The Ministry of Economy and Finance welcomed on Wednesday the development of the Retirement Savings Plan (PER), a funded retirement product resulting from the 2019 Pacte law, which totals 7 million customers and 80 billion euros. outstanding at the end of 2022. "The PER reform (...) is a great success: we have more than doubled our PER distribution target at the end of 2022, with more than 7 million French people equipped", welcomed Bruno Le Maire, quoted in a press release. Bercy initially had a target of 3 million subscribers by the end of 2022.

The outstanding amount, which was to reach 50 billion euros on this date, is also higher than expected, according to the ministry. This dynamic "concerns both corporate, collective (more than 19 billion euros in outstandings) and mandatory (more than 12 billion euros in outstandings) PERs, as well as individual PERs (more than 49 billion euros in outstandings and more than 3 million holders)”, he explains.

The PER is a "tunnel" product, which is envisaged over the long term. Payments are free but will not be recoverable before retirement age, except in exceptional cases such as the purchase of a principal residence or well-defined "accidents of life": disability, over-indebtedness, expiry of insurance rights unemployment…

At the time of retirement, two options are possible: a capital exit, a real innovation of this product compared to its ancestors PERP and Madelin contracts but highly taxed, or an exit spread over time, as an annuity. Most of the management of PERs is delegated to insurers. The younger the client, the riskier the investments: before the age of 40, the payments are invested almost entirely in units of account (UA), i.e. riskier investments but potentially more profitable in good years.

The blocking of funds over the very long term and the large share of investments more subject to the vagaries of the markets, which also generate commissions, above all make PER a godsend for insurers. Reflecting the “new expectations of the French”, according to the managing director of France insurers Franck Le Vallois, the PER also benefited from concerns around the pension system, opening a way for supporters of a dose of capitalization.

After 13 years of mission and seven successive leaders, the UN at an impasse in Libya

After 13 years of mission and seven successive leaders, the UN at an impasse in Libya Germany: search of AfD headquarters in Lower Saxony, amid accusations of embezzlement

Germany: search of AfD headquarters in Lower Saxony, amid accusations of embezzlement Faced with Iran, Israel plays appeasement and continues its shadow war

Faced with Iran, Israel plays appeasement and continues its shadow war Iran-Israel conflict: what we know about the events of the night after the explosions in Isfahan

Iran-Israel conflict: what we know about the events of the night after the explosions in Isfahan Sánchez condemns Iran's attack on Israel and calls for "containment" to avoid an escalation

Sánchez condemns Iran's attack on Israel and calls for "containment" to avoid an escalation China's GDP grows 5.3% in the first quarter, more than expected

China's GDP grows 5.3% in the first quarter, more than expected Alert on the return of whooping cough, a dangerous respiratory infection for babies

Alert on the return of whooping cough, a dangerous respiratory infection for babies Can relaxation, sophrology and meditation help with insomnia?

Can relaxation, sophrology and meditation help with insomnia? Vacation departures and returns: with the first crossovers, heavy traffic is expected this weekend

Vacation departures and returns: with the first crossovers, heavy traffic is expected this weekend “Têtu”, “Ideat”, “The Good Life”… The magazines of the I/O Media group resold to several buyers

“Têtu”, “Ideat”, “The Good Life”… The magazines of the I/O Media group resold to several buyers The A13 motorway closed in both directions for an “indefinite period” between Paris and Normandy

The A13 motorway closed in both directions for an “indefinite period” between Paris and Normandy The commitment to reduce taxes of 2 billion euros for households “will be kept”, assures Gabriel Attal

The commitment to reduce taxes of 2 billion euros for households “will be kept”, assures Gabriel Attal The exclusive Vespa that pays tribute to 140 years of Piaggio

The exclusive Vespa that pays tribute to 140 years of Piaggio Kingdom of the great maxi scooters: few and Kymco wants the crown of the Yamaha TMax

Kingdom of the great maxi scooters: few and Kymco wants the crown of the Yamaha TMax A complaint filed against Kanye West, accused of hitting an individual who had just attacked his wife

A complaint filed against Kanye West, accused of hitting an individual who had just attacked his wife In Béarn, a call for donations to renovate the house of Henri IV's mother

In Béarn, a call for donations to renovate the house of Henri IV's mother Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

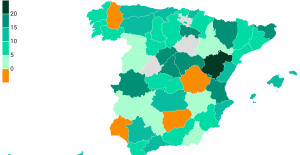

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy During the night of the economy, the right points out the budgetary flaws of the macronie

During the night of the economy, the right points out the budgetary flaws of the macronie These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Rally: Neuville and Evans neck and neck after the first day in Croatia

Rally: Neuville and Evans neck and neck after the first day in Croatia Gymnastics: after Rio and Tokyo, Frenchman Samir Aït Saïd qualified for the Paris 2024 Olympics

Gymnastics: after Rio and Tokyo, Frenchman Samir Aït Saïd qualified for the Paris 2024 Olympics Top 14: in the fight for maintenance, Perpignan has the wind at its back

Top 14: in the fight for maintenance, Perpignan has the wind at its back Top 14: Toulon-Toulouse, a necessarily special reunion for Melvyn Jaminet

Top 14: Toulon-Toulouse, a necessarily special reunion for Melvyn Jaminet