The chief executive revealed to EXPANSIÓN that the entity will increase its sustainable credit plan and will create another division as a "bank for entrepreneurs".

Interviewing Carlos Torres (Salamanca, 1966) is a luxury for the interviewer. The president of BBVA neither shuns questions nor vetoes them in advance, even if some are compromised.

And in case the interlocutor is left with doubts, he didactically repeats the answer, explaining it patiently so that in a few minutes, the essence of a world as complex as the financial system is grasped.

How can banking contribute to the global transformation that is expected... Simple. "BBVA is the protagonist of the two trends that define the future: innovation and sustainability," he explains in a meeting with EXPANSIÓN at the World Economic Forum, in the Swiss town of Davos.

It is the only interview with a Spanish media at Davos 2022, an event that brings together more than 2,000 international political and business leaders, including Torres, who has participated in various presentations.

"We are experiencing an unprecedented wave of disruption thanks to technologies such as robotics, quantum computing, blockchain or artificial intelligence, and I believe that all of them are a source of opportunities for everyone," he says.

"In this context, we want to go further to decisively support the companies that are defining the future. To do this, we have created a new unit, called Banking for Growth Companies", as a "bank for entrepreneurs".

It was born to "be the bank for high-growth companies that are developing business models based on technology." These young companies "need financing, but also advice and adapted solutions, and BBVA wants to be by their side at all times". Torres prefers to use the term entrepreneurs instead of start up, "more limiting." "They can be start-ups or companies that need to grow."

How will it work? "Changing financial parameters". Until now, whether or not a company gets credits is based on parameters such as results. "With Banking for Growth Companies, the variable could be the sales forecast," explains Torres.

"This is a natural step after our firm commitment to innovation for years, a strategy that has been reaffirmed by the accelerated adoption of digitization during the pandemic.

We have done this through internal developments and also with direct investments in purely digital banks, such as Atom Bank in the United Kingdom, Solarisbank in Germany, or Neon in Brazil; or through leading venture capital vehicles, such as Propel, Lowercarbon, Leadwind or Sinovation Ventures". The other big disruption is "in the field of sustainability and climate change".

The financing necessary to decarbonize the planet is historic, "of a magnitude never seen before," says the head of BBVA. "Our role begins with financing and advice. At BBVA, we are fully committed to it."

Green financing, or more broadly "sustainable", to also include other social components, has been growing like a soufflé. In total, since "since 2018, we have already channeled 97,000 million in sustainable financing, of the 200,000 million euros that we had set ourselves as a goal until 2025."

"Although a few months ago we doubled this objective, which was initially 100,000 million, taking into account the evolution, it is possible that we will revise it upwards again." In the first quarter alone, 11,000 million have been covered, that is, a third of everything that was given in 2021.

Torres, who was a senior manager at Endesa, and continues to have the "soul" of an electrical engineer, has perfectly understood the enormous business that financing the energy transition will entail, especially in Spain.

"In the current context and especially in the energy field, Spain has a great growth opportunity" due to its "meteorological and geographical" characteristics, he comments.

"The sun and the wind are the new oil, and we have a lot of both. Spain can be an exporter of energy to Europe." Renewables, electrification and energy efficiency "are areas where we have proven and profitable technologies, we must remove barriers to their deployment."

In sectors like this, "the role of the authorities is key to boosting the economy, generating confidence, with a stable legal framework and with adequate incentives to promote private investment." "Spanish banks are prepared to support companies and work in coordination with public authorities in the transition towards an emission-free, more sustainable and inclusive economy."

His body naturally produces alcohol, he is acquitted after a drunk driving conviction

His body naturally produces alcohol, he is acquitted after a drunk driving conviction Who is David Pecker, the first key witness in Donald Trump's trial?

Who is David Pecker, the first key witness in Donald Trump's trial? What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain?

What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain? The shadow of Chinese espionage hangs over Westminster

The shadow of Chinese espionage hangs over Westminster Colorectal cancer: what to watch out for in those under 50

Colorectal cancer: what to watch out for in those under 50 H5N1 virus: traces detected in pasteurized milk in the United States

H5N1 virus: traces detected in pasteurized milk in the United States What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France The right deplores a “dismal agreement” on the end of careers at the SNCF

The right deplores a “dismal agreement” on the end of careers at the SNCF The United States pushes TikTok towards the exit

The United States pushes TikTok towards the exit Air traffic controllers strike: 75% of flights canceled at Orly on Thursday, 65% at Roissy and Marseille

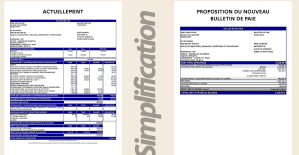

Air traffic controllers strike: 75% of flights canceled at Orly on Thursday, 65% at Roissy and Marseille This is what your pay slip could look like tomorrow according to Bruno Le Maire

This is what your pay slip could look like tomorrow according to Bruno Le Maire Sky Dome 2123, Challengers, Back to Black... Films to watch or avoid this week

Sky Dome 2123, Challengers, Back to Black... Films to watch or avoid this week The standoff between the organizers of Vieilles Charrues and the elected officials of Carhaix threatens the festival

The standoff between the organizers of Vieilles Charrues and the elected officials of Carhaix threatens the festival Strasbourg inaugurates a year of celebrations and debates as World Book Capital

Strasbourg inaugurates a year of celebrations and debates as World Book Capital Kendji Girac is “out of the woods” after his gunshot wound to the chest

Kendji Girac is “out of the woods” after his gunshot wound to the chest Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar NBA: the Wolves escape against the Suns, Indiana unfolds and the Clippers defeated

NBA: the Wolves escape against the Suns, Indiana unfolds and the Clippers defeated Real Madrid: what position will Mbappé play? The answer is known

Real Madrid: what position will Mbappé play? The answer is known Cycling: Quintana will appear at the Giro

Cycling: Quintana will appear at the Giro Premier League: “The team has given up”, notes Mauricio Pochettino after Arsenal’s card

Premier League: “The team has given up”, notes Mauricio Pochettino after Arsenal’s card