The full credit was not available to people who had enough income to pay income taxes.

As part of the $1.9 trillion Coronavirus Relief Package, President Joe Biden increased the program. He increased the payments to as high as $3,600 per child under 5 years old and $3,000 to those 6-17 years.

Monthly payments were $300 for children 5 years and under and $250 for those 5-17 years old.

The government began to send the payments out -- an overall $93 billion -- monthly starting in July. There are six additional months of payments that have yet to be claimed. Some families are still waiting to receive the benefits they deserve. An estimated $193 billion in benefits are still to be claimed.

You can only receive the money by filing a tax return.

Here are some questions and answers regarding who is eligible for the credit, and how to obtain it.

Who gets the CHILD TAX CODE?

In December, more than 36 million families received advanced payments. This was the last month in which advanced monthly payments were sent out to households. If their 2021 adjusted income is at or below $150,000, married couples filing joint returns, or $75,000 for single filers parents, families are eligible for full credit

HOW DO I KNOW I QUALIFY? AND WHAT IF i DON'T OWE ANY TAXES.

No matter if a family owes or has previously filed taxes, they must file a return in order to receive all or part of their money.

Families that did not receive advance child credit payments in 2021 may still be eligible to claim the entire amount of the child credit on their federal tax returns. Families who aren't sure if they have received any payments or if they may have received uncashed paper checks can visit the Children Tax Credit Update Portal to find out how much credit they should have received.

Families that have received advance payments must have received a letter 6419, 2021 advance CTC notice. This notice includes information about the amount received by families and tax information to file.

The IRS stated that some people may have submitted incorrect information. If you want to verify the amount that they have received, this portal will help. The IRS recommends that taxpayers keep the letter and any other IRS communications regarding advance payments with their tax records, despite any inconsistencies in documentation.

What is the best way to file?

To speed up the processing of taxes, the IRS encourages people to file electronically. It also provides links to free filing sites such GetYourRefund.org which allows families with incomes below $66,000 to file their taxes free of charge. This organization is a partner with IRS-certified Volunteer Income tax Assistance and offers free assistance in English and Spanish. Another option is MyFreeTaxes.com which offers virtual assistance for people earning $58,000 or less in order to file their state and federal taxes free of charge. This service is provided by the United Way.

An IRS tool can also be used to identify tax-filing sites.

What if I live outside the 50 states?

The coronavirus relief package also included child tax credit benefits to Puerto Rican residents, but they were not eligible for the monthly advance payments. Puerto Ricans can instead receive the maximum amount of child credit they are eligible for by submitting a federal income tax returns this year. Residents of American Samoa and the Commonwealth of the Northern Mariana Islands (Guam), Guam, or the U.S. Virgin Islands might also be eligible for full child tax credit payments. However, they will need to contact the local U.S. territory tax agency.

Who can help me solve this problem?

The IRS launched ChildTaxCredit.gov a website that lists the criteria filers must meet to be eligible for full credit. Beginning February 12, the federal agency will offer walk in assistance to individuals who need assistance filing taxes.

Thirty-five tax assistance centres across the country will open on the second Saturday in the next four month, from 9 a.m. - 4 p.m.

His body naturally produces alcohol, he is acquitted after a drunk driving conviction

His body naturally produces alcohol, he is acquitted after a drunk driving conviction Who is David Pecker, the first key witness in Donald Trump's trial?

Who is David Pecker, the first key witness in Donald Trump's trial? What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain?

What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain? The shadow of Chinese espionage hangs over Westminster

The shadow of Chinese espionage hangs over Westminster Colorectal cancer: what to watch out for in those under 50

Colorectal cancer: what to watch out for in those under 50 H5N1 virus: traces detected in pasteurized milk in the United States

H5N1 virus: traces detected in pasteurized milk in the United States What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France The right deplores a “dismal agreement” on the end of careers at the SNCF

The right deplores a “dismal agreement” on the end of careers at the SNCF The United States pushes TikTok towards the exit

The United States pushes TikTok towards the exit Air traffic controllers strike: 75% of flights canceled at Orly on Thursday, 65% at Roissy and Marseille

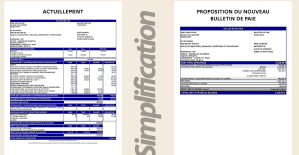

Air traffic controllers strike: 75% of flights canceled at Orly on Thursday, 65% at Roissy and Marseille This is what your pay slip could look like tomorrow according to Bruno Le Maire

This is what your pay slip could look like tomorrow according to Bruno Le Maire Sky Dome 2123, Challengers, Back to Black... Films to watch or avoid this week

Sky Dome 2123, Challengers, Back to Black... Films to watch or avoid this week The standoff between the organizers of Vieilles Charrues and the elected officials of Carhaix threatens the festival

The standoff between the organizers of Vieilles Charrues and the elected officials of Carhaix threatens the festival Strasbourg inaugurates a year of celebrations and debates as World Book Capital

Strasbourg inaugurates a year of celebrations and debates as World Book Capital Kendji Girac is “out of the woods” after his gunshot wound to the chest

Kendji Girac is “out of the woods” after his gunshot wound to the chest Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar NBA: the Wolves escape against the Suns, Indiana unfolds and the Clippers defeated

NBA: the Wolves escape against the Suns, Indiana unfolds and the Clippers defeated Real Madrid: what position will Mbappé play? The answer is known

Real Madrid: what position will Mbappé play? The answer is known Cycling: Quintana will appear at the Giro

Cycling: Quintana will appear at the Giro Premier League: “The team has given up”, notes Mauricio Pochettino after Arsenal’s card

Premier League: “The team has given up”, notes Mauricio Pochettino after Arsenal’s card