If one of the 25 members of the Governing Council was still in a holiday mood after the summer break, it will be gone today at the latest: The Governing Council of the European Central Bank (ECB) is meeting in Frankfurt am Main for the first time since the last meeting at the end of July to decide on policy rates.

But the whole situation has become even more complicated since then. Inflation has risen to a record high of 9.1 percent. This is not only due to the peddling energy and food prices. The core rate also marked a historic high at 4.3 percent.

At the same time, the euro has fallen below parity against the dollar. The common currency is now only trading at 99 US cents. This is also due to the tough interest rate policy of the US Federal Reserve, which the ECB is practically driving in front of it.

The inflation figures and the weakness of the euro have not only increased public pressure on the monetary authorities to take tough countermeasures.

Even the central bankers themselves were apparently overwhelmed by the impact of inflation in the euro area. Most recently, the voices from the Council calling for a rapid pace of interest rate hikes have increased.

A rate hike of 0.67 percentage points is being priced in on the financial markets. A small residual doubt remains as to whether the monetary politicians are now really going to make a big interest rate hike and raise the key interest rate by 75 basis points - for the first time in the history of the ECB.

But inflation, the nemesis that has to be banished with the help of rising key interest rates, has become so strong at the worst possible time. Europe is on the verge of a recession, and according to Deutsche Bank boss Christian Sewing, it can no longer be averted in Germany, the largest euro-economy.

It is now becoming very clear that the ECB hesitated far too long with its fight against inflation. The ECB can no longer take a similarly tough stance as pursued by the US central bank if it does not want to risk a deep recession and serious upheavals within the monetary union.

The US Federal Reserve started raising interest rates in March. Policy rates are now between 2.25 and 2.5 percent and a third big hike of 75 basis points at the next meeting on September 21 seems a foregone conclusion.

The new forecasts, which ECB economists will present, reflect in black and white the dilemma facing the monetary authorities. Most recently, the ECB economists had forecast an inflation rate of 6.8 percent and an increase in gross domestic product of 2.8 percent for this year. At the time, economists predicted inflation of 3.5 percent and economic growth of 2.1 percent for next year.

The forecasts presented in June seem like they are from another world. This is mainly due to energy prices: the ECB inflation projections have so far been based on an average natural gas price of EUR 99 per megawatt hour this year and EUR 81 next year. Natural gas currently costs more than 200 euros per megawatt hour.

The council members don't even have to look at their own inflation projections to grasp the predicament in which the monetary authorities find themselves. A look at the bond markets shows that the interest premium on Italian government bonds has skyrocketed to 2.3 percentage points and is thus at levels seen during the corona crisis.

At the meeting before the summer break, the monetary watchdogs launched a new instrument, the so-called "Transmission Protection Instrument", or TPI for short, to minimize such risk premiums. But the effect of the new weapon seems to have fizzled out for the time being.

It is striking that ECB President Christine Lagarde has been silent for a long time. At the prominent central bank conference in Jackson Hole at the end of August, it was left to the German ECB Director Isabel Schnabel to verbally set the direction with her appearance. Now the augurs want to know from Lagarde whether she thinks like Schnabel.

"In this environment, the central banks have to act vigorously," Schnabel said at the time. "The longer inflation remains high, the greater the risk that the public will lose confidence in our determination and ability to maintain purchasing power." Policymakers must therefore express their "strong determination" to quickly bring inflation to the target level move.

On the other hand, ECB chief economist Philip Lane had recently shown himself to be rather cautious and warned of the dangers of an overly aggressive rate hike. There are "no shortcuts" to analyzing the inflation cycle and he is confident that inflation will soon come down from "extremely high levels," Lane told an event in Barcelona.

The interest rate decision is also not getting any easier because the money markets are currently in disarray. Due to the energy crisis and the necessary collateral that utilities have to deposit, short-term interest rates have skyrocketed.

Here, market participants want to know whether the ECB might want to pump liquidity into the markets to ensure calm. But that in turn would thwart a tougher pace. And the ECB cannot afford that either, because the euro is under devaluation pressure. Forex traders can only be pacified with forceful action.

For the currency guardians, this means a lot. Making a decision in this situation will amount to making the least evil out of a multitude of calamities.

"Everything on shares" is the daily stock exchange shot from the WELT business editorial team. Every morning from 7 a.m. with our financial journalists. For stock market experts and beginners. Subscribe to the podcast on Spotify, Apple Podcast, Amazon Music and Deezer. Or directly via RSS feed.

Torrential rains in Dubai: “The event is so intense that we cannot find analogues in our databases”

Torrential rains in Dubai: “The event is so intense that we cannot find analogues in our databases” Rishi Sunak wants a tobacco-free UK

Rishi Sunak wants a tobacco-free UK In Africa, the number of millionaires will boom over the next ten years

In Africa, the number of millionaires will boom over the next ten years Iran's attack on Israel: these false, misleading images spreading on social networks

Iran's attack on Israel: these false, misleading images spreading on social networks New generation mosquito nets prove much more effective against malaria

New generation mosquito nets prove much more effective against malaria Covid-19: everything you need to know about the new vaccination campaign which is starting

Covid-19: everything you need to know about the new vaccination campaign which is starting The best laptops of the moment boast artificial intelligence

The best laptops of the moment boast artificial intelligence Amazon invests 700 million in robotizing its warehouses in Europe

Amazon invests 700 million in robotizing its warehouses in Europe Switch or signaling breakdown, operating incident or catenaries... Do you speak the language of RATP and SNCF?

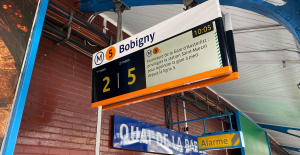

Switch or signaling breakdown, operating incident or catenaries... Do you speak the language of RATP and SNCF? Transport in Île-de-France: operators are pulling out all the stops on passenger information before the Olympics

Transport in Île-de-France: operators are pulling out all the stops on passenger information before the Olympics Radio audiences: France Inter remains firmly in the lead, Europe 1 continues its rise

Radio audiences: France Inter remains firmly in the lead, Europe 1 continues its rise Russian cyberattacks pose a global “threat”, Google warns

Russian cyberattacks pose a global “threat”, Google warns A new Lennon-McCartney duo, more than 50 years after the Beatles split

A new Lennon-McCartney duo, more than 50 years after the Beatles split The Curse vs Immaculée: two thrillers but only one plot

The Curse vs Immaculée: two thrillers but only one plot Mathieu Kassovitz adapts The Beast is Dead!, the comic book about the Second World War and the Occupation by Calvo

Mathieu Kassovitz adapts The Beast is Dead!, the comic book about the Second World War and the Occupation by Calvo Goldorak 'has never lived so much as now'

Goldorak 'has never lived so much as now' Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy During the night of the economy, the right points out the budgetary flaws of the macronie

During the night of the economy, the right points out the budgetary flaws of the macronie Europeans: Glucksmann denounces “Emmanuel Macron’s failure” in the face of Bardella’s success

Europeans: Glucksmann denounces “Emmanuel Macron’s failure” in the face of Bardella’s success These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Champions League: semi-final schedule revealed

Champions League: semi-final schedule revealed Serie A: AS Roma extends Daniele De Rossi

Serie A: AS Roma extends Daniele De Rossi Ligue 1: hard blow for Monaco with Golovin’s premature end to the season

Ligue 1: hard blow for Monaco with Golovin’s premature end to the season Paris 2024 Olympics: two French people deprived of the Olympic Games because of a calculation error by the international federation?

Paris 2024 Olympics: two French people deprived of the Olympic Games because of a calculation error by the international federation?