron, Aya Nakamura sows new clues about her participation in the Olympics

With Brigitte Macron, Aya Nakamura sows new clues about her participation in the Olympics Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Serie A: Bologna surprises AS Rome in the race for the C1

Serie A: Bologna surprises AS Rome in the race for the C1 Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues?

Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues? Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby

Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season

Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season