In the interannual rate, the number of mortgages signed on homes increased by 9.3% last November, although it moderated four points compared to the October rate. This is clear from the latest data published today by the National Institute of Statistics (INE) which also show that, despite the fact that the granting of mortgages stopped, the best month of November since 2010 closed - when more than 39,600 mortgages were signed -.

"Although the data continues to be very bulky, the result of the haste of citizens to overcome the tightening of loans, the percentage increase is slowly slowing down," explains María Matos, director of Studies at Fotocasa.

Ferran Font, director of Pisos.com Studies, also agrees with this analysis, who explains that "symptoms of slowdown are consolidating although record values are still being recorded."

Juan Villén, general director of Idealista Mortgages, assures that "the data for November reflect the reality of the end of the summer and do not show the slowdown that we already know has occurred in October and November (according to the data advanced by the Notaries), due to so we will surely see worse data in the coming months".

The average amount of mortgages constituted on homes rose by 5.8% year-on-year in the penultimate month of last year, to 147,673 euros, while the capital lent grew by 15.6%, to 5,804.1 million euros.

The slowdown in the signing of mortgages is evident when analyzing the evolution compared to the previous month. In fact, home mortgages fell 4.2% in November compared to October and borrowed capital fell 5.5%. In both cases they are their biggest setbacks in a month of November in the last five years.

By autonomous communities, those that registered the highest number of mortgages constituted on homes in November 2022 were Andalucía (8,271), Cataluña (6,947) and Madrid (6,640).

Where more capital was lent for the constitution of mortgages on homes was in Madrid (1,433.8 million euros), Catalonia (1,177.4 million) and Andalusia (1,041.6 million).

In thirteen communities, more home mortgages were signed last November than in the same month of 2021 and four registered year-on-year decreases: Castilla-La Mancha (-10.1%), Cantabria (-9.4%), Castilla and León (-8.7%) and the Basque Country (-5.3%).

On the other hand, the greatest increases occurred in La Rioja (41.3%), Extremadura (36%) and the Canary Islands (35.2%), while the most moderate advances were experienced by Navarra (0.3%) and Galician (1.7%).

In the first eleven months of 2022, the number of mortgages to buy a home increased by 12.6%, while the capital lent rose by 19.7%.

Experts say that the ECB's policy change can already be seen in the rates that were negotiated in November.

In November 2022, the average interest rate for all mortgage loans stood at 2.73%, with an average term of 24 years. In the case of homes, the average interest was 2.55%, the highest since February 2020 and slightly higher than the 2.54% of a year earlier, with an average term of 25 years.

In addition, the average interest rate at the beginning was 2.12% for variable-rate home mortgages and 2.80% in the case of fixed-rate ones.

"The ECB rate increase policy is clearly visible in this statistic, increasing the average interest rate at the beginning of the mortgage to 2.55%, a value not seen for a year; this increase is transferred to variable interest and especially the fixed rate and, as a consequence, fewer and fewer fixed-rate mortgages are being granted", explains Font.

34.6% of home mortgages were established last November at a variable rate, while 65.4% were signed at a fixed rate, the lowest percentage since June 2021.

In Matos' opinion, these data do show "a very clear change in the cycle, since at the moment 65% are fixed, compared to the 75% that was reached in April; this figure has been decreasing due to the change in banking conditions.

The number of mortgages on rural and urban properties (the latter include homes) increased by 4.2% in November 2022 compared to the same month in 2021, up to a total of 51,459 loans.

The capital of the mortgage loans granted increased by 11.9% in the penultimate month of last year, to exceed 8,103 million euros, while the average amount of the mortgages constituted on the total number of properties rose by 7.4% and added 157,476 euros.

Last November, a total of 10,760 mortgages changed their conditions, a figure 47.7% lower than that of the same month of 2021.

Considering the type of change in the conditions, there were 8,839 novations (or modifications produced with the same financial entity), with an annual decrease of 49%.

The number of operations that changed entities (subrogations to the creditor) was 1,514, 39.3% less than in November 2021. For its part, in 407 mortgages the owner of the mortgaged asset changed (subrogations to the debtor), 44 .6% less than a year before.

Of the 10,760 mortgages with changes in their conditions, 34.8% are due to changes in interest rates. After the change in conditions, the percentage of fixed interest mortgages increased from 16.3% to 51.2%, while that of variable interest mortgages decreased from 87.7% to 47%.

The Euribor is the rate to which the highest percentage of variable-rate mortgages refer, both before the change (76%) and after (43.3%).

After the modification of conditions, the average interest on loans on fixed-rate mortgages fell one point and that of variable-rate mortgages dropped four tenths.

Torrential rains in Dubai: “The event is so intense that we cannot find analogues in our databases”

Torrential rains in Dubai: “The event is so intense that we cannot find analogues in our databases” Rishi Sunak wants a tobacco-free UK

Rishi Sunak wants a tobacco-free UK In Africa, the number of millionaires will boom over the next ten years

In Africa, the number of millionaires will boom over the next ten years Iran's attack on Israel: these false, misleading images spreading on social networks

Iran's attack on Israel: these false, misleading images spreading on social networks New generation mosquito nets prove much more effective against malaria

New generation mosquito nets prove much more effective against malaria Covid-19: everything you need to know about the new vaccination campaign which is starting

Covid-19: everything you need to know about the new vaccination campaign which is starting The best laptops of the moment boast artificial intelligence

The best laptops of the moment boast artificial intelligence Amazon invests 700 million in robotizing its warehouses in Europe

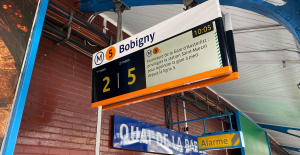

Amazon invests 700 million in robotizing its warehouses in Europe Switch or signaling breakdown, operating incident or catenaries... Do you speak the language of RATP and SNCF?

Switch or signaling breakdown, operating incident or catenaries... Do you speak the language of RATP and SNCF? Transport in Île-de-France: operators are pulling out all the stops on passenger information before the Olympics

Transport in Île-de-France: operators are pulling out all the stops on passenger information before the Olympics Radio audiences: France Inter remains firmly in the lead, Europe 1 continues its rise

Radio audiences: France Inter remains firmly in the lead, Europe 1 continues its rise Russian cyberattacks pose a global “threat”, Google warns

Russian cyberattacks pose a global “threat”, Google warns A new Lennon-McCartney duo, more than 50 years after the Beatles split

A new Lennon-McCartney duo, more than 50 years after the Beatles split The Curse vs Immaculée: two thrillers but only one plot

The Curse vs Immaculée: two thrillers but only one plot Mathieu Kassovitz adapts The Beast is Dead!, the comic book about the Second World War and the Occupation by Calvo

Mathieu Kassovitz adapts The Beast is Dead!, the comic book about the Second World War and the Occupation by Calvo Goldorak 'has never lived so much as now'

Goldorak 'has never lived so much as now' Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy During the night of the economy, the right points out the budgetary flaws of the macronie

During the night of the economy, the right points out the budgetary flaws of the macronie Europeans: Glucksmann denounces “Emmanuel Macron’s failure” in the face of Bardella’s success

Europeans: Glucksmann denounces “Emmanuel Macron’s failure” in the face of Bardella’s success These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Champions League: semi-final schedule revealed

Champions League: semi-final schedule revealed Serie A: AS Roma extends Daniele De Rossi

Serie A: AS Roma extends Daniele De Rossi Ligue 1: hard blow for Monaco with Golovin’s premature end to the season

Ligue 1: hard blow for Monaco with Golovin’s premature end to the season Paris 2024 Olympics: two French people deprived of the Olympic Games because of a calculation error by the international federation?

Paris 2024 Olympics: two French people deprived of the Olympic Games because of a calculation error by the international federation?