This is a consecration for the strategy pursued for years by the Ticket Restaurant issuer. This ex-subsidiary of Accor has been listed on the stock market since 2010. It has just entered the CAC 40. Already a member of the CAC 40 ESG since September 2022, the value had been expected for a while to integrate the stock market's flagship index. from Paris.

"If that hadn't happened, life would have gone on," says Bertrand Dumazy, CEO of Edenred. Joining the CAC 40 is a source of pride for Edenred and its 12,000 employees. It is also a source of pride for France. The restaurant voucher is a French idea, which has irrigated the whole world. Even if we only generate 16% of turnover in France, Edenred is a French success story. Our story is one of international development and successful digitization”.

Even today, Edenred is best known for its Ticket Restaurant. However, the company has expanded its offer to many other services in recent years, to the point that its flagship product now represents only 44% of turnover.

Present in 45 countries, Edenred has focused on three main product lines: employee benefits (Ticket Restaurant, Kadéos gift card, payment of expenses in the context of teleworking, etc.), professional mobility solutions (Ticket Mobility for tolls, fuel, car parks, etc. and intercompany payments. A winning strategy.

Claiming a leadership position in most of its activities, the former Accor Services now has 52 million users, via 1 million corporate clients and 2 million merchants and restaurateurs. Since 2016 (year of arrival of Bertrand Dumazy at the head of the group), the turnover has been multiplied by two, to 2 billion euros. The net result has also doubled, while the market capitalization has increased almost fourfold, to more than 15 billion euros. This is almost as much as Sodexo, which has just cut itself in half, in order to in turn better promote its employee benefits and rewards activity. It is also much more than its former parent company Accor, which is worth 8.6 billion euros on the stock market.

“From a company that issued paper, we have become a digital company, adds Bertrand Dumazy. Edenred has been able to adapt to a changing world. We were pioneers in the arrival of the card and now in mobile payment”.

Edenred's latest acquisition - the largest in its history - is a perfect illustration of this. For 1.3 billion euros, the group has just acquired the British start-up Reward Gateway, which has developed a service platform for companies that recruit and seek to motivate their teams (reductions on leisure and sports halls, rewards in gift vouchers, psychological assistance, etc.).

By being a member of the CAC 40, Edenred is stepping into the limelight. The start of a new adventure. “Constraint creates talent. We will be keen to do even better,” promises Bertrand Dumazy.

Torrential rains in Dubai: “The event is so intense that we cannot find analogues in our databases”

Torrential rains in Dubai: “The event is so intense that we cannot find analogues in our databases” Rishi Sunak wants a tobacco-free UK

Rishi Sunak wants a tobacco-free UK In Africa, the number of millionaires will boom over the next ten years

In Africa, the number of millionaires will boom over the next ten years Iran's attack on Israel: these false, misleading images spreading on social networks

Iran's attack on Israel: these false, misleading images spreading on social networks New generation mosquito nets prove much more effective against malaria

New generation mosquito nets prove much more effective against malaria Covid-19: everything you need to know about the new vaccination campaign which is starting

Covid-19: everything you need to know about the new vaccination campaign which is starting The best laptops of the moment boast artificial intelligence

The best laptops of the moment boast artificial intelligence Amazon invests 700 million in robotizing its warehouses in Europe

Amazon invests 700 million in robotizing its warehouses in Europe Switch or signaling breakdown, operating incident or catenaries... Do you speak the language of RATP and SNCF?

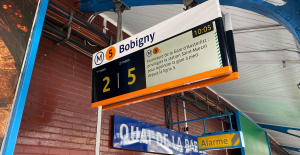

Switch or signaling breakdown, operating incident or catenaries... Do you speak the language of RATP and SNCF? Transport in Île-de-France: operators are pulling out all the stops on passenger information before the Olympics

Transport in Île-de-France: operators are pulling out all the stops on passenger information before the Olympics Radio audiences: France Inter remains firmly in the lead, Europe 1 continues its rise

Radio audiences: France Inter remains firmly in the lead, Europe 1 continues its rise Russian cyberattacks pose a global “threat”, Google warns

Russian cyberattacks pose a global “threat”, Google warns A new Lennon-McCartney duo, more than 50 years after the Beatles split

A new Lennon-McCartney duo, more than 50 years after the Beatles split The Curse vs Immaculée: two thrillers but only one plot

The Curse vs Immaculée: two thrillers but only one plot Mathieu Kassovitz adapts The Beast is Dead!, the comic book about the Second World War and the Occupation by Calvo

Mathieu Kassovitz adapts The Beast is Dead!, the comic book about the Second World War and the Occupation by Calvo Goldorak 'has never lived so much as now'

Goldorak 'has never lived so much as now' Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy During the night of the economy, the right points out the budgetary flaws of the macronie

During the night of the economy, the right points out the budgetary flaws of the macronie Europeans: Glucksmann denounces “Emmanuel Macron’s failure” in the face of Bardella’s success

Europeans: Glucksmann denounces “Emmanuel Macron’s failure” in the face of Bardella’s success These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Champions League: semi-final schedule revealed

Champions League: semi-final schedule revealed Serie A: AS Roma extends Daniele De Rossi

Serie A: AS Roma extends Daniele De Rossi Ligue 1: hard blow for Monaco with Golovin’s premature end to the season

Ligue 1: hard blow for Monaco with Golovin’s premature end to the season Paris 2024 Olympics: two French people deprived of the Olympic Games because of a calculation error by the international federation?

Paris 2024 Olympics: two French people deprived of the Olympic Games because of a calculation error by the international federation?