It was well seen when the Rune Mai and his growing team of employees in 2015 made a significant shift with økonomiappen Spiir.

at that Time, the young danes and their money made to the area of focus for the company, which soon rounds 300,000 users. And it is a focus that has created success for both the Spiir and the app's users.

– public attitudes to young people was that they are careless and smoking out over the edge financially with consumer loans and unmanageable debt. It was about to impose on young people that they must stay on a stone, because they did the absolutely not. But is it really this way, reads the question from the Rune Mai, who since 2010 has been at the forefront of the digital service.

Close to Iran's young blærerøve: Boasting with luxury-toys, tight skin and binge drinking

the Answer is according to him quite another.

- It's all the more that when you are exposed to a great deal of social pressure, so it is difficult to make the right decisions, because you do not have a financial overview.

And the lack of overview was already in 2010 the idea behind the company, as the Danish Bank and a Norwegian DNB last year chose to invest tens of millions of dollars in. They believe so much in the idea of Spiir, that they would like to sit at the table, where the next ideas are born.

There are still red numbers in the Rune Mai's Spiir, but the hope he may soon change. Photo: Gregers Tycho

the Users of the Spiir can choose to put their transactions into the app, but they can also link data from their bank accounts in several banks directly, together with the app.

- So, the data will be analyzed and gathered into categories. Then you can put personal forbrugsmål for, how much you will use in the course of a week or month, explains Rune Mai.

- do you buy coffee every day? Or will you save on the coffee, and instead to Roskilde Festival? The idea is that each update in the Spiir counts as a nudge in the direction of that you will become more financially aware.

- If you need to make decisions about your priorities from your money, you must also know how you spend your money. And it was difficult in the past, he believes.

How it works

It is free to use Spiir, and all data you share with the service is kept completely private and cannot be viewed by others without user consent.

According to the Spiir decreases the consumption of luxury goods, typically with 10 percent of those who have used the service in three months.

You can find Spiir for Apple's mobile devices here and for Android here.

so far Spiir even red numbers on the bottom line, but the Rune Mai is not in doubt that they may be black.

the Money comes today from the services offered by other companies against payment is based, in cooperation with Spiir. But also from a focused marketplace, where selected digital partners get access to give users some really good offers.

- We are at the same time started to build a fordelsklub for Spiir-users and already offers now a cheap digital insurance.

His body naturally produces alcohol, he is acquitted after a drunk driving conviction

His body naturally produces alcohol, he is acquitted after a drunk driving conviction Who is David Pecker, the first key witness in Donald Trump's trial?

Who is David Pecker, the first key witness in Donald Trump's trial? What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain?

What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain? The shadow of Chinese espionage hangs over Westminster

The shadow of Chinese espionage hangs over Westminster What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France Food additives suspected of promoting cardiovascular diseases

Food additives suspected of promoting cardiovascular diseases “Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic

“Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic Collection of booklet A stalls in March

Collection of booklet A stalls in March Kering expects a 40 to 45% drop in operating profit in the first half

Kering expects a 40 to 45% drop in operating profit in the first half Smartphones, televisions, household appliances… MEPs adopt a “right to repair”

Smartphones, televisions, household appliances… MEPs adopt a “right to repair” Fintechs increasingly focused on business services

Fintechs increasingly focused on business services The standoff between the organizers of Vieilles Charrues and the elected officials of Carhaix threatens the festival

The standoff between the organizers of Vieilles Charrues and the elected officials of Carhaix threatens the festival Strasbourg inaugurates a year of celebrations and debates as World Book Capital

Strasbourg inaugurates a year of celebrations and debates as World Book Capital Kendji Girac is “out of the woods” after his gunshot wound to the chest

Kendji Girac is “out of the woods” after his gunshot wound to the chest The Court of Auditors scrutinizes the management and projects of the Center Pompidou

The Court of Auditors scrutinizes the management and projects of the Center Pompidou Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

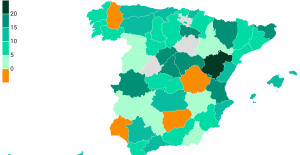

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Football: VAFC supporters are ironic after their descent into National

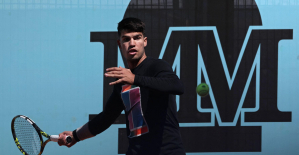

Football: VAFC supporters are ironic after their descent into National Tennis: Carlos Alcaraz should play in Madrid

Tennis: Carlos Alcaraz should play in Madrid Football: victim of discomfort in the middle of a match in mid-April, Evan Ndicka will resume training with AS Roma

Football: victim of discomfort in the middle of a match in mid-April, Evan Ndicka will resume training with AS Roma Ligue 1: PSG almost champion, OM, shock for the C1… 5 reasons to follow an exciting evening

Ligue 1: PSG almost champion, OM, shock for the C1… 5 reasons to follow an exciting evening