From today's perspective, threatens the capital increase, the on Monday at the extraordinary General meeting of Swiss steel company Schmolz + Bickenbach (S + B) is to be decided, to fail. The largest shareholder, Viktor Vekselberg-controlled Liwet Holding, rejects the submitted rescue plan. It is assumed that the third party agrees to largest shareholders against the capital increase. An alternative plan could not come to the application, unless the major shareholders of some but still.

for the time being, the account of the Investor, Martin Haefner seems not to be working. He wanted 325 million Swiss francs in the struggling company include, on the condition that he keeps after 37.5 percent of the shares, and thus the largest shareholder is. He especially wanted to limit Vekselbergs influence and stop him from doing to increase its share in the capital increase. Reportedly it goes Haefner, that he, if he will inject so much money, more votes than Liwet and the S+B-participation in society.

the problem was Haefners statement on Wednesday in the "Finance and economy". He said: "A rejection of the capital increase at the extraordinary General meeting of shareholders of 2. December would be the equivalent of a bankruptcy judge the next day." This has triggered the customers, suppliers and, not least, in the case of the 10'000 employees of S+B is large uncertainty.

spokesman Ulrich Steiner resist Haefner speaks clearly: "We must judge not on the Tuesday prior to the Bankruptcy. We have from today's point of view until January sufficient liquidity." For the employees it is, however, only conditional all-clear: "From today's perspective, the wages for December are protected," he says. "A lot depends on the supplier, the credit insurers and the banks." To be with you all for weeks in the conversation.

UBS and Credit Suisse in the Cretaceous

"If the capital increase, we continue to search for a different solution," says Steiner. That the company needs at the end of January the money is in the banks. For weeks, you are looking for with the top of the company and the shareholders to find a solution. They are even under pressure: you have a Total of 375 million euros in loans outstanding, as of documents to the takeover Commission. To give to the lending banks, the two Swiss big banks, UBS and Credit Suisse include, in addition to the German Commerzbank in particular.

"at The Moment we do not meet the credit conditions of the banks, but we have until the end of January to find a solution," says Steiner. "Until then, we can schedule a General meeting of shareholders, if the capital increase. In order to meet the loan conditions, we need not necessarily more equity." Added to this is a Problem with the Obligationären. According to Steiner, the company would have to pay back the bonds "immediately, to 101 per cent", when it comes to a change of control. The bonds are traded in the stock exchange of 80 percent of the value. This means that if an Investor holds more than one-third of the shares, make speculators immediately for a profit of 20 per cent.

image to enlarge

in Order to avoid bankruptcy, are looking for the fractious shareholders a way out. On Friday, it gave up in the late evening negotiations for a "Last Minute Deal", as representatives from both sides to confirm. So far, there was still no agreement. Vekselberg has, apparently, have a secret plan, he wants to bring in as a request to the General Assembly. Accordingly, it is intended to give a capital increase of "only" 200 million Swiss francs. Even the opposition accepts that the Plan would be adopted. However, the money is not sufficient then, in order to meet the requirements of the banks. Therefore, the major shareholders Haefner and Liwet should eat, per 100 million as a subordinated loan in a single coat. Haefner rejects the but. Vekselberg does not want to attract his Plan alone, if it still comes to an agreement. Haefner would be then only a small minority shareholder.

willing to Compromise: Martin Haefner. Photo: PD

According to his spokesman Haefner is ready to Vekselberg to meet, in order to allow a "Last Minute Deal". In particular, it is discussed that Haefner Liwet, the share buys. The Problem with this solution is that Vekselberg is affected because of his alleged closeness to Vladimir Putin of sanctions of the USA. Haefner in turn, wants to avoid under all circumstances that he gets in trouble himself with the Americans, because he geschäftet with Vekselberg. Haefner is involved as the owner of the car dealer Amag closely with the German VW group, and he can not risk problems with the Americans.

But, apparently, eager to find solutions that work around the Problem, it is called by Haefners. The negotiations will continue until Monday at noon. "Before the General Assembly, there will be a meeting of the Board", says S + B speaker Ulrich Steiner. Which would have to approve the Deal. The parties Involved are confident.

In an open letter to Dr. Martin Haefner, the Board of Directors of Liwet Holding AG sets the conditions for a solution, and calls for responses to open-ended questions.

click here to read the Letter.

This Text is from the current issue. Now all of the articles in the E-Paper of the Sunday newspaper, read: App for iOS App for Android – Web-App

Created: 30.11.2019, 21:13 PM

Rishi Sunak wants a tobacco-free UK

Rishi Sunak wants a tobacco-free UK In Africa, the number of millionaires will boom over the next ten years

In Africa, the number of millionaires will boom over the next ten years Iran's attack on Israel: these false, misleading images spreading on social networks

Iran's attack on Israel: these false, misleading images spreading on social networks Iran-Israel: David Cameron wants the G7 to impose “coordinated sanctions” on Iran

Iran-Israel: David Cameron wants the G7 to impose “coordinated sanctions” on Iran New generation mosquito nets prove much more effective against malaria

New generation mosquito nets prove much more effective against malaria Covid-19: everything you need to know about the new vaccination campaign which is starting

Covid-19: everything you need to know about the new vaccination campaign which is starting The best laptops of the moment boast artificial intelligence

The best laptops of the moment boast artificial intelligence Amazon invests 700 million in robotizing its warehouses in Europe

Amazon invests 700 million in robotizing its warehouses in Europe Boeing tries to defuse the long-haul crisis

Boeing tries to defuse the long-haul crisis Solar panels: French manufacturer Systovi announces the cessation of its activities due to “Chinese dumping”

Solar panels: French manufacturer Systovi announces the cessation of its activities due to “Chinese dumping” Tesla: canceled in court, Musk's huge compensation plan will again be submitted to shareholders

Tesla: canceled in court, Musk's huge compensation plan will again be submitted to shareholders Two, three or a hundred euros: who are the most generous customers with tips?

Two, three or a hundred euros: who are the most generous customers with tips? Bruno Vandelli: one year suspended sentence required against the choreographer for corruption of a minor

Bruno Vandelli: one year suspended sentence required against the choreographer for corruption of a minor Jul fills the Stade de France and the Vélodrome in record time

Jul fills the Stade de France and the Vélodrome in record time Immersion among the companions of the Liberation

Immersion among the companions of the Liberation Provence-Alpes-Côte d’Azur releases several hundred thousand euros for the promotion of the work of Marcel Pagnol

Provence-Alpes-Côte d’Azur releases several hundred thousand euros for the promotion of the work of Marcel Pagnol Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

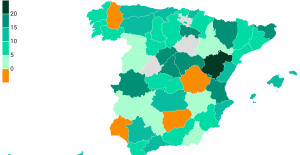

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy During the night of the economy, the right points out the budgetary flaws of the macronie

During the night of the economy, the right points out the budgetary flaws of the macronie Europeans: Glucksmann denounces “Emmanuel Macron’s failure” in the face of Bardella’s success

Europeans: Glucksmann denounces “Emmanuel Macron’s failure” in the face of Bardella’s success These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Champions League: “It’s painful, but we have to learn,” says Arteta

Champions League: “It’s painful, but we have to learn,” says Arteta Champions League: “Madrid never dies”, says Ancelotti

Champions League: “Madrid never dies”, says Ancelotti Champions League: Manchester City played “exceptionally”, according to Guardiola

Champions League: Manchester City played “exceptionally”, according to Guardiola Champions League: video summary of the Manchester City-Real Madrid clash

Champions League: video summary of the Manchester City-Real Madrid clash