As a US citizen, sheltering a basic amenity comes at a cost; your mortgage. Most people have a monthly arrangement for paying their mortgage and quite a good number still pay via checks. This is the silicon age, and many inconvenient things have been made convenient over recent decades, so many payment methods have evolved. Paying on time keeps you in the right and helps prevent eviction. This article gives you an outline of the various common payment methods you can employ, along with their benefits and downsides. Equipped with this information, you can then proceed to choose the method of payment that fits your requirements best.

Internet Banking

This is a convenient option for you, as you can use your bank account directly or a mortgage lending arrangement if you have one. Users of internet banking have control over when payments will be made, an account of payment dates for record purposes, and a way to keep track of when future payments are to be made. The main benefit of this method is its convenience. In the comfort of your home, you can easily log in to your bank or lender’s website and make payments any time you want.

There is also the ability to set up automatic withdrawals for payment with your bank. This way, you don’t need to concern yourself, as they handle the payment and timing. The issue of security with internet banking comes into play. Internet hacking is always a risk for people who use the internet for transactions, so always ensure to take special care when entering passwords and sensitive information to avoid third-party meddling with your funds.

Setting Up Automatic Payment

This is a more convenient way by which you can pay your mortgage early. You don’t need to lay your hands on the money before it is withdrawn. Using your mortgage lender’s website, you can set this into motion: Your bank permits automatic withdrawals from your account to be transferred to your realistic loans lender. This is a good fit if you have a constant income source at a time of the month, say a check from the government or a paycheck. You do not need to sign into your bank or lender’s website.

The transfer automatically takes place, even when you are away from your computer or phone. The benefit is that you can control the amount you want withdrawn to fit into your budget. However, the risk of an overdraft is ever present. To prevent this, keep at least the amount to be withdrawn in your account at the time of withdrawal. Automatic payments also provide the avenue for making extra payments to permit settling mortgages early. Use this benefit, especially if you don’t plan on staying where you live for a long time.

Mortgage Payments Via Credit Card

Life happens and sometimes, situations beyond your control can arise. You might end up having no choice but to settle your mortgage payment via credit card. Using a credit card to settle bills like this can attract an appreciable fee. Not all credit card networks support payment of mortgages. And, in addition, some mortgage lenders do not accept them. These two factors can complicate matters, so before proceeding to use your credit card, find out the terms of your card company. Make sure they support mortgage payments before using them. A lot of people tend to think they would gain appreciable rewards when using credit cards. However, most times, the fees charged by the companies can be so high that they negate any reward you might have gained. Only use your credit card when you don’t have any other option; don’t make it a routine habit.

Mortgage Payments Via Your Mobile Phone

This is also a very convenient means by which you can make your payments. It eliminates the problem of missing deadlines and the need for paying online. You are called directly by the company for inquiries. By placing the required phone number on the bill, or when setting up a profile online, you can easily be contacted to give the necessary details for payment.

This procedure would generally follow the pattern of providing your account number for mortgage and details of your bank account; these details include your account and routing numbers. It is a fast method of payment and is convenient. If you use your mobile phone number, wherever you are, your payments can be made. Once you have your account details, you are good to go. However, the ease of use might attract a fee. It is, therefore, necessary to find out if any extra fees will be charged.

Mortgage Payments the Old School Way

A good number of people still prefer to make payments by mail or in person. This is a good fit for you if your mortgage lender is based in the same area or city as you are. A lot of lenders accept ‘in person’ payments. If you don’t want to carry cash around, you have the option of making a check payment or money order. The advantage of money orders lies in the fact that your sensitive details are not required, so they are secure.

They usually, however, have a limit to the amount that can be run through them. Because of this, big mortgage payments might not be able to use money orders. A good option to consider is to issue a cashier’s check, as this does not have a restriction on the amount that can be paid through them. The good old mailbox has been around for centuries and is an excellent way to send a check. When using mail, however, your mortgage account number should be indicated on the check, as this is payment protocol. Don’t just assume that your address would be cross-referenced with the check. Unlike online platforms that move at the speed of light, the mail would take some time to arrive at the company and get processed. Therefore, you should factor in this time to determine how early you should mail your check.

In Conclusion

Years ago, you could only use checks or cash deposits to make your mortgage payments. In recent times, however, the invention of the internet and technological gadgets like computers have made life more comfortable. There are now various methods by which you can make mortgage payments, as outlined above. Each method has its benefits and limitations. Consider which works best for you. In the end, picking the right payment method can enable you to make your payments on time as expected.

After 13 years of mission and seven successive leaders, the UN at an impasse in Libya

After 13 years of mission and seven successive leaders, the UN at an impasse in Libya Germany: search of AfD headquarters in Lower Saxony, amid accusations of embezzlement

Germany: search of AfD headquarters in Lower Saxony, amid accusations of embezzlement Faced with Iran, Israel plays appeasement and continues its shadow war

Faced with Iran, Israel plays appeasement and continues its shadow war Iran-Israel conflict: what we know about the events of the night after the explosions in Isfahan

Iran-Israel conflict: what we know about the events of the night after the explosions in Isfahan Sánchez condemns Iran's attack on Israel and calls for "containment" to avoid an escalation

Sánchez condemns Iran's attack on Israel and calls for "containment" to avoid an escalation China's GDP grows 5.3% in the first quarter, more than expected

China's GDP grows 5.3% in the first quarter, more than expected Alert on the return of whooping cough, a dangerous respiratory infection for babies

Alert on the return of whooping cough, a dangerous respiratory infection for babies Can relaxation, sophrology and meditation help with insomnia?

Can relaxation, sophrology and meditation help with insomnia? Vacation departures and returns: with the first crossovers, heavy traffic is expected this weekend

Vacation departures and returns: with the first crossovers, heavy traffic is expected this weekend “Têtu”, “Ideat”, “The Good Life”… The magazines of the I/O Media group resold to several buyers

“Têtu”, “Ideat”, “The Good Life”… The magazines of the I/O Media group resold to several buyers The A13 motorway closed in both directions for an “indefinite period” between Paris and Normandy

The A13 motorway closed in both directions for an “indefinite period” between Paris and Normandy The commitment to reduce taxes of 2 billion euros for households “will be kept”, assures Gabriel Attal

The commitment to reduce taxes of 2 billion euros for households “will be kept”, assures Gabriel Attal The exclusive Vespa that pays tribute to 140 years of Piaggio

The exclusive Vespa that pays tribute to 140 years of Piaggio Kingdom of the great maxi scooters: few and Kymco wants the crown of the Yamaha TMax

Kingdom of the great maxi scooters: few and Kymco wants the crown of the Yamaha TMax A complaint filed against Kanye West, accused of hitting an individual who had just attacked his wife

A complaint filed against Kanye West, accused of hitting an individual who had just attacked his wife In Béarn, a call for donations to renovate the house of Henri IV's mother

In Béarn, a call for donations to renovate the house of Henri IV's mother Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

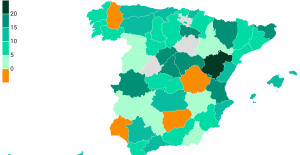

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy During the night of the economy, the right points out the budgetary flaws of the macronie

During the night of the economy, the right points out the budgetary flaws of the macronie These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Rally: Neuville and Evans neck and neck after the first day in Croatia

Rally: Neuville and Evans neck and neck after the first day in Croatia Gymnastics: after Rio and Tokyo, Frenchman Samir Aït Saïd qualified for the Paris 2024 Olympics

Gymnastics: after Rio and Tokyo, Frenchman Samir Aït Saïd qualified for the Paris 2024 Olympics Top 14: in the fight for maintenance, Perpignan has the wind at its back

Top 14: in the fight for maintenance, Perpignan has the wind at its back Top 14: Toulon-Toulouse, a necessarily special reunion for Melvyn Jaminet

Top 14: Toulon-Toulouse, a necessarily special reunion for Melvyn Jaminet