Money and asset investments in general:

Enrico Eberlein: 01802 468801

Elimar from Festenberg-Pakisch: 01802 468802

Alexander Golle: 01802 468803

Andreas Koengeter: 01802 468804

Construction financing:

Gordon Maus: 01802 468805

Finances in general:

Thomas Schlueter

Tobias Boehm

Who would have thought that: In the twelve-month comparison of the values from the German stock index, two companies dominate that can generally be counted among the bores of dividend stocks: The utility RWE leads the list with a 24.7 percent plus, followed by it Deutsche Telekom with 16.1 percent. Crazy stock market world? You could say that. How could it be otherwise when the situation in the real world is also capricious? The war in Ukraine, massive increases in energy prices, inflation unprecedented in the western world, the endless pandemic - all of this has consequences for investments beyond the stock market.

More and more savers are at a loss when faced with this initial situation. What is the best way to invest your money so that it is not completely devalued within a few years due to rising inflation? WELT AM SONNTAG offers support for its readers in this difficult situation. Together with the Federal Association of German Banks, it has been giving them the opportunity twice a year for more than three decades to have their questions on the subject of investments answered individually by experts. It's that time again this Sunday. From 10 a.m. to 12:30 p.m., a total of seven experts selected by the banking association and employed by member banks – five on the phone (costs: six cents per connection), two in online chat – will be available to answer readers’ questions. You can find the chat behind this link.

One of the key issues for investors in recent months has been the development of the inflation rate. In Germany, the corresponding value is currently 10.4 percent. The deposits of the savers are thus devalued to this extent. It is of little consolation that the commercial banks are starting to pay interest on deposits again – in real terms, i.e. after deducting the inflation rate, the return on invested money remains clearly in negative territory. In response to inflation, which the central banks in particular had described as a “temporary phenomenon” well into 2022, the central banks have started to raise interest rates – albeit in some cases far too late. Money should become more expensive so that the demand for goods and services falls and prices fall again.

The measures taken by the central banks also affect the shareholders. High-growth companies in particular, such as US technology stocks, which have been hyped for a long time, suffered from the interest rate hikes because their future profits are discounted with higher interest rates, which is reflected in an adjustment in valuations. Commodity stocks, which according to the much-cited principles of sustainable investment (the so-called ESG criteria) should actually have poorer return prospects in the future, are suddenly in demand and successful again. Markets went into rally mode on Thursday as participants speculated that inflation may have peaked, at least in the US. But is the interpretation sustainable? How should investors now deal with the situation on the stock exchange?

But the steps taken by the central banks also have massive consequences for prospective property buyers and owners. Anyone who thought about buying a house or apartment was faced with a new reality in view of the rapid increase in yields on the bond market and the correspondingly sharp increase in interest on loans. Whole financing collapsed, banks withdrew their commitments if purchase contracts were not signed and sealed quickly enough, and for many the equity they had saved was suddenly no longer sufficient. How is it still possible to buy or finance home ownership under the changed conditions?

However, questions from the readers may also relate to all other areas of investment. Whether it's about account details, gold as a safe haven in the crisis of paper currencies, cryptocurrencies related to bitcoin or overnight money: call or use the chat, our experts will be happy to answer your questions. In the coming week, WELT AM SONNTAG will publish the most exciting questions and answers.

"Everything on shares" is the daily stock exchange shot from the WELT business editorial team. Every morning from 5 a.m. with the financial journalists from WELT. For stock market experts and beginners. Subscribe to the podcast on Spotify, Apple Podcast, Amazon Music and Deezer. Or directly via RSS feed.

His body naturally produces alcohol, he is acquitted after a drunk driving conviction

His body naturally produces alcohol, he is acquitted after a drunk driving conviction Who is David Pecker, the first key witness in Donald Trump's trial?

Who is David Pecker, the first key witness in Donald Trump's trial? What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain?

What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain? The shadow of Chinese espionage hangs over Westminster

The shadow of Chinese espionage hangs over Westminster Colorectal cancer: what to watch out for in those under 50

Colorectal cancer: what to watch out for in those under 50 H5N1 virus: traces detected in pasteurized milk in the United States

H5N1 virus: traces detected in pasteurized milk in the United States What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France The right deplores a “dismal agreement” on the end of careers at the SNCF

The right deplores a “dismal agreement” on the end of careers at the SNCF The United States pushes TikTok towards the exit

The United States pushes TikTok towards the exit Air traffic controllers strike: 75% of flights canceled at Orly on Thursday, 65% at Roissy and Marseille

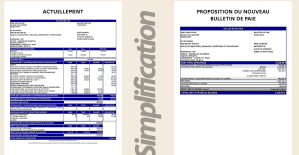

Air traffic controllers strike: 75% of flights canceled at Orly on Thursday, 65% at Roissy and Marseille This is what your pay slip could look like tomorrow according to Bruno Le Maire

This is what your pay slip could look like tomorrow according to Bruno Le Maire Sky Dome 2123, Challengers, Back to Black... Films to watch or avoid this week

Sky Dome 2123, Challengers, Back to Black... Films to watch or avoid this week The standoff between the organizers of Vieilles Charrues and the elected officials of Carhaix threatens the festival

The standoff between the organizers of Vieilles Charrues and the elected officials of Carhaix threatens the festival Strasbourg inaugurates a year of celebrations and debates as World Book Capital

Strasbourg inaugurates a year of celebrations and debates as World Book Capital Kendji Girac is “out of the woods” after his gunshot wound to the chest

Kendji Girac is “out of the woods” after his gunshot wound to the chest Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar NBA: the Wolves escape against the Suns, Indiana unfolds and the Clippers defeated

NBA: the Wolves escape against the Suns, Indiana unfolds and the Clippers defeated Real Madrid: what position will Mbappé play? The answer is known

Real Madrid: what position will Mbappé play? The answer is known Cycling: Quintana will appear at the Giro

Cycling: Quintana will appear at the Giro Premier League: “The team has given up”, notes Mauricio Pochettino after Arsenal’s card

Premier League: “The team has given up”, notes Mauricio Pochettino after Arsenal’s card