Back in the early stages of 2020, the Government proposed an initial scenario of containment against Covid-19, already known to all: ERTEs, ICO loans and a battery of public aid to put a stop to the effects that were expected to be caused by the crisis caused by the virus was going to generate economically and socially.

Two years after the outbreak of the pandemic, the situation, far from being clarified, has become even grayer after the invasion of Ukraine by Russia, the crisis due to lack of supplies or the increase in the price of raw materials. An explosive cocktail that has completely exploded in companies and, how could it be otherwise, has had a negative impact on their income statement.

In this sense, at the beginning of this crisis, many companies financed their losses with the endorsement of the Official Credit Institute (ICO) to try to maintain their accounts. At present, the companies that requested these guarantees to withstand the downpour are facing the end of the lack of loans despite the recent extension approved by the Government at the end of March of this year within the framework of the National Response Plan to the economic and social consequences of the war in Ukraine.

Faced with this situation, the ICO credit becomes more important than ever in any business refinancing agreement: either out of bankruptcy, where the ICO credit becomes a financial one; either in bankruptcy, which can be through an anticipated or ordinary agreement.

In any of the cases, the ICO credit becomes a player with a passive ticket and must actively participate in a situation of business insolvency. This is a big change from his role prior to the arrival of COVID-19. Previously, the ICO was a rather passive actor in this type of operation, since its position used to be marginal with respect to the total debt of the companies. Now, the ICO credit is not only an essential pillar, but also has the key to the decision to go ahead with an extra-bankruptcy refinancing agreement or the approval of an agreement in which there must be accessions and their favorable vote.

Why is this happening? The ICO does not have defined instruments to support those agreements. This happens because the ICO is a guarantee that is proposed, in loans with financial entities, as a pari passu clause, which means that the losses are shared between the bank and the Ministry of Economic Affairs and Digital Transformation, which will only pay the guarantee at the end of the operation, with ownership and defense of the credit belonging to the financial entity until then.

All in all, this guarantee granted by the ICO comes from the Ministry, which is protected by the aforementioned entity, and this is the one that has to make the decisions on the financial operations of these guarantees. As the Ministry is a public body, its credits are ultimately managed by the Tax Agency, which is the one that ultimately has to adhere to and vote on any type of agreement. With which, the financial entities will not take any position that is not authorized by the aforementioned Ministry and the Tax Agency will not vote on any agreement that has to do with that credit because it has never participated in this type of withdrawal or long-waiting agreements.

Therefore, we find ourselves in a government that has made available to companies billions of euros in ICO guarantees, has financed the ERTE mechanisms, has maintained a bankruptcy moratorium for more than a year and a half and, when companies have tried to survive and do their homework, the very regulation of ICO credits is going to cause them to end up in a restructuring process and even, ultimately, in liquidation.

A scenario that also becomes more complex given that the Bank of Spain has recently indicated that there are already 3,000 million euros in the form of loans guaranteed by the ICO that are unpaid.

What future awaits companies in the face of this uncertainty? Unless the Government implements measures that reverse this situation and give another role to the ICO, companies will be headed towards the precipice of restructuring or even finally doomed to liquidation and, therefore, to their disappearance.

5

Germany: Man armed with machete enters university library and threatens staff

Germany: Man armed with machete enters university library and threatens staff His body naturally produces alcohol, he is acquitted after a drunk driving conviction

His body naturally produces alcohol, he is acquitted after a drunk driving conviction Who is David Pecker, the first key witness in Donald Trump's trial?

Who is David Pecker, the first key witness in Donald Trump's trial? What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain?

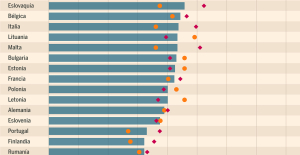

What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain? Spain is the country in the European Union with the most overqualified workers for their jobs

Spain is the country in the European Union with the most overqualified workers for their jobs Parvovirus alert, the “fifth disease” of children which has already caused the death of five babies in 2024

Parvovirus alert, the “fifth disease” of children which has already caused the death of five babies in 2024 Colorectal cancer: what to watch out for in those under 50

Colorectal cancer: what to watch out for in those under 50 H5N1 virus: traces detected in pasteurized milk in the United States

H5N1 virus: traces detected in pasteurized milk in the United States Insurance: SFAM, subsidiary of Indexia, placed in compulsory liquidation

Insurance: SFAM, subsidiary of Indexia, placed in compulsory liquidation Under pressure from Brussels, TikTok deactivates the controversial mechanisms of its TikTok Lite application

Under pressure from Brussels, TikTok deactivates the controversial mechanisms of its TikTok Lite application “I can’t help but panic”: these passengers worried about incidents on Boeing

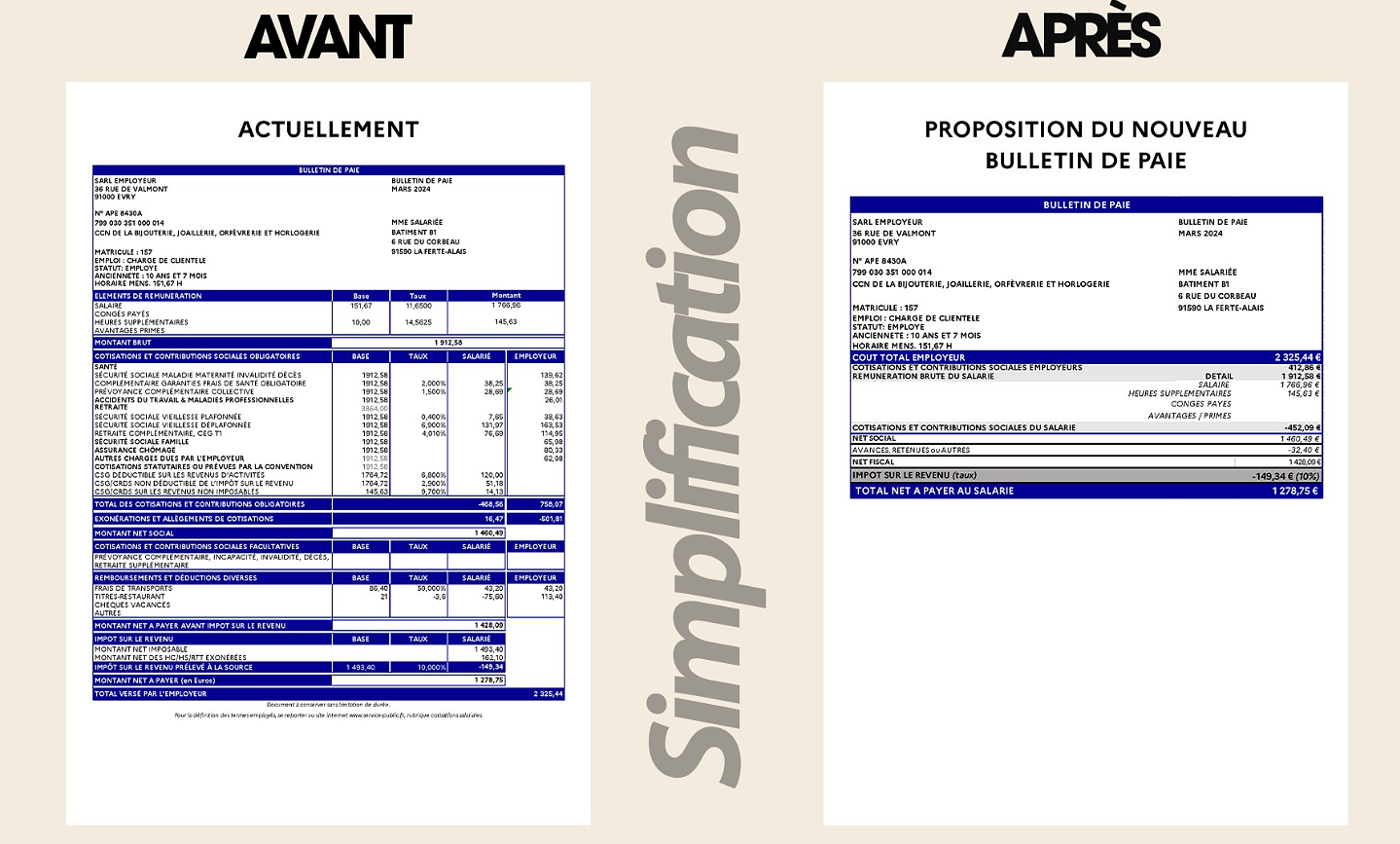

“I can’t help but panic”: these passengers worried about incidents on Boeing “I’m interested in knowing where the money that the State takes from me goes”: Bruno Le Maire’s strange pay slip sparks controversy

“I’m interested in knowing where the money that the State takes from me goes”: Bruno Le Maire’s strange pay slip sparks controversy 25 years later, the actors of Blair Witch Project are still demanding money to match the film's record profits

25 years later, the actors of Blair Witch Project are still demanding money to match the film's record profits At La Scala, Mathilde Charbonneaux is Madame M., Jacqueline Maillan

At La Scala, Mathilde Charbonneaux is Madame M., Jacqueline Maillan Deprived of Hollywood and Western music, Russia gives in to the charms of K-pop and manga

Deprived of Hollywood and Western music, Russia gives in to the charms of K-pop and manga Exhibition: Toni Grand, the incredible odyssey of a sculptural thinker

Exhibition: Toni Grand, the incredible odyssey of a sculptural thinker Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

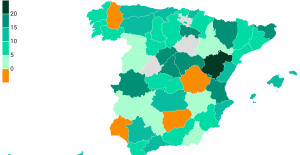

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Sale of Biogaran: The Republicans write to Emmanuel Macron

Sale of Biogaran: The Republicans write to Emmanuel Macron Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Hand: Montpellier crushes Kiel and continues to dream of the Champions League

Hand: Montpellier crushes Kiel and continues to dream of the Champions League OM-Nice: a spectacular derby, Niçois timid despite their numerical superiority...The tops and the flops

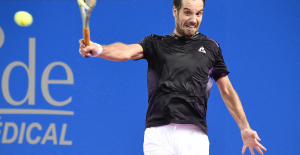

OM-Nice: a spectacular derby, Niçois timid despite their numerical superiority...The tops and the flops Tennis: 1000 matches and 10 notable encounters by Richard Gasquet

Tennis: 1000 matches and 10 notable encounters by Richard Gasquet Tennis: first victory of the season on clay for Osaka in Madrid

Tennis: first victory of the season on clay for Osaka in Madrid