(Finansavisen.no): on Wednesday, had oil prices fallen close to 21 dollars, 25 per cent, from the peak in early October. This provides a huge case, also in the state's total net worth.

In august rejected the committee led by professor and principal Øystein Thøgersen proposal from Norges Bank to remove energiaksjene from its oil wealth. Norges Bank's argument for an oil-free Oljefond was that this would reduce the state's overall risk linked to oil prices, writes Finansavisen.

Thøgersen-selection said, in principle, agree that such a grip would reduce the state's oljeprisrisiko, but felt that the payoff would be so small against the big loss from a lasting oljeprisfall that it would not be worth it.

Equinor down 13 %From the 3. October to yesterday is the value of Equinor down 13 percent to 665 billion, according to Finansavisen.

the State owns 67 per cent direct and 3.3 per cent through the government pension fund norway, and has consequently had an impairment of just over 72 billion.

the State's direct ownership in the oil industry, SDFI, is worth close to 50 per cent more than the entire Equinor and approximately twice that of the state Equinor-shares. Rystad Energy valued in the summer on behalf of the ministry of Petroleum and energy EXPENSES to 1.093 billion, up 35 per cent from the previous valuation in 2016.

Newspaper writes that for the SDFI isolated estimates Rystad Energy that a lasting realprisfall on the 20 dollar barrel provides an impairment at 133 billion, when also the effect of lower oil prices on the krone exchange rate is considered.

Here included also the assumption that such a lower prisbilde will lead to a 12 per cent fewer of the future discoveries will be realized.

Only stableAlso Thøgersen-the committee looked at the effect of a oljeprisfall of about the same scale as we have seen in the fall. A lasting fall in prices of 20 percent reduces the present value of the state's future oil income with 1,750 square billion.

So far it is only the largest part of the state's oil-related wealth is almost unchanged, writes the newspaper. the

At the beginning of October was NBIM worth 8.400 billion and there is value still. the

currency:

Bitcoin plungesScatec Solar is a possible oppkjøpsmål - predict further large price gains

Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday

Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations

New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations What is Akila, the mission in which the Charles de Gaulle is participating under NATO command?

What is Akila, the mission in which the Charles de Gaulle is participating under NATO command? Lawyer, banker, teacher: who are the 12 members of the jury in Donald Trump's trial?

Lawyer, banker, teacher: who are the 12 members of the jury in Donald Trump's trial? What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France Food additives suspected of promoting cardiovascular diseases

Food additives suspected of promoting cardiovascular diseases “Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic

“Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic Orthodox bishop stabbed in Sydney: Elon Musk opposes Australian injunction to remove videos on X

Orthodox bishop stabbed in Sydney: Elon Musk opposes Australian injunction to remove videos on X One in three facial sunscreens does not protect enough, warns L'Ufc-Que Choisir

One in three facial sunscreens does not protect enough, warns L'Ufc-Que Choisir What will become of the 81 employees of Systovi, a French manufacturer of solar panels victim of “Chinese dumping”?

What will become of the 81 employees of Systovi, a French manufacturer of solar panels victim of “Chinese dumping”? “I could lose up to 5,000 euros per month”: influencers are alarmed by a possible ban on TikTok in the United States

“I could lose up to 5,000 euros per month”: influencers are alarmed by a possible ban on TikTok in the United States Dance, Audrey Hepburn’s secret dream

Dance, Audrey Hepburn’s secret dream The series adaptation of One Hundred Years of Solitude promises to be faithful to the novel by Gabriel Garcia Marquez

The series adaptation of One Hundred Years of Solitude promises to be faithful to the novel by Gabriel Garcia Marquez Racism in France: comedian Ahmed Sylla apologizes for “having minimized this problem”

Racism in France: comedian Ahmed Sylla apologizes for “having minimized this problem” Mohammad Rasoulof and Michel Hazanavicius in competition at the Cannes Film Festival

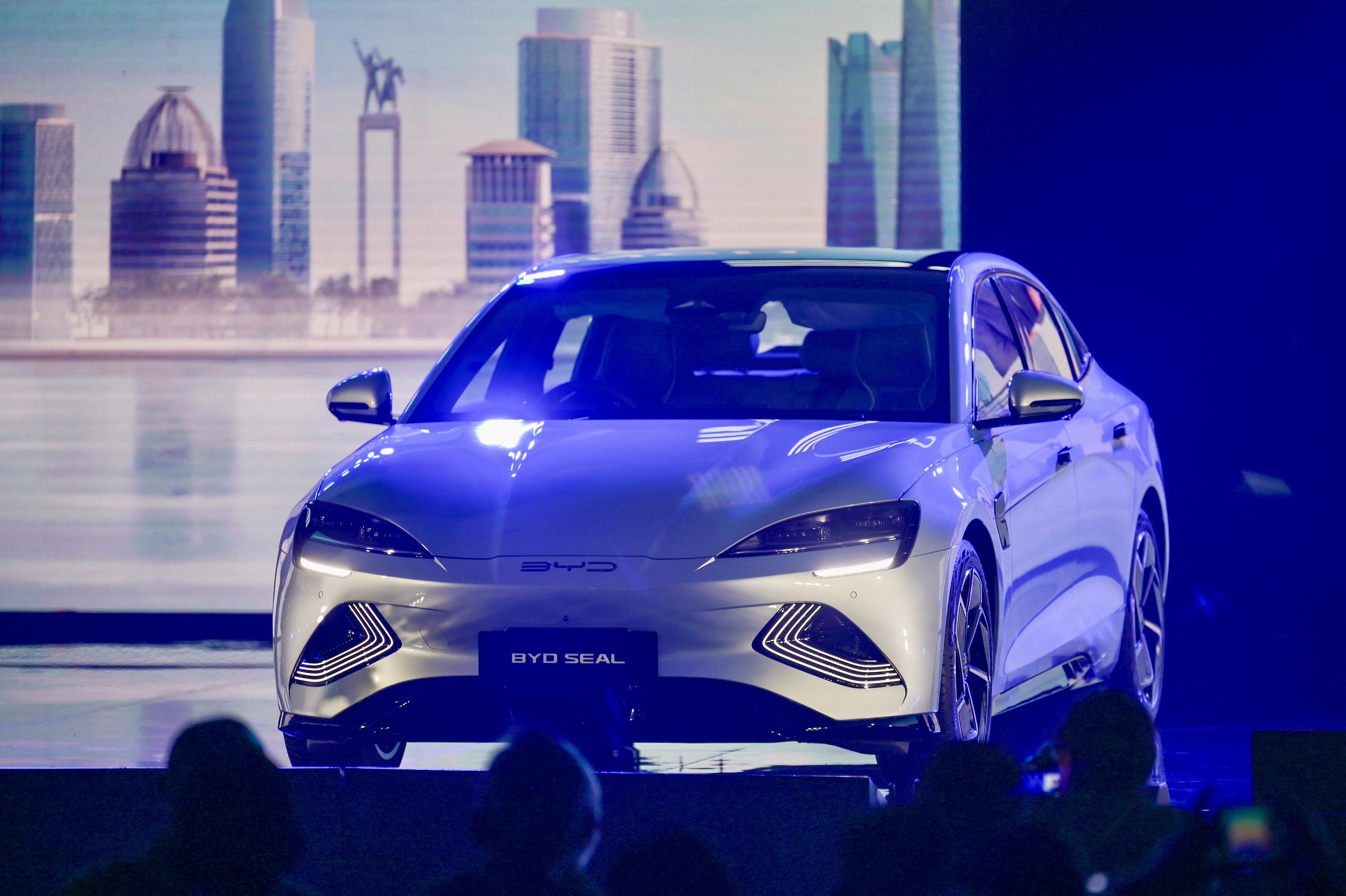

Mohammad Rasoulof and Michel Hazanavicius in competition at the Cannes Film Festival Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Serie A: Bologna surprises AS Rome in the race for the C1

Serie A: Bologna surprises AS Rome in the race for the C1 Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues?

Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues? Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby

Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season

Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season