has Actually been happy John Pierpont Morgan in a sociable round. Comfortably the most powerful bankers of America, sits on this winter evening in February 1902 with business friends in his swanky dining room with red walls and expensive oak paneling. Then the phone call comes. As Morgan returns to the Board, he can hide his shock. Puzzled, he tells the guests that his railroad trust, the Northern Securities is of the government as an illegal monopoly and sued – and the without warning of President Theodore Roosevelt, with whom he is since the youth is well known. All of his contacts in Washington use him this Time, nothing. Northern Securities is smash, which in the United States, a wide campaign against cartels and corruption begins.

Graphically the trend in many industries is similar to the tournament tree of a Grand Slam in Tennis.

More than a century later, ask yourself whether it needs a new rigorous measures. In the critique, especially giants such as Amazon, Google and Facebook, which have enormous market power, world's data from billions of users gather and our private life to spy on. The Problem, however, goes far beyond the IT sector. Since the eighties, a merger wave after the other on Corporate America. In the US economy, it is due to excessive concentration. Graphically, the development is similar to shown in many industries, the tournament tree of a Grand Slam in Tennis: A wide field of competitors is cut in half with each round, until only a few players.

Convenient authorities

A similar agglomerations of economic Power confronted America at the turn of the 20th century. Century. In the manner of the robber barons of industry accumulated magnates such as J. P. Morgan, John Rockefeller and Andrew Carnegie unimaginable wealth by placing all sectors in Trust companies. Of tobacco and cotton to coal, Oil, and steel to the Railways, and telecommunications Big Business-dominated "to" almost every industry. Often, the gigantic conglomerates handles to unethical business practices, exploit workers, and cared neither to customers nor its competitors. The Sherman Antitrust Act of 1890 was intended to prohibit anti-competitive behaviour, but up to Roosevelt's strike against Northern Securities, the authorities had come to no Trust in the way.

As at the time of the robber barons, cartels have little to fear today in the United States. Neither the justice Department nor the Federal Trade Commission take their responsibilities seriously as cartel guard properly. Not infrequently, they support Acquisitions. Your failure with the Figures. Scientific studies show that the market concentration in 75 percent of all industries during the past two decades has increased. Nearly 90 percent of the announced mergers are implemented. Transactions are blown into, as a rule, only if it is superior to the fusion partner is different. How helpless the competition authorities, has highlighted the futile lawsuit against the 85-billion Dollar major acquisition of Time Warner by AT&T last summer. The last major engagement of the antitrust guardians of the Microsoft case twenty years ago.

pictures: The WEF 2019

The consequences of this merger boom are devastating, because fair competition is a fundamental requirement of the capitalist economic system. Like it is argued in the case of acquisitions with synergies, from which consumers would benefit. The reality of excessive prices, a lack of Innovation and lousy customer service. In fact, economies of scale in some industries, the economic Benefits, especially in network-based sectors such as Telecom and electricity. When it comes to infrastructure, cutting off the USA, but desolate. In terms of broadband availability, for example, you are at the rear end of the developed countries. Other studies show that US cellular would pay customers annually up to $ 65 billion less, if the framework would be designed in such a way as it is in Germany or Denmark, where the market is at best comparable.

improvement is not in sight. Through the Acquisition of Sprint by T-Mobile, only three operators to share soon the mobile market. Not less problematic is the Situation in the health sector, where larger and larger hospital chains such as HCA, CHS, or Tenet cripple the competition. Far the consolidation has progressed as well under health insurance companies like UnitedHealth, Humana and Cigna. That explains, sometimes, why the health costs are exorbitantly higher than in any other Western country. Another example is the air traffic. With United, Delta, American and Southwest four airline companies control in a comfortable oligopoly of the air space. Accordingly, it can afford a company like United, a number of customers to pull violently from his seat from the aircraft. Such a PR fiasco, not be charged once the share price, as the investment adviser and author Johnathan Tepper holds in his excellent book, "The Myth of Capitalism".

"If we have done anything wrong, send your man to my man and they can fix it up."J. P. Morgan to Theodore Roosevelt

Similar scandals caused during the domination of the Trusts for headlines. Meat factories, for example, were so infested with vermin that, not infrequently, rats were processed to sausages. In order to protect consumers, put Roosevelt in 1907, the Pure Food and Drug Act into force, which laid the Basis for the health authority FDA. In the fight against cartels, he did not happen to J. P. Morgan as its first objective. The New York Financier, was closely involved in the creation of industrial giants such as General Electric, US Steel and AT&T, which today are icons of the American economy. To do this, he took advantage of close relationships in the policy. "If we have done anything wrong, send your man to my man and they can fix it up if we have done something wrong, send your man over to my so that you can clean up the thing," he is said to have Roosevelt proposed. Of collusion of this wanted to know but nothing.

Hidden links

nepotism and nontransparent influence of corporate associations trust in capitalism on soft today. Donald Trump on the Right and Bernie Sanders on the Left of the mobile 2016 mobilized the masses with the Slogan that the System is corrupted. The growing dissatisfaction in the population has a lot to do with human relations, with which companies can influence policy. Clearly, this is reflected in the financial reform Dodd-Frank. Ten years after major banks brought the world economy almost to Collapse, around 30 per cent of lawyers and 40 percent of the high-ranking officials who have drafted the Dodd-Frank act, for or in financial institutions, searches of the "Washington Post".

No wonder, then, populist currents of the inlet. Under President Roosevelt, the US government went at the time, with over forty lawsuits against cartels, which earned him the reputation as a "trust Buster," but the Republicans, rush proposed the Establishment. Rather, he was committed to a social consensus that large corporations in check, keeps, protects consumers and guarantees equal opportunities. Property rights and competition formed the basis on which the United States became in the following decades, the leading economic power. Historically, this capitalist principles in the United States are deeply rooted. Already, the Boston Tea Party, which marked the end of 1773 the prelude to the American Revolution, was a revolt against the British East India Company, the greatest monopoly of all time.

(financial and economic)

Created: 06.02.2019, 21:47 PM

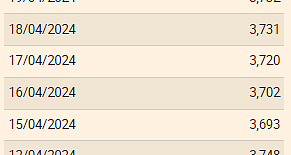

The Euribor today remains at 3.734%

The Euribor today remains at 3.734% Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday

Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations

New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations What is Akila, the mission in which the Charles de Gaulle is participating under NATO command?

What is Akila, the mission in which the Charles de Gaulle is participating under NATO command? What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France Food additives suspected of promoting cardiovascular diseases

Food additives suspected of promoting cardiovascular diseases “Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic

“Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic MEPs validate reform of EU budgetary rules

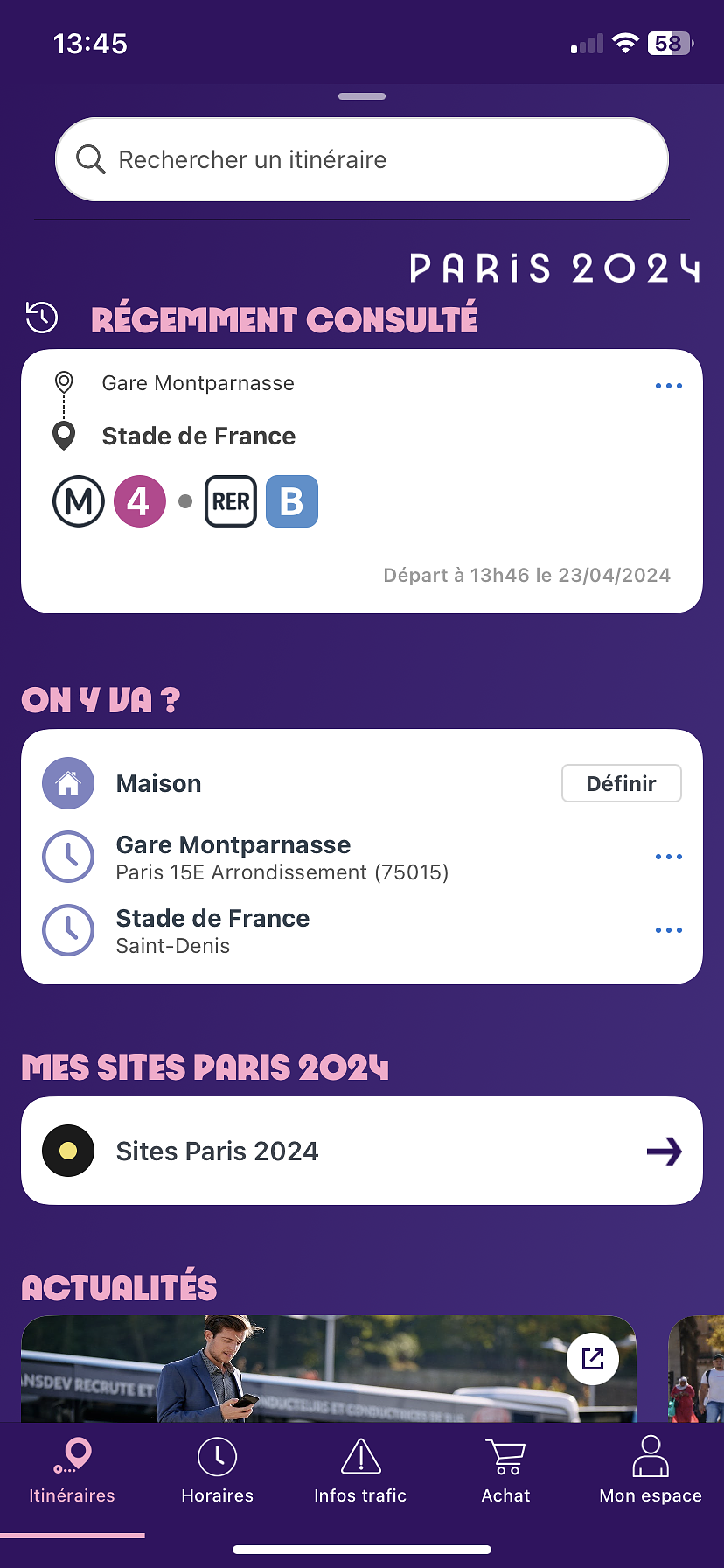

MEPs validate reform of EU budgetary rules “Public Transport Paris 2024”, the application for Olympic Games spectators, is available

“Public Transport Paris 2024”, the application for Olympic Games spectators, is available Spotify goes green in the first quarter and sees its number of paying subscribers increase

Spotify goes green in the first quarter and sees its number of paying subscribers increase Xavier Niel finalizes the sale of his shares in the Le Monde group to an independent fund

Xavier Niel finalizes the sale of his shares in the Le Monde group to an independent fund Owner of Blondie and Shakira catalogs in favor of $1.5 billion offer

Owner of Blondie and Shakira catalogs in favor of $1.5 billion offer Cher et Ozzy Osbourne rejoignent le Rock and Roll Hall of Fame

Cher et Ozzy Osbourne rejoignent le Rock and Roll Hall of Fame Three months before the Olympic Games, festivals and concert halls fear paying the price

Three months before the Olympic Games, festivals and concert halls fear paying the price With Brigitte Macron, Aya Nakamura sows new clues about her participation in the Olympics

With Brigitte Macron, Aya Nakamura sows new clues about her participation in the Olympics Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Serie A: Bologna surprises AS Rome in the race for the C1

Serie A: Bologna surprises AS Rome in the race for the C1 Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues?

Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues? Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby

Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season

Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season