The boom in consumer subscriptions during the pandemic could suffer as the cost-of-living crisis deepens and regulators take action.

I recently canceled a streaming service. Well I tried. My first try couldn't get past the repeated offers and "are you sure?" prompts. along the process. My prescription package arrives much less frequently. I've canceled one beauty subscription and downgraded another. I've given up shipments of kitchen towels because do I really need more? I have had numerous frictions managing the various subscriptions that are part of our daily lives.

I am a walking economic stereotype, one increasingly in the crosshairs of global regulators. The "subscription economy" is facing its first serious crisis. The rush of companies offering consumers subscription services or products began around 2011, led by streaming music and TV services, and quickly followed by boxes of beauty products, clothing, organic coffee, craft beer, food for pets and much more.

For consumers, the appeal was convenience or the ability to try new things, without the need to do any research. For the companies, entrepreneurs, and venture capitalists that jumped into this space, the hook was a more direct relationship with customers who were supposedly not only less price-sensitive, but also more open to buying more. stuff.

This is about to be put to the test. Netflix is the canary of this process. Its shares fell 40% last month as it warned its subscriber growth had reversed. Bland content and ruthless competition were two of the explanations. But data from Ampere Analysis suggests that the tightening of belts has played a role, as there is evidence that younger and lower-earning subscribers are leaving Netflix in greater numbers.

The spending audit will not end there. The Kantar Global Affairs Barometer found that almost 40% of households around the world plan to cut entertainment subscriptions this year. But a much larger number hope to cut back on luxuries, especially in markets where inflation is highest. This will cause customers to consider whether it offsets the implied convenience that some services offer: Meal kits, for example, are 60% to 140% more expensive than buying the ingredients separately or the meal prepared, according to Bernstein's analysis.

Post-pandemic, a lot can be eliminated: captive consumers, fear of going to stores and simple boredom favored a boom in subscriptions. Barclaycard estimated last year that 8 in 10 British households subscribed to at least one service, putting the average per household at seven in 2020. Zuora, a subscription management platform, found that the average number of subscriptions per person had increased between 2018 and 2020 in most world markets, with China in the lead. That growth was led by younger adults who were more willing to try new categories, Bernstein notes.

"Personally, I think there's a limit to the number of subscriptions one person can have," says Balderton's Suranga Chandratillake, who has backed established companies like Beauty Pie and Smol. "Things that are a bit superfluous will have to be removed... some [models] that were doing well in good times will have problems in the next couple of years."

The boom-time mindset may have given a technological sheen to companies that were subject to the same price, quality, and customer whim pressures as any other consumer goods business. "Investors have liked...the recurring income stream," explains another venture capitalist. "It looks like software as a service." Global venture investment in consumer subscription services doubled between 2016 and 2020, and did so again in 2021, according to data from Dealroom.

Meanwhile, regulators want to subject the economics of subscriptions to new rules, in ways that could further dent bullish assumptions about customer loyalty or the rate of free trials converting to paying customers. In the United States, where 84% of consumers underestimate what they spend on subscriptions each month, according to a 2018 study, efforts are being made to address so-called negative choices, such as renewing subscriptions without explicit consent.

The EU and the United Kingdom have focused on the asymmetries between the ease of subscribing and the difficulty of unsubscribing. The British government, which wants to create a reinforced consumer regulator with new powers to impose fines, calculates that unwanted subscription payments by consumers amount to 1,800 million pounds (2,120 million euros) a year, that is, about £60 per household. "It's inevitable that the environment will get tougher for these companies," says Ben Chivers, business partner at Travers Smith.

The answer to the question of how loyal a subscriber is is probably lower than previously thought.

© The Financial Times Limited [2021]. All rights reserved. FT and Financial Times are registered trademarks of Financial Times Limited. Redistribution, copying or modification is prohibited. EXPANSIÓN is solely responsible for this translation and Financial Times Limited is not responsible for its accuracy.

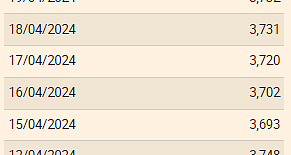

The Euribor today remains at 3.734%

The Euribor today remains at 3.734% Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday

Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations

New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations What is Akila, the mission in which the Charles de Gaulle is participating under NATO command?

What is Akila, the mission in which the Charles de Gaulle is participating under NATO command? What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France Food additives suspected of promoting cardiovascular diseases

Food additives suspected of promoting cardiovascular diseases “Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic

“Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic MEPs validate reform of EU budgetary rules

MEPs validate reform of EU budgetary rules “Public Transport Paris 2024”, the application for Olympic Games spectators, is available

“Public Transport Paris 2024”, the application for Olympic Games spectators, is available Spotify goes green in the first quarter and sees its number of paying subscribers increase

Spotify goes green in the first quarter and sees its number of paying subscribers increase Xavier Niel finalizes the sale of his shares in the Le Monde group to an independent fund

Xavier Niel finalizes the sale of his shares in the Le Monde group to an independent fund Owner of Blondie and Shakira catalogs in favor of $1.5 billion offer

Owner of Blondie and Shakira catalogs in favor of $1.5 billion offer Cher et Ozzy Osbourne rejoignent le Rock and Roll Hall of Fame

Cher et Ozzy Osbourne rejoignent le Rock and Roll Hall of Fame Three months before the Olympic Games, festivals and concert halls fear paying the price

Three months before the Olympic Games, festivals and concert halls fear paying the price With Brigitte Macron, Aya Nakamura sows new clues about her participation in the Olympics

With Brigitte Macron, Aya Nakamura sows new clues about her participation in the Olympics Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Serie A: Bologna surprises AS Rome in the race for the C1

Serie A: Bologna surprises AS Rome in the race for the C1 Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues?

Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues? Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby

Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season

Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season