Today is a special day for the Swiss Market Index (SMI). Because, exceptionally, he is not from the shares of the 20, but the 21 major Swiss companies. The pharmaceutical company Alcon, which is from the parent company, Novartis, is cleaved, it creates it instantly in the benchmark index, and provides for an unscheduled adjustment.

The IPO of Alcon is the second largest in Swiss history. The eye surgery and contact lenses, specialized companies have been assessed with around $ 27 billion, equivalent to virtually the same value in Swiss francs. Only the deep-sea drilling group Transocean reached at the time of its listing on the stock exchange in April 2009, an even higher value.

Alcon-plays worldwide. The US ride-sharing service Lyft has a rating at the end of March, with around 24 billion dollars. The Swiss medical technology company Medacta recently brought about 2 billion dollars on the balance. At Stadler Rail – the railway, the manufacturer of Peter Spuhler, which is also just before the IPO – analysts with a market value of 4 billion dollars.

Due to its procedural request, Alcon is ousted by another company from the SMI, will be reduced again on Wednesday 20 title: Julius Baer – and, of all things, a Bank. In the leading index will be represented in the industry, only the big banks UBS and Credit Suisse.

the SMI is Dominated by the food group Nestlé, and the pharmaceutical companies Novartis and Roche are The three Index heavyweights in the last twelve months (April 2018 to March 2019), together with a share of almost 40 percent. With the spin-off of Alcon, Novartis will lose weight now in the SMI. The pharmaceutical industry as a whole will increase somewhat at the expense of the banks.

In 2007, UBS was still in front of Roche and Credit Suisse close behind. In addition, Julius Baer was not the last, but the 13. Place the most important companies. Together, the three banks came to a share of almost 22 percent. Today, one day before the departure of Julius Baer from the SMI, it is only 9 percent.

Since the international financial crisis in 2008, banks have lost a lot of weight. Of all the companies that are today represented in the SMI, had to cope with the UBS, the largest loss of importance. Your share of the Index declined by 6.77 per cent. The Credit Suisse lost 5,52%, and thus the second most.

at the same time, Nestlé increased with 3.52 per cent. Roche could also increase slightly (+0.26 percent), while Novartis lost easily (-0,13 percent), but significantly less than the banks.

The energy company ABB and the Zurich insurance lost since the financial crisis, a third or a quarter of their share of the SMI. In order to include, in addition to UBS and Credit Suisse, the biggest "losers" – at least from the companies that are still represented in the Index.

The agricultural company Syngenta fell even from the SMI. Are gone and now the dental implants manufacturer Nobel Biocare, the Orthopaedics company Synthes and the baloise insurance. For other rose four in the circle of the most important Swiss companies in the chemical and pharmaceutical company Lonza, the chemicals specialist Sika, the plumbing company Geberit, Givaudan, the world's largest manufacturer of flavors and fragrance.

"Now, we can further expand our market leadership even further."David Endicott, Alcon CEO

As important for a company's inclusion in the illustrious SMI-circle is shown by the testimony of Alcon's CEO David Endicott. "We see Alcon in a strong Position, with which we can maintain our market leadership even further," says the Manager after the IPO to the news Agency AWP. Today's step represents a turning point.

The opening price of Alcon was on Tuesday morning at 55 Swiss francs, bringing the market capitalization amounted to almost 27 billion Swiss francs. By noon of the titles gained. According to the dealers has surprised this course of development some market participants, if not on the wrong foot caught. Many were pessimistic because Alcon is managed after a few weak years only in the last year of the Turnaround.

Today, Alcon is once again one of the industry leaders. The company is in both the eye surgery, as well as in the area of contact lenses and care products on-the-go. "The need for ophthalmology to grow significantly as our population ages and people spend more time in front of screens and mobile devices," says CEO of Endicott.

the SMI to all-time high

The brilliant entry of the Alcon shares for the benefit of the whole of the Swiss stock exchange. After a slow Start this Morning, the SMI climbed just before lunch to a new all-time high of 9628,80 points. The benchmark index surpassed its previous record of 24. January 2018 to more than 12 points.

Nevertheless, feel a certain reluctance to, is it on the market. Because on tomorrow's "Super Wednesday" is the decisive EU summit in connection with the other Brexit plans in the centre. Also, the publication of the minutes of the last meeting of the American Central Bank, as well as the interest rate decision by the European Central Bank is planned.

(editing Tamedia)

Created: 09.04.2019, 15:58 PM

Germany: Man armed with machete enters university library and threatens staff

Germany: Man armed with machete enters university library and threatens staff His body naturally produces alcohol, he is acquitted after a drunk driving conviction

His body naturally produces alcohol, he is acquitted after a drunk driving conviction Who is David Pecker, the first key witness in Donald Trump's trial?

Who is David Pecker, the first key witness in Donald Trump's trial? What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain?

What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain? Parvovirus alert, the “fifth disease” of children which has already caused the death of five babies in 2024

Parvovirus alert, the “fifth disease” of children which has already caused the death of five babies in 2024 Colorectal cancer: what to watch out for in those under 50

Colorectal cancer: what to watch out for in those under 50 H5N1 virus: traces detected in pasteurized milk in the United States

H5N1 virus: traces detected in pasteurized milk in the United States What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Insurance: SFAM, subsidiary of Indexia, placed in compulsory liquidation

Insurance: SFAM, subsidiary of Indexia, placed in compulsory liquidation Under pressure from Brussels, TikTok deactivates the controversial mechanisms of its TikTok Lite application

Under pressure from Brussels, TikTok deactivates the controversial mechanisms of its TikTok Lite application “I can’t help but panic”: these passengers worried about incidents on Boeing

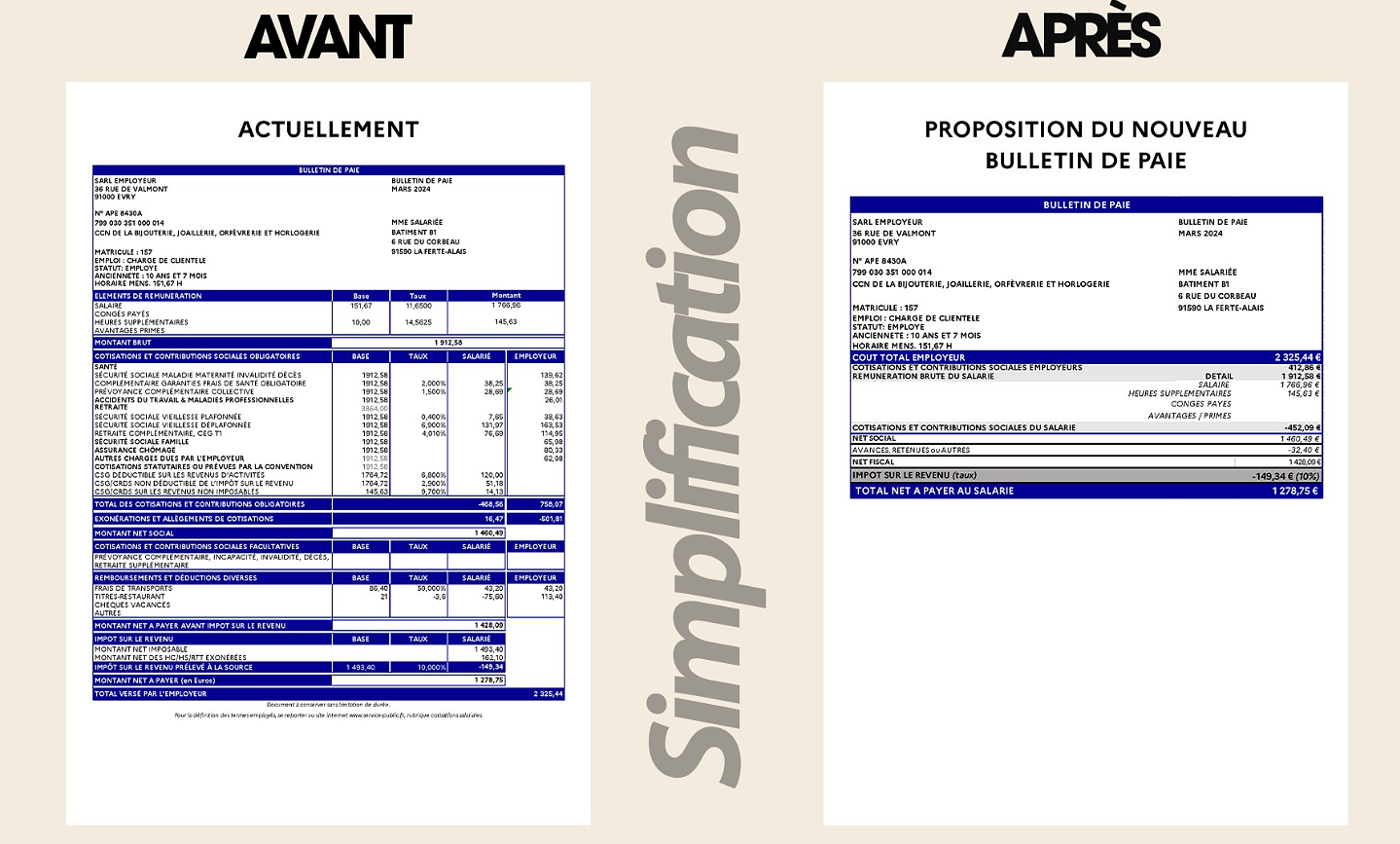

“I can’t help but panic”: these passengers worried about incidents on Boeing “I’m interested in knowing where the money that the State takes from me goes”: Bruno Le Maire’s strange pay slip sparks controversy

“I’m interested in knowing where the money that the State takes from me goes”: Bruno Le Maire’s strange pay slip sparks controversy 25 years later, the actors of Blair Witch Project are still demanding money to match the film's record profits

25 years later, the actors of Blair Witch Project are still demanding money to match the film's record profits At La Scala, Mathilde Charbonneaux is Madame M., Jacqueline Maillan

At La Scala, Mathilde Charbonneaux is Madame M., Jacqueline Maillan Deprived of Hollywood and Western music, Russia gives in to the charms of K-pop and manga

Deprived of Hollywood and Western music, Russia gives in to the charms of K-pop and manga Exhibition: Toni Grand, the incredible odyssey of a sculptural thinker

Exhibition: Toni Grand, the incredible odyssey of a sculptural thinker Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

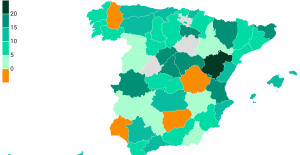

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Sale of Biogaran: The Republicans write to Emmanuel Macron

Sale of Biogaran: The Republicans write to Emmanuel Macron Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Tennis: 1000 matches and 10 notable encounters by Richard Gasquet

Tennis: 1000 matches and 10 notable encounters by Richard Gasquet Tennis: first victory of the season on clay for Osaka in Madrid

Tennis: first victory of the season on clay for Osaka in Madrid La Rochelle-Toulon: at what time and on which channel to follow the closing match of the 22nd day of Top 14

La Rochelle-Toulon: at what time and on which channel to follow the closing match of the 22nd day of Top 14 Ligue 2: Dunkirk accuses a Girondins de Bordeaux player of racist insults

Ligue 2: Dunkirk accuses a Girondins de Bordeaux player of racist insults