The Swiss economy cools significantly. The show new data for January. The today of the business cycle research of the ETH Zurich (KOF) released the business situation indicator has decreased for the second month in a row. And the companies are less optimistic than previously. The indicator is based on responses from more than 4500 companies from the private sector of the economy, a monthly survey by the KOF.

Thus, the expectation of the economy seems to confirm forecasters expect for the full year will be significantly lower on Swiss economic growth. The Economists of the Federal government have revised their estimate to in the last year from 2.9 to 2.6 percent, and for 2019, they expect only an increase of 1.5 percent. In the third quarter of last year, the Swiss economy has shrunk to the Surprise of Economists, even slightly.

The whole economy is affected

For the last quarter, the estimate is not yet available. Then results again in negative growth, one would speak according to the technical Definition of a recession in the Swiss economy. Economists do not go out of date, however. The negative development in the third quarter was mainly due to extraordinary factors such as, among other things, the hot weather, the about pressed to the retail sales.

the results of The survey of the KOF make now, however, clear that the momentum is decreasing over almost the entire economy: both manufacturing as well as in the wholesale trade and service providers such as the hospitality industry, the retail and wholesale trade, as well as in the Hotels. In the construction industry, the engineering sector and in the financial and insurance service providers has changed the business situation, however little.

The slowdown in the Swiss economy has already shown in the latest purchasing managers ' indices (PMI). They are collected through surveys of shoppers of large companies and are therefore considered to be particularly valuable indicators about the current course of the economy. They are constructed so that the index points to expansion there are over 50 for a more Economic and lower values for a contraction.

Rising global risks

to the beginning of the month for the Switzerland of the Credit Suisse and the purchasers Association to Procure a published Index for the manufacturing sector since last August, when he was still at a high with 64.6 points, each month, deep down. At the beginning of February he points 54.3 index, and is thus at least in the area of growth. Much better is the PMI for the services of the noted 59.8. However, this indicator says about the business cycle is significantly less than that for the manufacturing sector, since services such as those of the health division or the state to hang a little with the cyclical economic history.

The latest data are, in themselves, no reason to great. The PMI data are still in the growth area, and also the KOF survey shows that below the line the Confidence of the company outweighs for the future.

the problem is the weaker economic momentum, especially against the Background of rising risks in the global economy. In fact, a considerable slowdown in the growth is also there. From a Swiss point of view, especially the development in Europe and in Germany in Particular. 53 per cent of Swiss exports go to the EU and 20 percent to Germany alone.

The Problem: interest rates are already negative and can hardly be lowered any further.

As those of Switzerland, the German economy contracted in the third quarter of the previous year already. For the fourth quarter of a low rate of growth is estimated, so that the Northern neighbor is rammed quite close to the Definition of a recession is over. However, the indicators for the current development remain poorly by Markit, calculated PMI for the manufacturing sector was the beginning of the month with 49.7 points already in the area, which is a shrinking economy. So deep is this not as it was for 50 months.

In the rest of Europe it looks a lot better. Italy is already in a recession, and the PMI for the Eurozone, with 50.5 points, just in the area of growth. The Sentix Index, which is considered to be another important early indicator for the Eurozone at the beginning of February, the lowest level since 2014, for Germany even to the lowest since 2012. To Ensure the further development of the world economy. This applies especially to China, where data also to a strong slowdown of the economy.

what's next?

especially for Germany, Economists are also temporary factors that have recently pushed the country's economic dynamism. You are right, there is even the Chance of a recovery there, as well as in Switzerland. Even if the growth figures are not as high as in the recent Boom. When the world economy and the economy of the Eurozone and of Germany, but in fact significantly worse develop, and speak to a number of risks, then one cannot avoid, Switzerland, and the economic situation should deteriorate further.

The Problem for Europe and for Switzerland would be then, that the most important Instrument would be largely ineffective: the monetary policy. The interest rates are already negative and can hardly be lowered further.

(editing Tamedia)

Created: 05.02.2019, 10:30 a.m.

After 13 years of mission and seven successive leaders, the UN at an impasse in Libya

After 13 years of mission and seven successive leaders, the UN at an impasse in Libya Germany: search of AfD headquarters in Lower Saxony, amid accusations of embezzlement

Germany: search of AfD headquarters in Lower Saxony, amid accusations of embezzlement Faced with Iran, Israel plays appeasement and continues its shadow war

Faced with Iran, Israel plays appeasement and continues its shadow war Iran-Israel conflict: what we know about the events of the night after the explosions in Isfahan

Iran-Israel conflict: what we know about the events of the night after the explosions in Isfahan Sánchez condemns Iran's attack on Israel and calls for "containment" to avoid an escalation

Sánchez condemns Iran's attack on Israel and calls for "containment" to avoid an escalation China's GDP grows 5.3% in the first quarter, more than expected

China's GDP grows 5.3% in the first quarter, more than expected Alert on the return of whooping cough, a dangerous respiratory infection for babies

Alert on the return of whooping cough, a dangerous respiratory infection for babies Can relaxation, sophrology and meditation help with insomnia?

Can relaxation, sophrology and meditation help with insomnia? Vacation departures and returns: with the first crossovers, heavy traffic is expected this weekend

Vacation departures and returns: with the first crossovers, heavy traffic is expected this weekend “Têtu”, “Ideat”, “The Good Life”… The magazines of the I/O Media group resold to several buyers

“Têtu”, “Ideat”, “The Good Life”… The magazines of the I/O Media group resold to several buyers The A13 motorway closed in both directions for an “indefinite period” between Paris and Normandy

The A13 motorway closed in both directions for an “indefinite period” between Paris and Normandy The commitment to reduce taxes of 2 billion euros for households “will be kept”, assures Gabriel Attal

The commitment to reduce taxes of 2 billion euros for households “will be kept”, assures Gabriel Attal The exclusive Vespa that pays tribute to 140 years of Piaggio

The exclusive Vespa that pays tribute to 140 years of Piaggio Kingdom of the great maxi scooters: few and Kymco wants the crown of the Yamaha TMax

Kingdom of the great maxi scooters: few and Kymco wants the crown of the Yamaha TMax A complaint filed against Kanye West, accused of hitting an individual who had just attacked his wife

A complaint filed against Kanye West, accused of hitting an individual who had just attacked his wife In Béarn, a call for donations to renovate the house of Henri IV's mother

In Béarn, a call for donations to renovate the house of Henri IV's mother Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

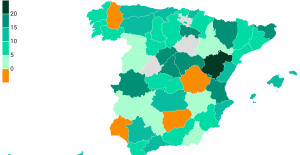

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy During the night of the economy, the right points out the budgetary flaws of the macronie

During the night of the economy, the right points out the budgetary flaws of the macronie These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Women's C1: at what time and on which channel to watch the OL-PSG semi-final first leg

Women's C1: at what time and on which channel to watch the OL-PSG semi-final first leg Tennis: after two victories this Friday, Grégoire Barrère qualifies for the semi-finals of the Bucharest tournament

Tennis: after two victories this Friday, Grégoire Barrère qualifies for the semi-finals of the Bucharest tournament Cycling: Mathieu Van der Poel “recharged the batteries” for Liège-Bastogne-Liège

Cycling: Mathieu Van der Poel “recharged the batteries” for Liège-Bastogne-Liège Mercato: Zidane at Bayern? We'll talk about it again, but...

Mercato: Zidane at Bayern? We'll talk about it again, but...