Unexpected commission fees could make it a bad idea to keep an account that you don't use. The Organization of Consumers and Users (OCU) has the following five questions to help you make this decision.

One

Accounts may be cancelled at any time without notice. Legally, the entity must cancel it within 24 hours after we request.

2

There are no fees for cancelling an account, except if the contract has been in effect for less than six month. You may need to cancel your account if you have received any promotional offer for opening it (e.g., if they give you money or a TV ), they may require that you keep the account open for a minimum of six months. If you cancel your account before the deadline, you'll have to return at most a portion of the gift.

However, if you pay commissions in advance (for example, because they are annually), the bank will return the appropriate portion. This is what would happen to the credit card maintenance commissions.

3

It is not stated that cancellations must be made through a particular channel or in a particular branch. We know from experience that many consumers go to the closest office of the entity to cancel an account. However, they often find that the branch where the account was opened is referred to them.

The Bank of Spain states that entities must follow all orders from their clients. This is especially true when it concerns ending the contractual relationship between the parties. It considers it a bad practice to request cancellation of an account remotely. However, the contract does not typically require that cancellations be made in person.

4

You are not required to give the entity any payment instruments, except the cards and the check book, to close an account. OCU recommends that you send a request in writing. You can also use the checking account cancellation method.

We have seen that you don't have to cancel in person, except for a few cases.

You can request it online or remotely.

If you are unable to present the original deed in person, you can request that the branch return a sealed copy. This will be used as proof.

Many accounts have shared ownership. You should remember that all account holders must sign the request to close an account. If not, the request might be rejected.

5

These regulations permit entities to require their clients to maintain a current account for contracting or managing other products such as a term deposit, loan, or a loan. However, the following requirements must be met.

-The client was informed prior to contracting of the need to maintain a linked accounts, and its cost.

- The contract will contain the exact same information.

You can cancel the contract if this is not true.

After 13 years of mission and seven successive leaders, the UN at an impasse in Libya

After 13 years of mission and seven successive leaders, the UN at an impasse in Libya Germany: search of AfD headquarters in Lower Saxony, amid accusations of embezzlement

Germany: search of AfD headquarters in Lower Saxony, amid accusations of embezzlement Faced with Iran, Israel plays appeasement and continues its shadow war

Faced with Iran, Israel plays appeasement and continues its shadow war Iran-Israel conflict: what we know about the events of the night after the explosions in Isfahan

Iran-Israel conflict: what we know about the events of the night after the explosions in Isfahan “Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic

“Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic Sánchez condemns Iran's attack on Israel and calls for "containment" to avoid an escalation

Sánchez condemns Iran's attack on Israel and calls for "containment" to avoid an escalation China's GDP grows 5.3% in the first quarter, more than expected

China's GDP grows 5.3% in the first quarter, more than expected Alert on the return of whooping cough, a dangerous respiratory infection for babies

Alert on the return of whooping cough, a dangerous respiratory infection for babies Vacation departures and returns: with the first crossovers, heavy traffic is expected this weekend

Vacation departures and returns: with the first crossovers, heavy traffic is expected this weekend “Têtu”, “Ideat”, “The Good Life”… The magazines of the I/O Media group resold to several buyers

“Têtu”, “Ideat”, “The Good Life”… The magazines of the I/O Media group resold to several buyers The A13 motorway closed in both directions for an “indefinite period” between Paris and Normandy

The A13 motorway closed in both directions for an “indefinite period” between Paris and Normandy The commitment to reduce taxes of 2 billion euros for households “will be kept”, assures Gabriel Attal

The commitment to reduce taxes of 2 billion euros for households “will be kept”, assures Gabriel Attal The exclusive Vespa that pays tribute to 140 years of Piaggio

The exclusive Vespa that pays tribute to 140 years of Piaggio Kingdom of the great maxi scooters: few and Kymco wants the crown of the Yamaha TMax

Kingdom of the great maxi scooters: few and Kymco wants the crown of the Yamaha TMax A complaint filed against Kanye West, accused of hitting an individual who had just attacked his wife

A complaint filed against Kanye West, accused of hitting an individual who had just attacked his wife In Béarn, a call for donations to renovate the house of Henri IV's mother

In Béarn, a call for donations to renovate the house of Henri IV's mother Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

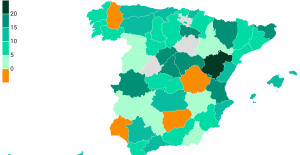

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy During the night of the economy, the right points out the budgetary flaws of the macronie

During the night of the economy, the right points out the budgetary flaws of the macronie These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Formula 1: Verstappen wins the sprint in China, Hamilton 2nd

Formula 1: Verstappen wins the sprint in China, Hamilton 2nd Rally: Neuville and Evans neck and neck after the first day in Croatia

Rally: Neuville and Evans neck and neck after the first day in Croatia Gymnastics: after Rio and Tokyo, Frenchman Samir Aït Saïd qualified for the Paris 2024 Olympics

Gymnastics: after Rio and Tokyo, Frenchman Samir Aït Saïd qualified for the Paris 2024 Olympics Top 14: in the fight for maintenance, Perpignan has the wind at its back

Top 14: in the fight for maintenance, Perpignan has the wind at its back