Nordic banks related to suspicion of money laundering omissions expanding. Now in the midst of them is also the Swedish SEB-bank.

SEB bank released Tuesday-the evening bulletin (switch to another service) the bank of Estonia-treasury has done the report. According to the bank of Estonia-units have flowed through the years 2005-2017 nearly 26 billion euros of suspicious sources of money.

according to the Bank account transfer you are a customer, who ”would not pass through the bank current requirements of” the transparency of the relationship.

Foreign customers to wire transfer the value of the Estonian branch of SEB:according to a little more than a decade of almost 85 billion euros. These, however, only the part of the bank suspicious.

the Bank reasons for the publication of information Estonia-unit suspicious transactions in order to demonstrate “significant work”, which it has wiped out the possibility of money laundering.

SEB:according to the suspicious wire transfer, you are out of practice entirely from the bank's Estonian unit.

as a Customer of nearly 200 shell companies tothe Bank released the information a few weeks after, when its representatives were allowed to belong to two Swedish media and Yle MOT:n from the bank's activities on the survey.

the MOT and the Swedish have studied the SEB as a customer of shell companies for suspicious money flows from the summer of 2019.

the Study found 194 table box company. Some of the companies activities associated with the suspicious features and the traditional money laundering signs.

the Report raised the suspicious transfers were worth significantly less than what the bank itself reported by so few of the hundreds of millions of euros.

Part of the SEB as a customer of the companies is directly connected with economic crimes. The vast majority of suspicious customers has been account in SEB bank Estonian branch.

the Prestigious british money laundering, according to the expert evidence on the basis of the SEB seems to have failed to money laundering prevention.

– alarm bells should have been ringing, said Graham Barrow the Swedish news agency TT in an interview.

money laundering refers to the means aimed at eradicating criminal means assets acquired origin.

SEB: No ”systematic” problems withSEB's representative, according to a Swedish bank has not been used for “systematic” money laundering. The bank acknowledges, however, that it should have identified the risk of customers better.

the Swedish news agency TT:one thing to comment on the bank's corporate responsibility director Gent Jansson said SEB see the subject to launch an independent and external party by the survey.

for Example, Danske Bank hired an outside statement of the person to study through the bank-made up of more than 200 billion euros in suspicious transfers.

SEB-bank ceo Johan Torgeby insurance in autumn 2018, the bank won't have a problem with money laundering.Fredrik Sandberg / EPA-EFEKaunisteliko bank situation?SEB is already four nordic banks, whose activities related to suspicions of money laundering, betrayal. Previously, it has been widely reported, Danske Bank, Nordea and Swedbankissa the event of suspicious account transfers.

SEB bank has previously told the public that it is not the problem of money laundering prevention.

we serve only the domestic market with customers. Our bank's culture of risk identification is also excellent, says SEB's ceo Johan Torgeby in October 2018, the bank's interim report process (switch to another service).

a customer of the Bank has, however, been at least 110 tax havens such as the British virgin islands, Panama or Belize, to register the company. Their owners, or the money source is in most cases almost impossible to identify and they have also been known to ghost leaders.

SEB:according to the vast majority of shell companies is no longer a customer of the bank.

the Fall of 2018 SEB ceo says the bank's activities for the next analyst for the ceremony, that the bank had cleared a large of money laundering-news due to their own activities.

– from 2008 onwards till this day we have not found any alarming signs, ceo Torgeby said at the time.

SEB:s report last suspicious money transfer you are from 2017. Did the ceo of investors with truthful information?

it's My opinion no, says money laundering expert Graham Barrow.

SEB's corporate responsibility director Gent Jansson, the bank does not see any justification to change a few years ago opinion.

Fraud, politicians, shell companiesthe SEB bank's report found signs of bank customers switched in many criminal cases or otherwise suspicious activities.

the Report revealed, inter alia, the following:

SEB client companies are closely linked to companies, whose suspicions of money laundering it has been widely reported previously, the majority of information leaks in connection with (move to another service).As many as 29 SEB client, the company gave or sent money to companies who are suspected of huge of Moscow airport incident-fuel fraud (you move to another service).SEB:no customer has been a cypriot company, which is owned by estonia's former minister of internal affairs of the Ain seppik's son. The cypriot company is the Estonian Postimees newspaper, according to (you move to another service) transferred millions of euros to a shell company relating to money laundering suspicions.SEB bank account through has made at least 193 account transfer to the company relating to the so-called magnit is the case. The Russian lawyer and accountant Sergei Magnitski revealed in 2008 the Russian authorities made by the approximately 230 million dollar fraud. The Russian authorities have not investigated the fraud, but was captured by Magnitsky, who died in captivity to be in.Investors concerned about money launderingSEB's stock price fell more than ten percent the week before, i.e. November 15. day. Rate calculator the reason was the concern for money laundering of suspicion (you move to another service).

SEB's stock price fell more than ten per cent on November 15. day.Valda Kalniņa / EPAthe Bank sent out a stock exchange release where it told Swedish broadcaster SVT asked for interview requests concerning money laundering suspicions. Interview requests regarding MOT's and the Swedish media in the context of the projects made discoveries.

money laundering suspect you are affected by a number of nordic banks ' market value. Many investors are beginning to hold banks already risky as an investment (you move to another service).

Subscribe Yle newsletters!Get Overeating the best content straight to your inbox!

Proceed to order

Torrential rains in Dubai: “The event is so intense that we cannot find analogues in our databases”

Torrential rains in Dubai: “The event is so intense that we cannot find analogues in our databases” Rishi Sunak wants a tobacco-free UK

Rishi Sunak wants a tobacco-free UK In Africa, the number of millionaires will boom over the next ten years

In Africa, the number of millionaires will boom over the next ten years Iran's attack on Israel: these false, misleading images spreading on social networks

Iran's attack on Israel: these false, misleading images spreading on social networks New generation mosquito nets prove much more effective against malaria

New generation mosquito nets prove much more effective against malaria Covid-19: everything you need to know about the new vaccination campaign which is starting

Covid-19: everything you need to know about the new vaccination campaign which is starting The best laptops of the moment boast artificial intelligence

The best laptops of the moment boast artificial intelligence Amazon invests 700 million in robotizing its warehouses in Europe

Amazon invests 700 million in robotizing its warehouses in Europe Switch or signaling breakdown, operating incident or catenaries... Do you speak the language of RATP and SNCF?

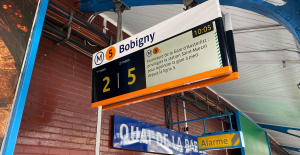

Switch or signaling breakdown, operating incident or catenaries... Do you speak the language of RATP and SNCF? Transport in Île-de-France: operators are pulling out all the stops on passenger information before the Olympics

Transport in Île-de-France: operators are pulling out all the stops on passenger information before the Olympics Radio audiences: France Inter remains firmly in the lead, Europe 1 continues its rise

Radio audiences: France Inter remains firmly in the lead, Europe 1 continues its rise Russian cyberattacks pose a global “threat”, Google warns

Russian cyberattacks pose a global “threat”, Google warns A new Lennon-McCartney duo, more than 50 years after the Beatles split

A new Lennon-McCartney duo, more than 50 years after the Beatles split The Curse vs Immaculée: two thrillers but only one plot

The Curse vs Immaculée: two thrillers but only one plot Mathieu Kassovitz adapts The Beast is Dead!, the comic book about the Second World War and the Occupation by Calvo

Mathieu Kassovitz adapts The Beast is Dead!, the comic book about the Second World War and the Occupation by Calvo Goldorak 'has never lived so much as now'

Goldorak 'has never lived so much as now' Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy During the night of the economy, the right points out the budgetary flaws of the macronie

During the night of the economy, the right points out the budgetary flaws of the macronie Europeans: Glucksmann denounces “Emmanuel Macron’s failure” in the face of Bardella’s success

Europeans: Glucksmann denounces “Emmanuel Macron’s failure” in the face of Bardella’s success These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Champions League: semi-final schedule revealed

Champions League: semi-final schedule revealed Serie A: AS Roma extends Daniele De Rossi

Serie A: AS Roma extends Daniele De Rossi Ligue 1: hard blow for Monaco with Golovin’s premature end to the season

Ligue 1: hard blow for Monaco with Golovin’s premature end to the season Paris 2024 Olympics: two French people deprived of the Olympic Games because of a calculation error by the international federation?

Paris 2024 Olympics: two French people deprived of the Olympic Games because of a calculation error by the international federation?