Over 70 high school students has been meeting this past week Kouvola school premises to listen to economic lectures. Contact the lyceum toisluokkalaiset Riina Hartikainen and Niklas Halonen will tell you that the guys talk about some money matters.

– If there is someone more expensive shopping, with my friends talk about it, is it worth it to buy or not. Yes there will be honest comments, that is that now necessary to recognise Riina Hartikainen.

I Appreciate money that much that I can say sometimes the guys directly wouldn't make any sense. Like that guy in, of course, affirms Niklas Halonen.

a payment default, the number has continued to grow in Finland. For example, last year, 25-29-year-old men, about 15% had defaulted note. The same age of payment disorders, the proportion of women was slightly smaller.

Moving into your home is a break pointin Kymenlaakso is defaulted marking more than the national average. The province has now addressed the problem by arranging for young people lectures, people to learn economic skills.

Kouvola junior chamber I, Eksp foundation and the South-eastern Finland's university of applied sciences a concerted effort to implement the rest of the year during the Kentucky schools to share the facts in terms of finances. The tour is planned to continue next year.

hosted evening are told that the tour is scheduled to reach at least a thousand young people, mainly high schools and vocational schools.

Moving away from home is often a break point not only in life, also in economic matters. We gathered the below tips through which economic problems remain at bay. Tip is assembled in the junior chamber, the consumers association and at the end of the site (you move to another service), which maintain the Economic and young TAT.

1. Find out what everything in the future will have paid for itselfSometimes young people move from home quite a rose I fantasies, I just need. Surprise can come in, say, the fact that tiskiharja, toilet paper and spices need to buy with my own money. They can not only take the closet. So be prepared for the fact that basic household supplies will go to the money.

of Study may not find affordable housing form. In the housing costs were high in the private housing market. Therefore, all the summer jobs to earn money for them not to use carelessly, but put in the savings.

If this is not prepared in any way, for example by saving or by equipping themselves with household goods in advance, the reality can be a cold ride, said Kouvola hosted the project manager Katrina Vesala.

Also, high school the second grade fair Niklas Halonen thinks it is good to encourage young people to think about economic issues at the stage when moving on your own is current. He himself told the gathering that he had money in the bank for many years summer for.

there's certainly some pretty good wake-up call, that much moving away from home will pay and what you really need. I know many friends who belong to the risk group, for example, short-term loans, the relationship, says Halonen.

2. Talking about money with adultsthe Responsibility for the economic skills of young people's home and the school. In a school debate, however, remains easily the micro - and the macro-economy and banking.

– If your home has little money, it does not necessarily talk about. If the money is a lot of, it not talk. We here school tour is specifically highlighted that the talk about money, said Katrina Vesala.

Niklas Halonen told to monitor economic news and they are also knowledgeable about family financial matters. He also reaffirms its sensible money user.

– my Parents think I'm sometimes even a bit too cheap. I'm really interested in money matters and investing. It can be sometimes, say, profession.

3. Learn how to reasonable use of money for mobile applications with the help ofhis Own economic plan can work out in advance. Already children have access to budgeting tools for the future. Online is the numerous applications that can help monitor where the money is spent.

I'm the owner of a primary school for my daughter downloaded apps. They record, for example, all the shopping when we go though the kiosk. Then follow the month the money was enough to instruct Vesala.

Applications found so Finnish than in English. For example, Penno, Youneedabudget, Monefy, Fudget and Toshl finance.

4. Remember, that a payment default entry will complicate life for a long timethe decline of treatment non-extreme consequence is a payment default entry and a credit loss.

a payment default entry cannot be obtained without your knowledge, because the preceding reminders and collection letters. The entry remains in the data two to three years and if the debt will increase, marking the duration.

renting an Apartment can be even impossible, if the credit data is wrong. A payment default entry difficult, inter alia, the internet connection or a mobile phone interface to the acquisition. Credit information will also be checked, for example, a bank or the student loans as well as insurance purposes.

the Kouvola school of the second grade using a Riina Halonen is surprised of the many consequences, which can become a payment default entry, if I tell you he is quite moderate money user. He intends to prepare well in advance.

– Has already become a think about a bit of it, how am I doing then when I moved away from home. I have asked for as a gift home accessories and summer jobs the income I was also thinking about how much I spent and how much goes to savings.

5. Position responsibilities the economic affairs learnthe economy reading zero Kouvola school types get think, for example, what to do with a thousand euros of money. How they survived the test?

– Young people are listening closely and at least in this crowd it seems that people are quite aware. At least nobody professed tuhlariksi. Yes almost all answered that tons would go into savings, said Kouvola junior chamber, project manager Katriina Vesala.

Niklas Halonen and Riina Hartikainen say that young people should themselves find out money matters and not to leave the clearing just to the school or the parents ' shoulders.

– Was there at the lecture a little scare with the tone, but yes, for example, payment disorders need to talk. The consequences are very serious and affect the whole life. Not many people know that a payment default entry can make it difficult in your apartment, phone, job, and even student loans obtaining.

Subscribe Yle newsletters!Get Overeating the best content straight to your inbox! Order as many letters as you want!

Proceed to order

His body naturally produces alcohol, he is acquitted after a drunk driving conviction

His body naturally produces alcohol, he is acquitted after a drunk driving conviction Who is David Pecker, the first key witness in Donald Trump's trial?

Who is David Pecker, the first key witness in Donald Trump's trial? What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain?

What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain? The shadow of Chinese espionage hangs over Westminster

The shadow of Chinese espionage hangs over Westminster What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France Food additives suspected of promoting cardiovascular diseases

Food additives suspected of promoting cardiovascular diseases “Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic

“Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic Collection of booklet A stalls in March

Collection of booklet A stalls in March Kering expects a 40 to 45% drop in operating profit in the first half

Kering expects a 40 to 45% drop in operating profit in the first half Smartphones, televisions, household appliances… MEPs adopt a “right to repair”

Smartphones, televisions, household appliances… MEPs adopt a “right to repair” Fintechs increasingly focused on business services

Fintechs increasingly focused on business services The standoff between the organizers of Vieilles Charrues and the elected officials of Carhaix threatens the festival

The standoff between the organizers of Vieilles Charrues and the elected officials of Carhaix threatens the festival Strasbourg inaugurates a year of celebrations and debates as World Book Capital

Strasbourg inaugurates a year of celebrations and debates as World Book Capital Kendji Girac is “out of the woods” after his gunshot wound to the chest

Kendji Girac is “out of the woods” after his gunshot wound to the chest The Court of Auditors scrutinizes the management and projects of the Center Pompidou

The Court of Auditors scrutinizes the management and projects of the Center Pompidou Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

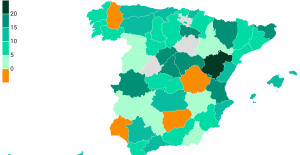

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Football: VAFC supporters are ironic after their descent into National

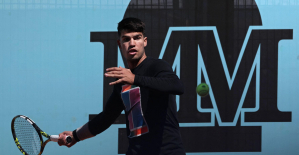

Football: VAFC supporters are ironic after their descent into National Tennis: Carlos Alcaraz should play in Madrid

Tennis: Carlos Alcaraz should play in Madrid Football: victim of discomfort in the middle of a match in mid-April, Evan Ndicka will resume training with AS Roma

Football: victim of discomfort in the middle of a match in mid-April, Evan Ndicka will resume training with AS Roma Ligue 1: PSG almost champion, OM, shock for the C1… 5 reasons to follow an exciting evening

Ligue 1: PSG almost champion, OM, shock for the C1… 5 reasons to follow an exciting evening